Render (RNDR) is currently consolidating, with its price maintaining support along the downtrend line. The Relative Strength Index (RSI) remains in the bearish zone, indicating that RNDR is waiting for a push past the neutral line.

Despite the market uncertainty, RNDR holders are choosing to hold onto their positions rather than sell, which suggests an underlying bullish sentiment.

Render (RNDR) Price Analysis: Market and Investor Impact

Render (RNDR) price is significantly influenced by broader market trends, which often dictate its price action. The token’s price has not shown a clear upward trajectory due to the current Relative Strength Index (RSI), which remains in the bearish zone. This reflects ongoing negative momentum and insufficient buying pressure, indicating that RNDR has yet to gain the strength needed for a substantial upward movement.

For Render to shift momentum, the RSI needs to push beyond the neutral line. Such a move would signal a change in market sentiment, potentially marking the start of a positive trend and suggesting increased buying interest that could drive a price recovery.

Render RSI. Source: TradingView

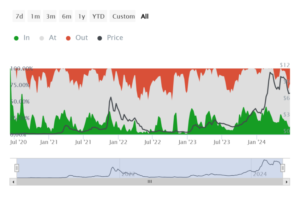

Despite the current market uncertainty, investor behavior indicates a level of bullish sentiment. Only about 11% of active investors are currently profitable, suggesting that most participants are not eager to sell for profits. This overall holding behavior may provide support for RNDR and could help it reverse recent losses, provided it can maintain this investor confidence.

Render Active Addresses by Profitability. Source: TradingView

Render (RNDR) Price Range and Potential Breakout Scenarios

Render’s price appears set for consolidation rather than a swift recovery, influenced by market cues and investor behavior. Currently, the resistance level stands at $8.0, while support is at $6.8.

Render Price Analysis. Source: TradingView

A breakout above the $8.0 resistance could propel RNDR towards $9.0 or higher, potentially recovering losses incurred during the early June decline. However, if market volatility or bearish conditions push the price below the $6.8 support, the bullish outlook would be negated, possibly leading to a further decline to $6.5 or lower.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News