- DOT was on the brink of a bullish breakout as it approached two critical support levels.

- However, the strength of the rebound at this support level will dictate how far DOT can rally.

Over the past month, Polkadot [DOT] has been in a bearish trend, slipping by 2.73%. In the last 24 hours alone, it declined by 3.74%.

While a minor drop from its current price is still possible, the stage is set for a potential rally.

AMBCrypto has analyzed the factors behind this anticipated move and what investors should watch for.

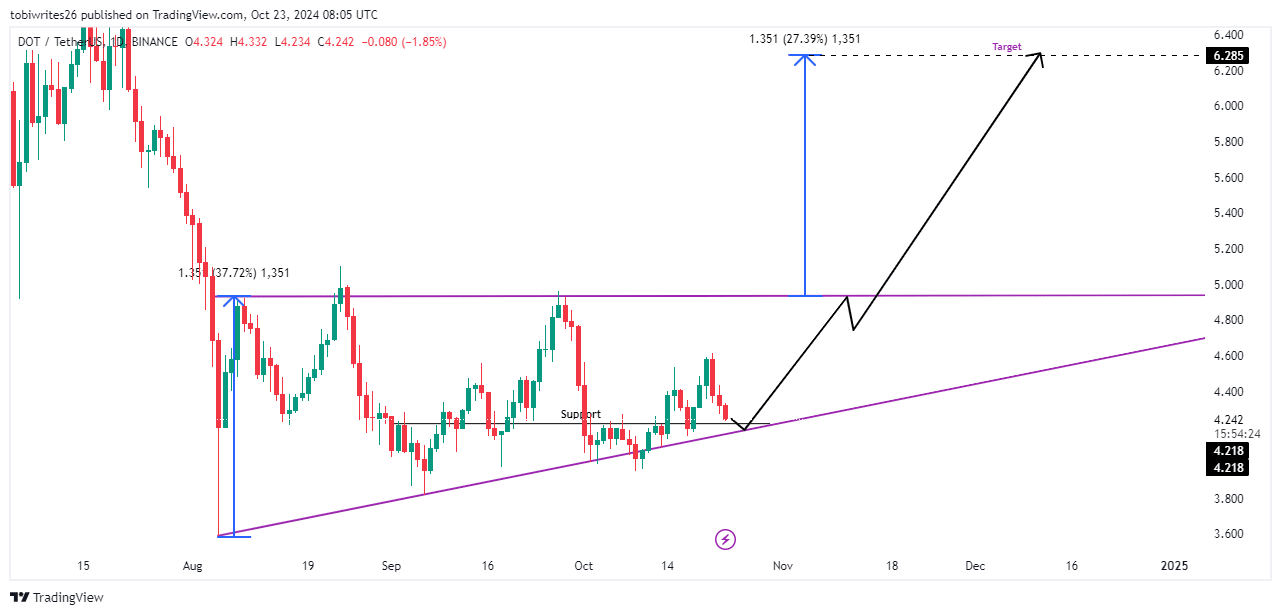

DOT set for major rally as key support levels near

DOT is approaching two critical support levels, positioning it for a potential significant rally. The first support lies at $4.218, while the second is the diagonal support line of the ascending channel.

A positive reaction from the first support (marked in black) could trigger a minor rally. However, if DOT bounces from the base of the bullish pattern, it’s likely to first rally to $4.93.

Breaking through this resistance could lead to an additional 27.39% surge, propelling DOT to $6.285.

A slight delay could occur if the support level of the pattern is breached, temporarily pausing DOT’s upward momentum.

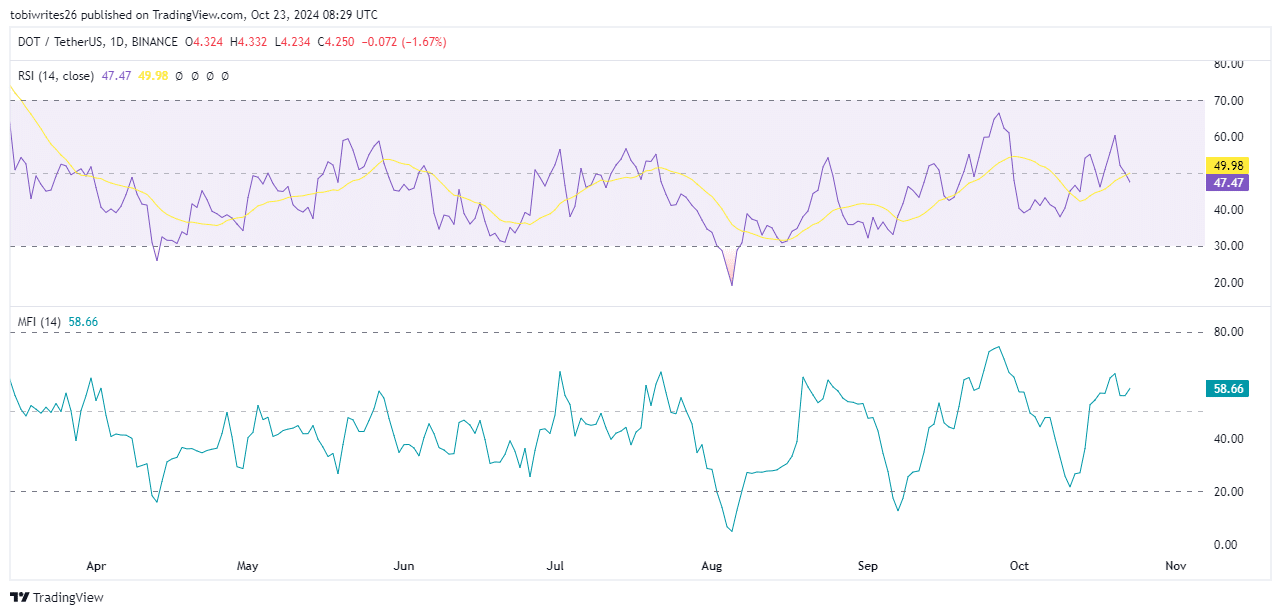

Market sentiment signals a bullish shift

The Relative Strength Index (RSI) has sharply declined to a reading of 49.99, placing it near the neutral zone.

This suggests that DOT may experience a further drop from its current level, possibly falling below the $4.218 support level as it seeks the ascending channel’s support line.

RSI measures the speed and magnitude of price changes to determine an asset’s momentum, indicating in this case that DOT could face additional declines in the short term.

However, the Money Flow Index (MFI), which tracks liquidity inflows and outflows, shows a healthy inflow for DOT. If this trend continues, it points to the potential for a near-term rally.

Overall market activity remains bullish

An analysis of market activity using the Exchange Netflow data from Coinglass suggested that sentiment remained bullish.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Over the past week, the Exchange Netflow has stayed negative, with $3.04 million worth of DOT withdrawn from exchanges.

This indicated that more market participants were holding onto their assets for safekeeping rather than selling, which would typically exert downward pressure on the price.