- RLUSD is a USD-backed stablecoin designed for enterprise applications, ensuring secure, compliant financial operations across global markets.

- Ripple partners with major exchanges and market makers to support RLUSD, boosting liquidity and cross-border payment efficiency.

- RLUSD is poised to facilitate real-world asset tokenization, enhancing its role in enterprise markets, from securities trading to international trade.

Ripple recently unveiled its new stablecoin called RLUSD during the Ripple Swell 2024 conference on Tuesday. RLUSD is an anchored stablecoin in USD meant for use in enterprise applications in the financial sector while seeking to address compliance issues. Entering the new year, the launch itself can be considered an important achievement in Ripple’s evolution as an actor within the global financial system.

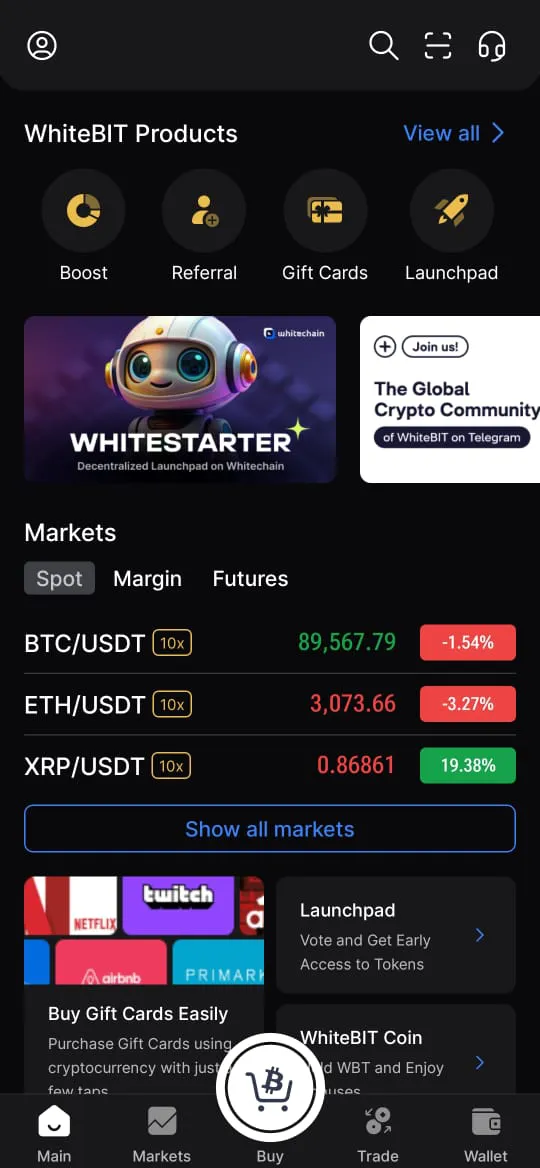

Ripple has ensured that the stablecoin works closely with some of the leading exchanges such as Bitstamp, Bitso, and Bullish to ensure that the digital asset is accessible to both institutional as well as retail traders. Established under a New York Trust Company Charter, RLUSD’s offering ensures that it complies with the necessary legal requirements in the United States making RLUSD one of the few stablecoins that is regulated.

The stablecoin is 100% backed by U.S. dollars, U.S. treasuries, cash, and cash equivalents, all of which can be audited by independent third-party auditors every month. This conformist mindset is backed by Ripple’s advisory, a panel that contains former FDIC Chair, Sheila Bair and Ripple co-founder, Chris Larsen.

Facilitating Cross-Border Transactions and Asset Tokenization

RLUSD is positioned as a crucial tool for facilitating cross-border payments, reducing the volatility often associated with digital assets. Liquidity support from market makers such as B2C2 and Keyrock will ensure smooth transactions, particularly for international trade and financial services. Ripple aims to leverage RLUSD alongside its native cryptocurrency, XRP, to enhance its payment solutions.

Furthermore, Ripple illustrated the role of RLUSD in the process of tokenization of other tangible and intangible assets. The stablecoin will be used for on-chain transactions like trading commodities and securities, and therefore increase its applicability in enterprise markets.

Read CRYPTONEWSLAND on

google news

RLUSD Adoption Support to Customers and Partners

Many of Ripple’s partners and clients are in support of the introduction of the stablecoin. Another important partner highlighted its vision that RLUSD could become an additional means for international settlements, particularly in the countries of Latin America. Another partner, MoonPay, was also excited about the increased relevance of stablecoins in today’s world and the fact that RLUSD is compliant.

Ripple, which connects more than 120 partners and almost $70 billion of transactions across over 90 markets, will be the major contributor to the growth of the new stablecoin. Given that RLUSD is an enterprise-focused legal service with strict adherence to regulations, the platform would surely become a part of the development of digital assets and assets in general when it performs its operations transparently.

Crypto News Land, also abbreviated as “CNL”, is an independent media entity – we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.