Accounting and consulting company Prager Metis CPAs and its California-based affiliate are now $1.95 million lighter. The SEC nailed them for two counts of misconduct during their audits of FTX.

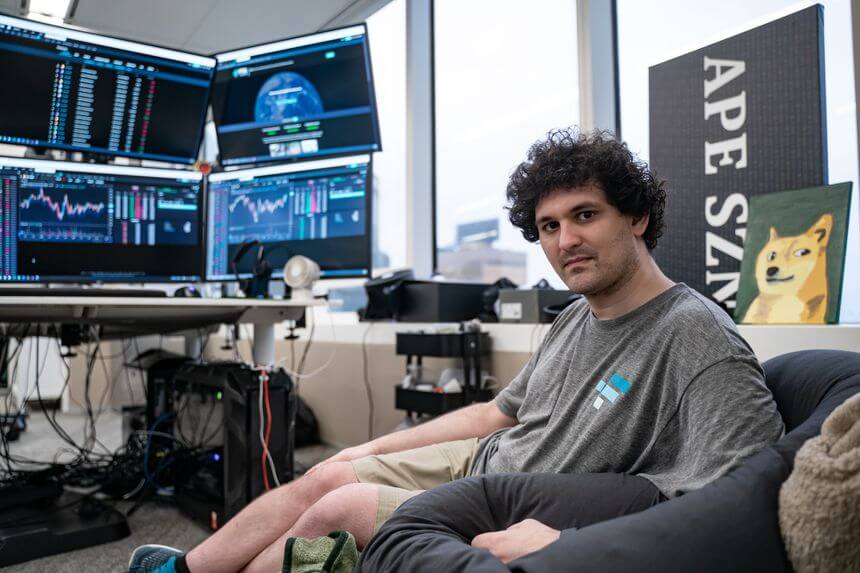

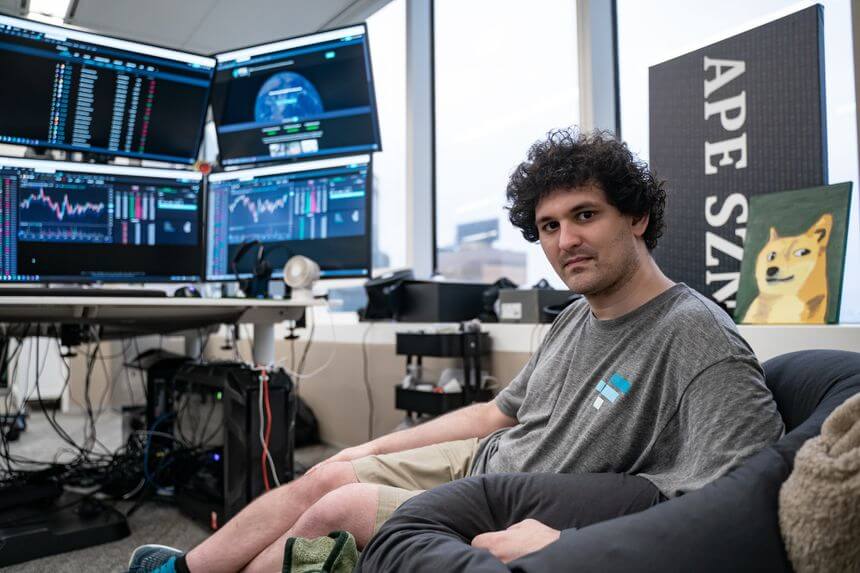

The once-prominent crypto trading platform crashed and burned, leaving billions of dollars in losses and a trail of lawsuits.

The SEC accuses Prager of falsely representing that its audits of FTX between February 2021 and April 2022 followed Generally Accepted Auditing Standards (GAAS).

The firm failed to assess whether it had the skills and manpower to handle such a high-stakes audit.

It also missed a huge red flag—the risky relationship between FTX and Alameda Research, the crypto hedge fund Samuel Bankman-Fried controlled.

Prager has agreed to pay a $745,000 civil penalty, face permanent injunctions, and implement some big changes.

But they neither admitted nor denied the SEC’s findings, which is pretty typical in these cases.

They must now hire an independent consultant to dig into their audit processes and quality control measures. In short, they’ll need to fix what they broke.

Gurbir S. Grewal, the SEC’s Director of Enforcement, said:

“Because Prager’s audits of FTX were conducted without due care, for example, FTX investors lacked crucial protections when making their investment decisions. Ultimately, they were defrauded out of billions of dollars by FTX and bore the consequences when FTX collapsed.”

This isn’t Prager’s first run-in with the SEC.

The firm also violated auditor independence rules, which sounds as bad as it is. Between December 2017 and October 2020, it included indemnification clauses in more than 200 audit engagement letters.

This created a conflict of interest and compromised their independence, as auditors are supposed to be completely neutral when reviewing a company’s finances.

Because of this, Prager had to agree to permanent injunctions, pay $1 million in civil penalties, and cough up an additional $205,000 in disgorgement (ill-gotten gains) and prejudgment interest.

The SEC also censured the firm for these violations. So now, Prager has two sets of settlements hanging over their heads.

SEC’s Miami Regional Office Director Eric I. Bustillo called auditor independence “critical to investor protection and the integrity of our financial markets.”

As for FTX, in August, a judge ordered FTX to pay $12.7 billion in reparations to its customers.

This came after it was revealed that FTX had misused deposits, gambling away innocent people’s money on speculative ventures.

The court’s ruling also permanently bans both FTX and Alameda from trading crypto assets or acting as intermediaries in the future.

FTX has also managed to strike a settlement with Emergent Technology over 55 million shares of Robinhood stock, valued at around $600 million.

This agreement will speed up asset recovery for creditors. Emergent will get $14 million to cover administrative costs for withdrawing the shares.

Several lawsuits related to FTX’s international operations have been dismissed, including those involving subsidiaries in Turkey and Japan.

The company’s restructuring efforts are in full swing as it tries to tie up loose ends.