New bill in New York proposes accepting stablecoins pegged to the US dollar as payment for bail bonds.

On May 10, New York State Democrat Latrice Walker introduced a partisan bill that aims to include “fiat-collateralized stablecoins” as an additional method of payment for bail bonds. The bill recognizes existing payment options such as cash, insurance bonds, and credit cards.

The New York Assembly Bill 7024. Source: cointelegraph

The bill aims to make changes to the existing criminal procedure law in New York by adding the category of fiat-collateralized digital assets as an acceptable form of payment.

It is not yet clear which specific fiat-backed stablecoins would be considered eligible under this new proposal, and it remains uncertain if there will be any stablecoins that may not meet the criteria set by New York officials.

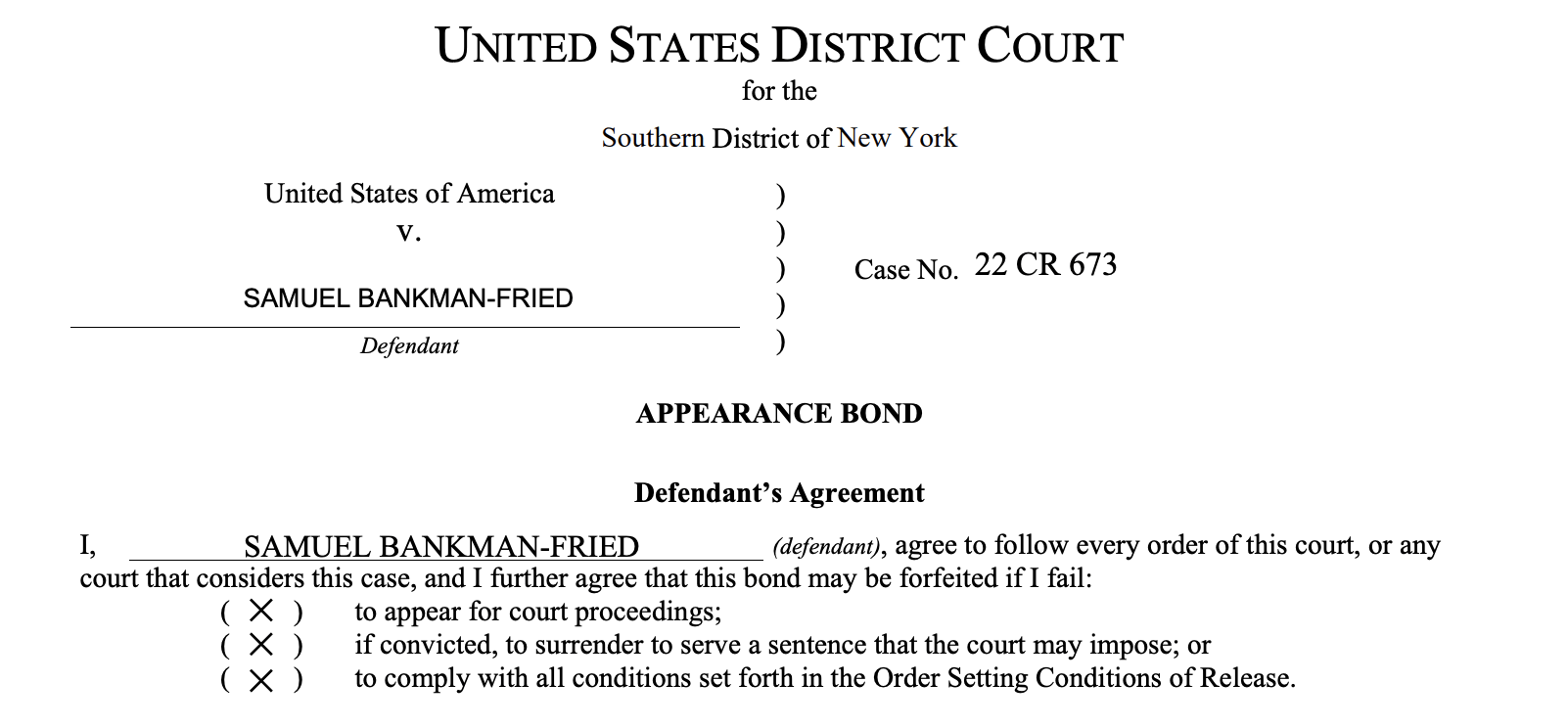

On December 22, 2022, two individuals provided $250 million in bail to the Manhattan federal court on behalf of FTX founder Sam Bankman-Fried. This allowed him to be released under strict home detention conditions until his criminal trial, scheduled for October 2.

Sam Bankman-Fried’s bail agreement. Source: contelegraph

The introduction of the new bill follows closely after New York Attorney General Letitia James proposed additional regulations on May 5. These regulations aim to give the state more authority over cryptocurrency exchanges.

The proposed legislation would give New York officials the ability to request subpoenas, impose fines on cryptocurrency companies that violate state laws, and potentially shut down firms that are suspected of engaging in fraud or illegal activities.

Although the bill’s introduction indicates the New York state government’s openness to incorporating stablecoins into its criminal procedure law, Attorney General James has taken a tough stance on cryptocurrencies in recent months.

In January, Attorney General James filed a lawsuit against former Celsius CEO Alex Mashinsky, and more recently, in March, she sued the Seychelles-based crypto exchange Kuoin for conducting the sale of securities and commodities without proper registration.