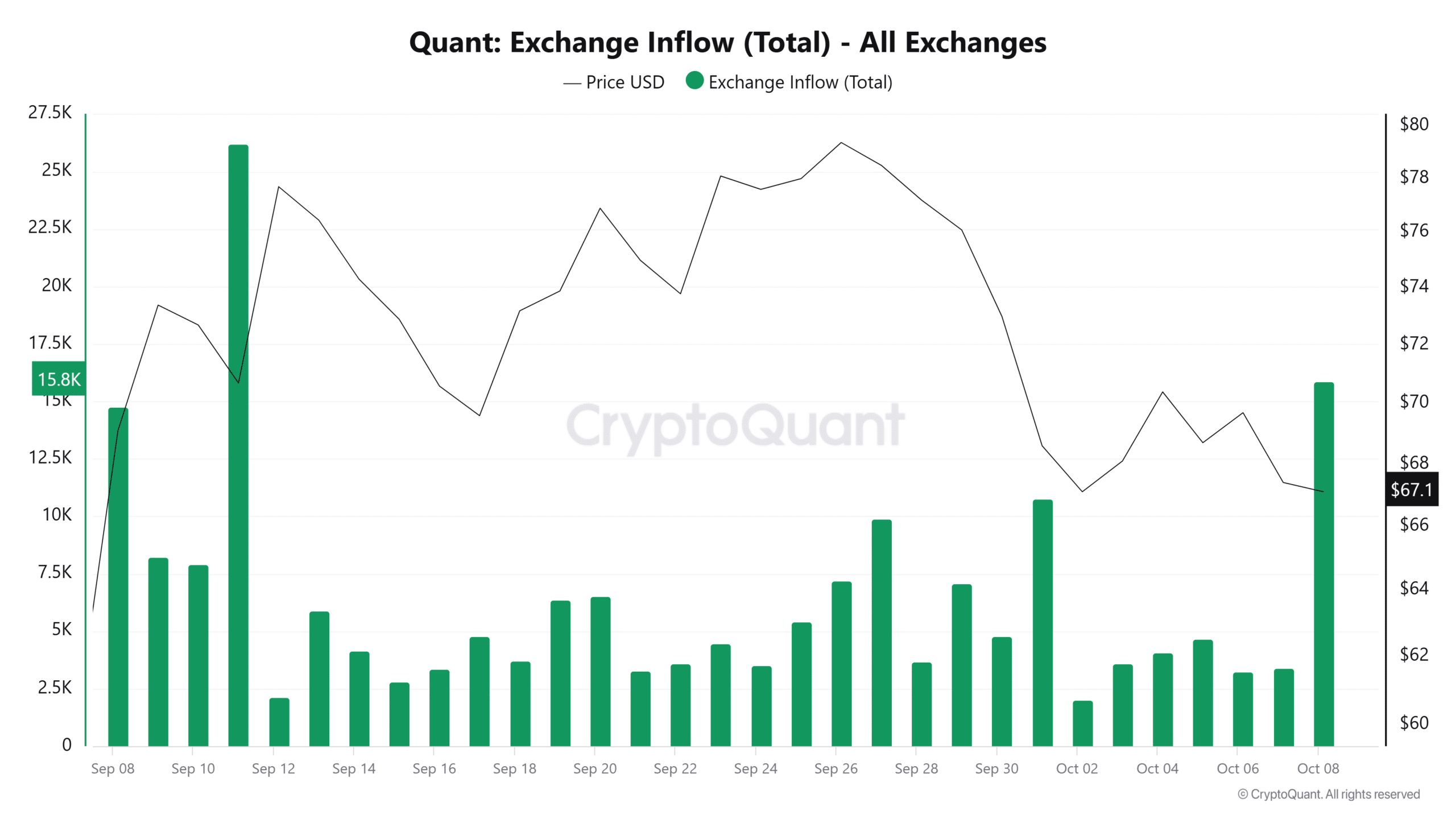

- QNT’s exchange inflows have surged, suggesting that the selling pressure could increase.

- The rising exchange inflows could increase the sell-side pressure and drop the price to test support at $57.

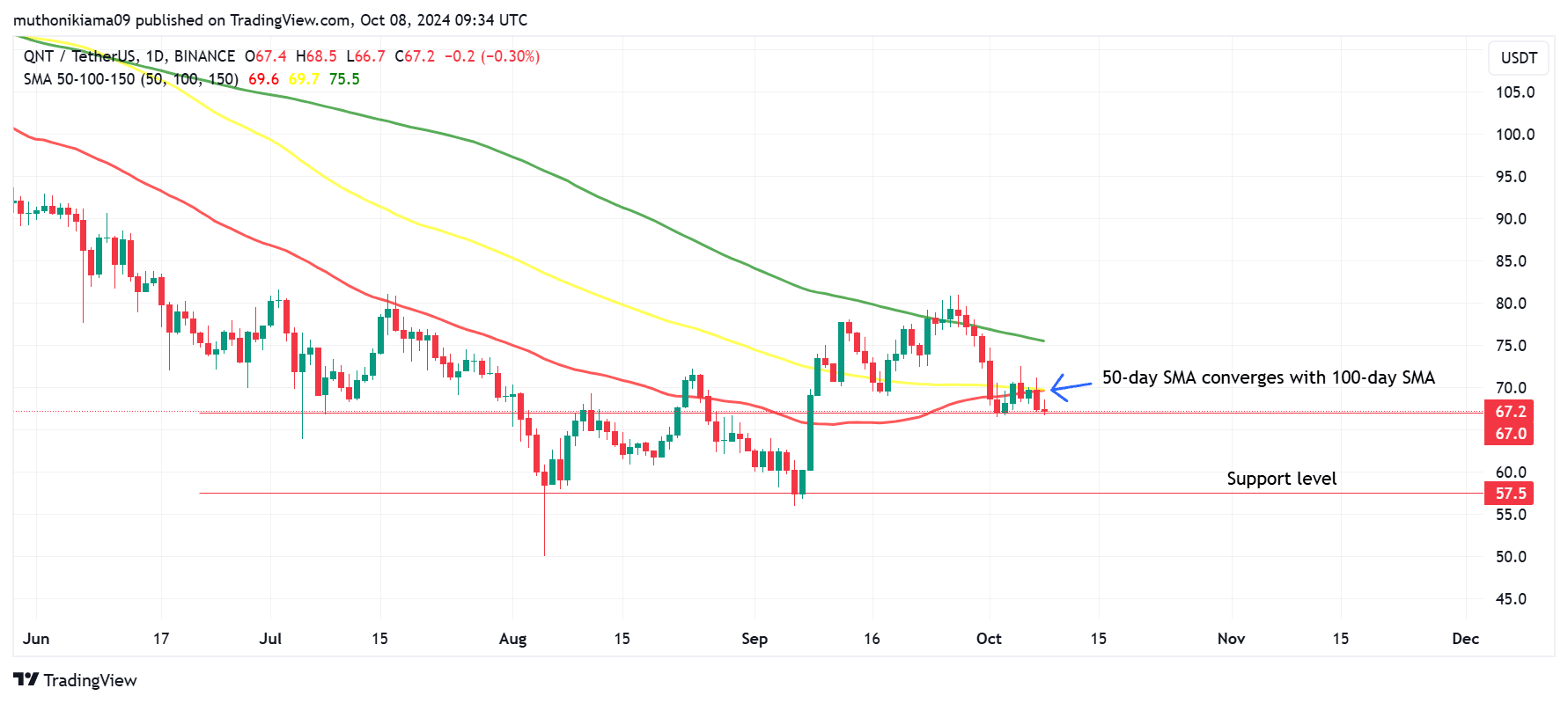

Quant [QNT] traded at $67 at press time after a 3% drop in 24 hours. Notably, QNT has been under bearish pressure as in the last seven days- it has dropped by nearly 10%.

Quant appears to be following the trend across the broader market, given that its 24-hour drop comes after Bitcoin [BTC] plunged from above $64K to $62K.

The recent drop has seen QNT drop to test a critical support level at $67. The token has held levels above this support since mid-September, but it has been forming lower highs.

This suggests that buying momentum was weakening, as sellers gained control.

If QNT loses its current support at $67, the price could drop to $57. Past performance shows that each time the price has lost this support level, it has formed a bearish leg.

Traders should watch out for the convergence of the 50-day Simple Moving Average (SMA) with the 100-day SMA. If the 50-day SMA crosses above the 100-day SMA from below, it will signal a strong bullish sentiment.

However, if this crossover fails, the short-term bearish sentiment will be confirmed, pushing the prices lower.

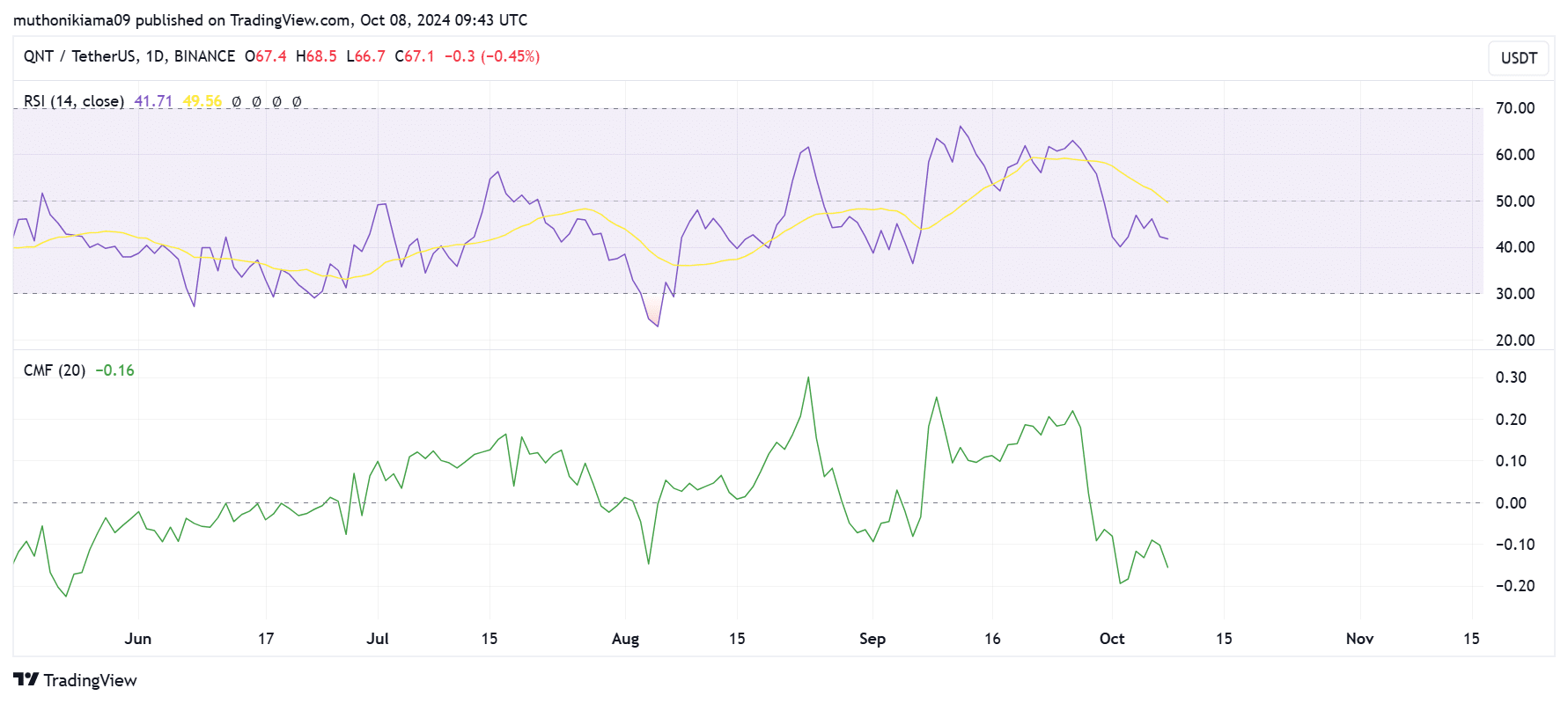

Buying activity is currently weak as the Chaikin Money Flow (CMF) is negative and dropping. This suggests money is flowing from QNT, showing selling pressure.

The Relative Strength Index (RSI) at 41 also showed that the bearish momentum was gaining strength, which could see the price drop further.

QNT exchange inflows spike

Data from CryptoQuant showed that Quant’s exchange inflows have spiked to the second-highest level in the last month.

At press time, QNT deposited to exchanges had surpassed 15,800 tokens, an over five times increase from the last day.

A rise in exchange inflows could increase selling pressure on Quant, as it indicated that traders were getting ready to sell.

This data further showed that QNT holders were losing confidence in the token, and they can choose to sell to minimize their losses.

This could create downward pressure on Quant and trigger a price decrease below the $67 support level.

Read Quant’s [QNT] Price Prediction 2024–2025

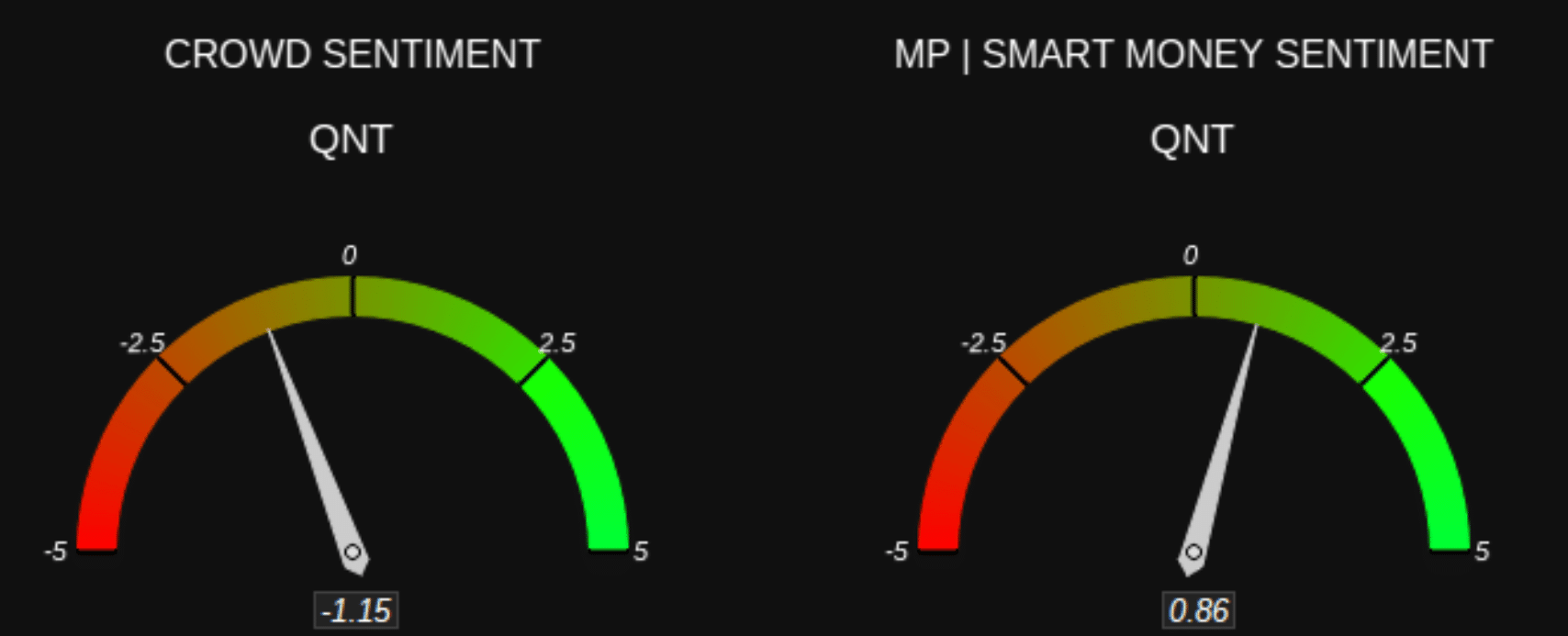

The rising exchange inflows also come as negative sentiment around the token strengthens. According to Market Prophit, the crowd was bearish on QNT at press time, pointing to a lack of confidence in price recovery.

On the other hand, smart money is bullish on QNT, showing that there is some level of optimism in the market.