The digital euro is being explored by the European Central Bank (ECB). This process raised some questions about privacy and technical challenges, especially in Germany. This new currency could change how we handle money and protect personal data.

Also Read: 2024 Crypto Surge: Must-Watch Trends for Savvy Investors

The Digital Euro: Privacy, Money, and What’s Next

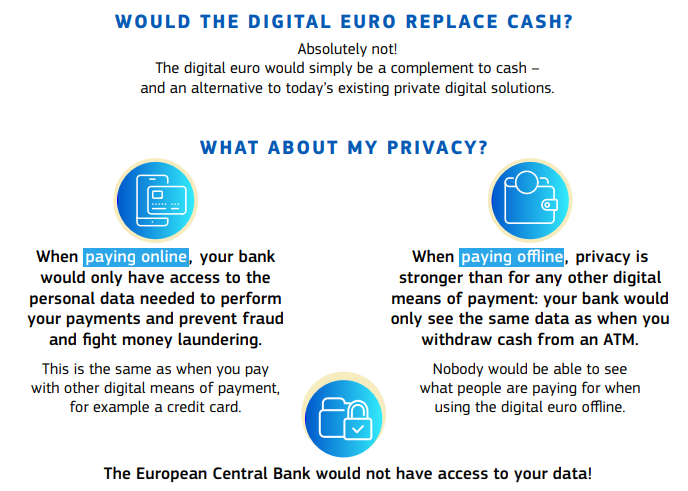

Privacy Safeguards

The digital Euro’s design prioritizes privacy. For online payments, banks would access personal data only for transaction necessities and fraud prevention. Offline payments would offer enhanced privacy, with bank access restricted to data similar to cash withdrawals. The ECB would not have access to user data.

Germany’s Privacy Concerns

In Germany, where cash is preferred, privacy concerns about the digital euro have been raised. Citizens worry about potential surveillance or misuse of their financial data. These concerns are being acknowledged by the Bundesbank.

Technical Challenges

Implementing the digital euro will surely face some problems. The system must be strong and safe enough for high transaction volumes. It is very important to develop security measures against fraud and cyberattacks.

Also Read: 47 Countries Ready To Join the BRICS Alliance

Financial Impact

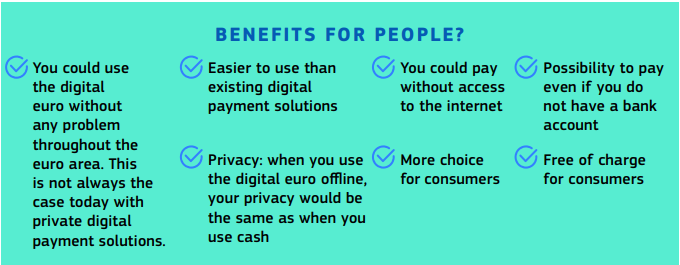

The new Euro could change how money works. It would be free for users and offer a new way to pay, alongside cash and private digital payments.

Digital Euro – Benefits for Users

The digital euro could be used without a bank account or internet. It would work across the euro area, unlike some other digital payments. This might help people without banks or good internet to use it.

Timeline and Future Prospects

The digital euro is being carefully planned. European lawmakers will debate it, and the ECB will decide. This might take years, allowing time to test and improve the system to address technical challenges and privacy concerns.

Public Reaction

As expected, different people view this change differently. Some see it as modern currency, while others worry about privacy, especially in Bavaria. Gaining trust will be extremely important for its success. It would help if the ECB would cover privacy protection. This is the most important pain point of those against it.

Also Read: Crypto Calendar: Must-Attend Crypto Events August 2024

The digital euro could really change European finance. As technical challenges are solved and rules are made, we’ll see if it becomes a privacy threat or a financial revolution. This project might influence digital currencies in other parts of the world, potentially changing global finance.