- RAY saw a 22% weekend pump – Is memecoin mania the reason?

- Raydium surpassed Uniswap in DEX volume, a growth that could further boost RAY.

Raydium [RAY] pumped 22% on Sunday, the 17th of November, tapping a new yearly high of $6.3 with room for extra growth, per market pundits.

The weekend pump was notable across the Solana ecosystem; however, SOL only saw a 10% daily rally compared to RAY’s 22%.

Raydium is the de facto memecoin trading scene on Solana. As memecoin dominance persists, will it fuel a further rally for the token?

What’s next for RAY?

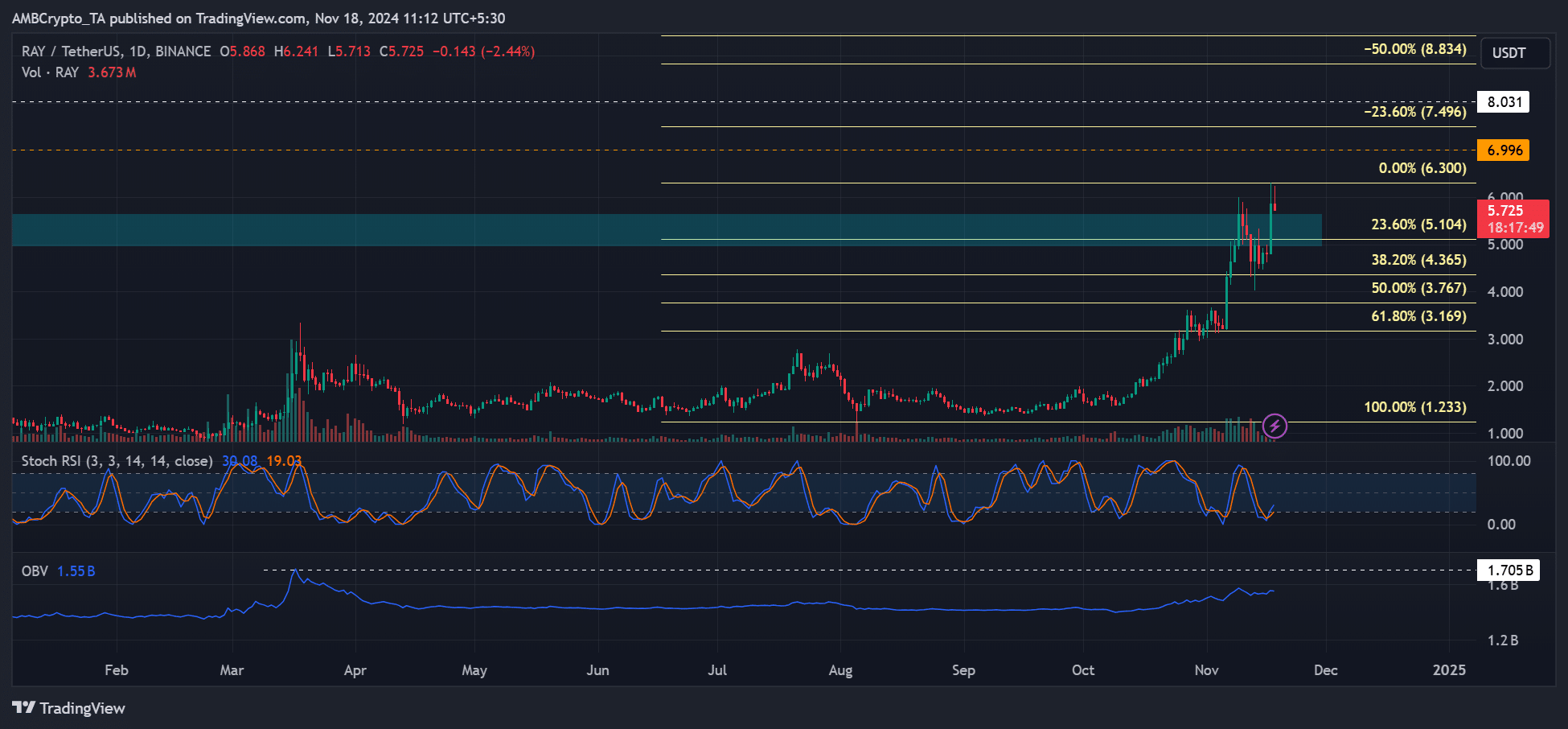

Since August’s recovery, RAY has surged over 350% from $1.2 to above $5. Technical indicators suggested a decisive move above the $5 level could set the token for higher targets.

On the daily chart, there was still room for OBV (on-balance volume) to surge to early 2024 highs (1.7B). Additionally, as shown by the Stochastic RSI, the price momentum eyed reversal from the oversold territory, further suggesting an upside move was likely.

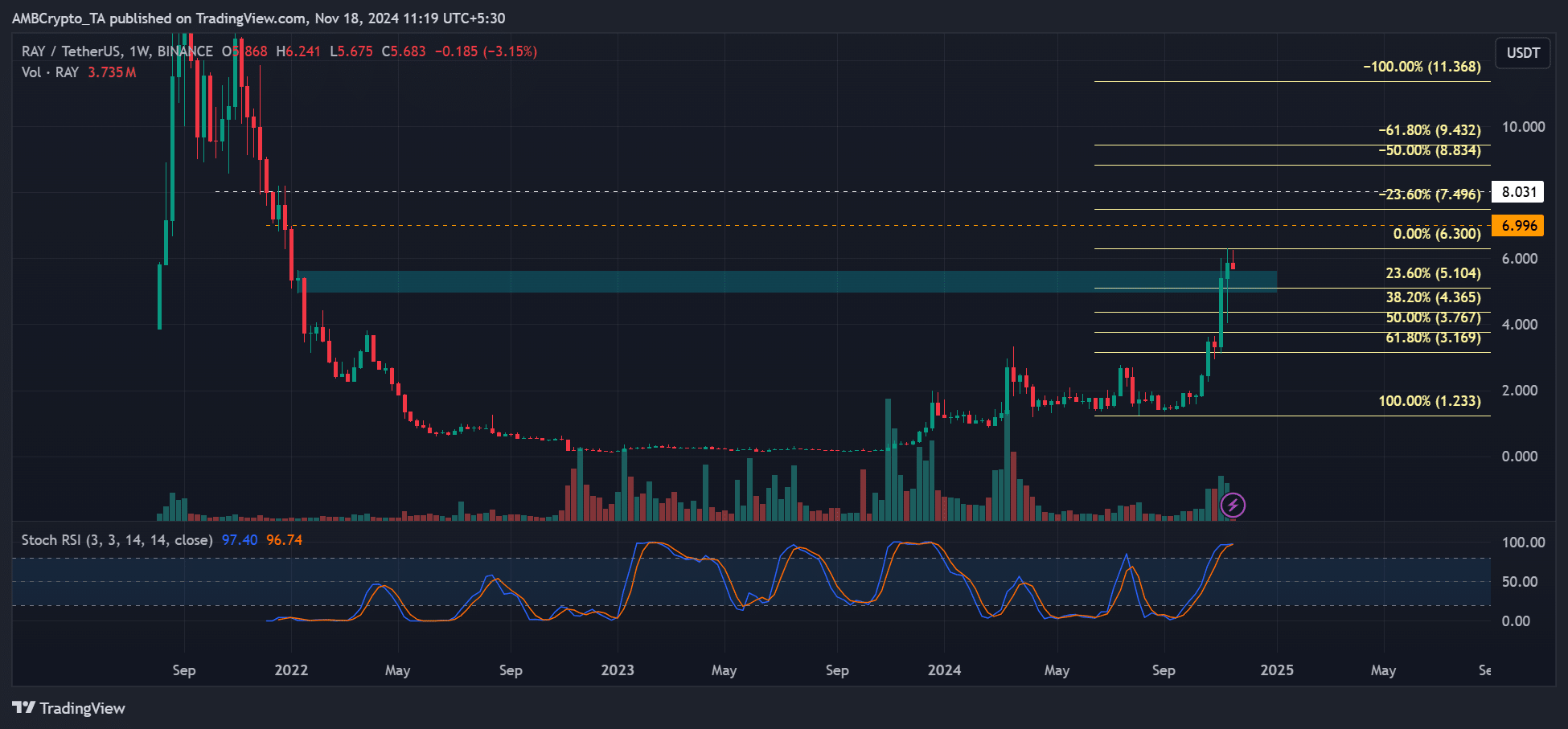

Perhaps the most positive insight was from the weekly candlestick close. The weekly candle closed above $5, which doubled as a bearish order block (OB, cyan) formed in 2022.

This meant that RAY could eye $7, $8, or $10 bullish targets if the uptrend momentum continued.

Raydium’s massive DEX growth

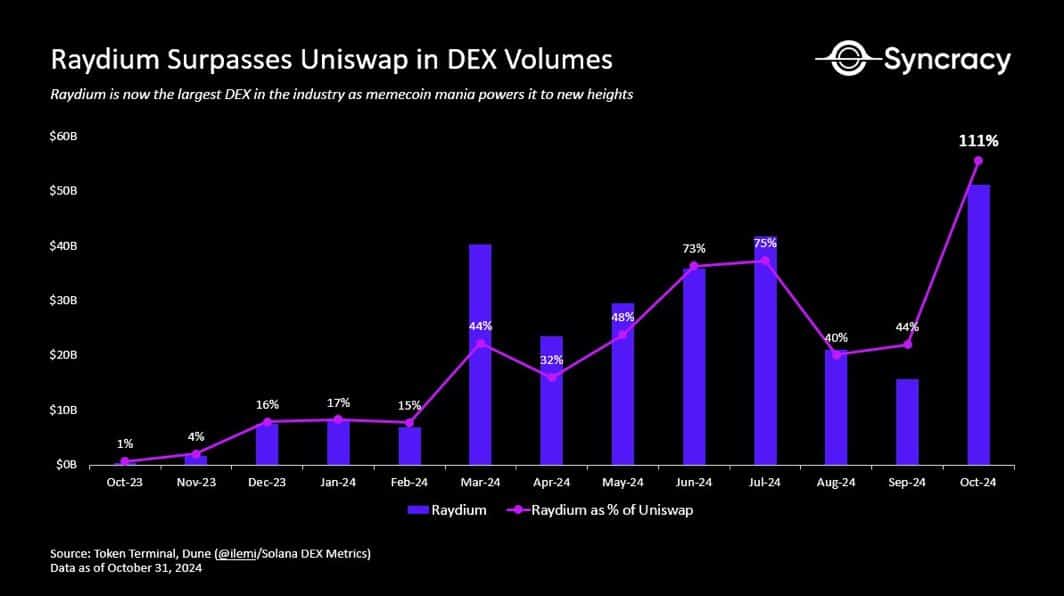

The bullish case for RAY was stronger from a fundamentals perspective. With memecoin mania dominating the market, Raydium surpassed Uniswap [UNI] in DEX (decentralized exchange) volume in October.

Commenting on the fete, Ryan Watkins, co-founder at crypto VC Syncracy Capital, noted that Raydium was responsible for DEX’s hitting 20% share of global exchange volume. He said,

“Raydium is now the #1 DEX in the cryptoeconomy by volume. It is also leading DEXs to their highest share of global exchange volumes ever (20%). Memecoin mania = Raydium’s piggy bank.”

Read Raydium [RAY] Price Prediction 2024-2025

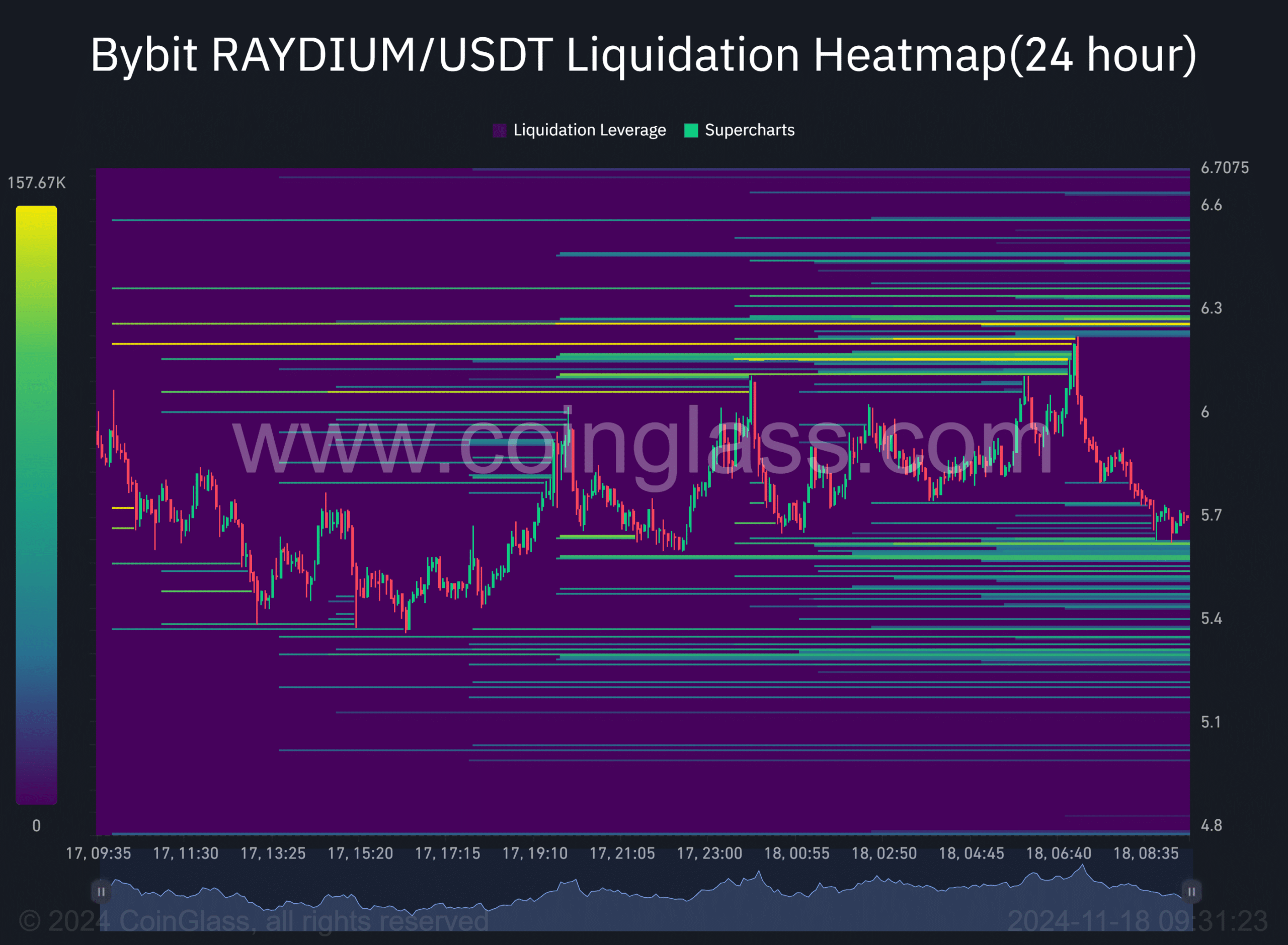

That said, RAY cooled off slightly at press time, a move that market makers could have triggered to grab liquidity below $5.7.

The next immediate liquidity was at $6.3, an upside target that could keep RAY above $5 and drive it higher. However, a break below $5 could delay the move to $10.