- Ripple Q3 2024 report confirms XRP’s non-security status and highlights growing institutional interest in XRP-focused ETFs and trusts.

- Regulatory clarity and global developments in XRP adoption mark significant progress, enhancing its position in the crypto market.

The Q3 2024 market report of Ripple offers important new perspectives on the changing XRP and more general cryptocurrency space. Most importantly, the paper attests to XRP’s legal non-security status being still intact.

This confirmation results from a past court decision declaring that under U.S. law, Ripple’s XRP does not fit under the definition of a security. Ripple’s reaction to the SEC’s continuous appeal—which does not question this particular status—shows its will to maintain the clarity attained in court.

Nevertheless, the ongoing legal conflicts with the SEC still affect XRP’s market impression and play a major role in determining its price swings.

Growing Institutional Interest and Global Economic Shifts Boost XRP

XRP has experienced especially increasing institutional interest in recent months. Important advancements include investment behemoths like Bitwise, Canary, and 21Shares submitting S-1 filings for XRP-oriented ETFs.

Grayscale has also started the XRP Trust project and worked on the ETF format conversion of its multi-coin fund, including XRP, according to our prior report. These calculated actions show more hope in XRP’s future and regulatory clarity after the historic court decision.

The third quarter (Q3) of 2024 also saw changes in the global crypto market impacted by more general macroeconomic patterns. Following a protracted period of monetary tightening, the U.S. Federal Reserve’s decision to cut interest rates by 50 basis points signalled a big change.

Central banks all over China, Japan, Europe, and the UK—who together implemented more accommodating monetary policies—mirrored this change. Risk assets responded quickly and favorably for this as well as cryptocurrency. For example, while some altcoins had price swings of up to 50%, Bitcoin jumped by over 10%.

XRP Market Trends and Volatility Insights in Q3 2024

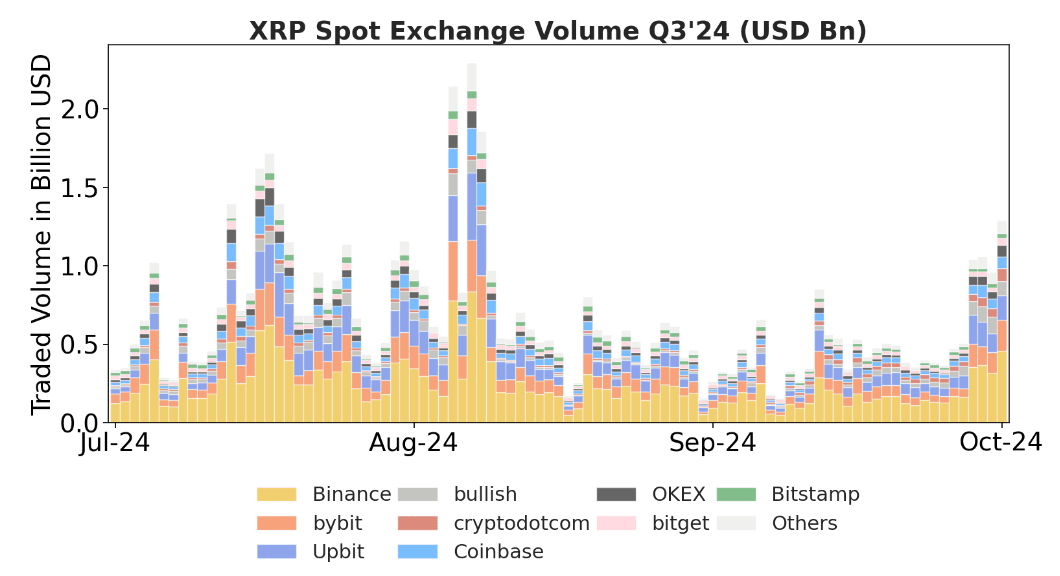

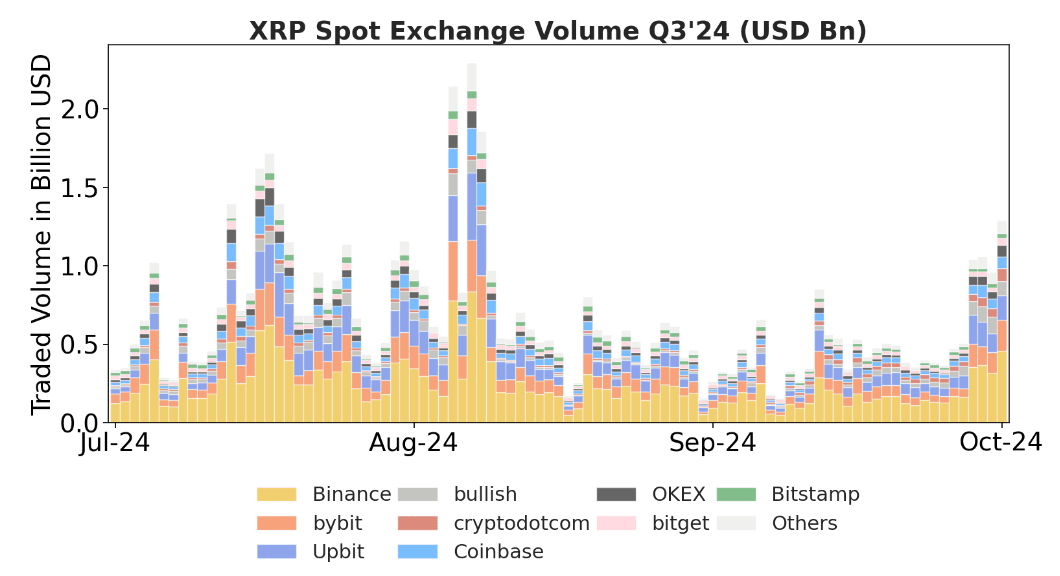

Market analysis showing notable patterns in trading indicators during Q3 2024 On top-tier exchanges, XRP’s average daily volumes (ADV) showed consistent trading interest ranging between $600-700 million.

In a time when Bitcoin’s dominance also climbed by 3%, the XRP/BTC ratio showed an amazing 27% gain throughout the quarter—a noteworthy success.

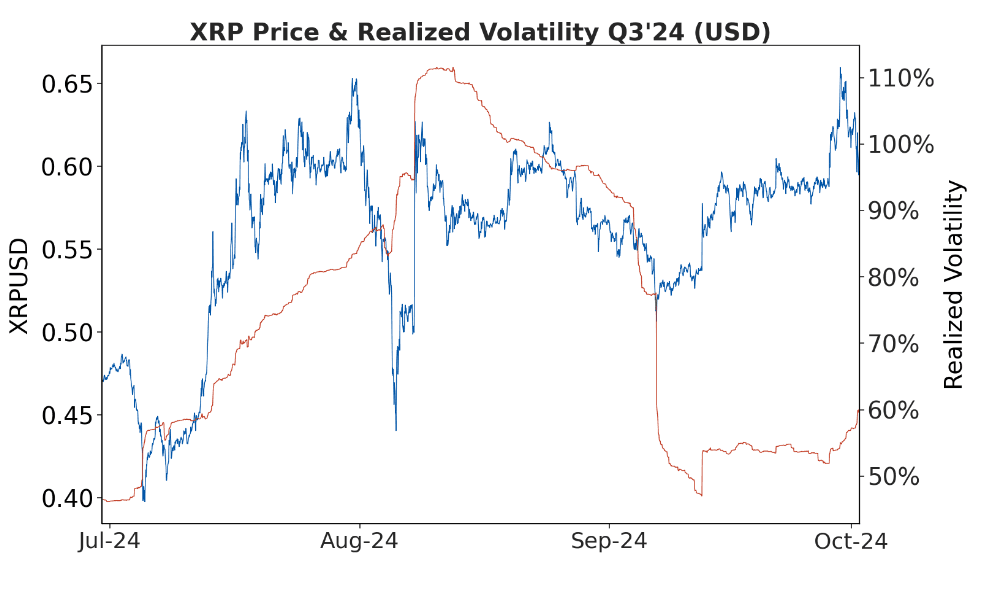

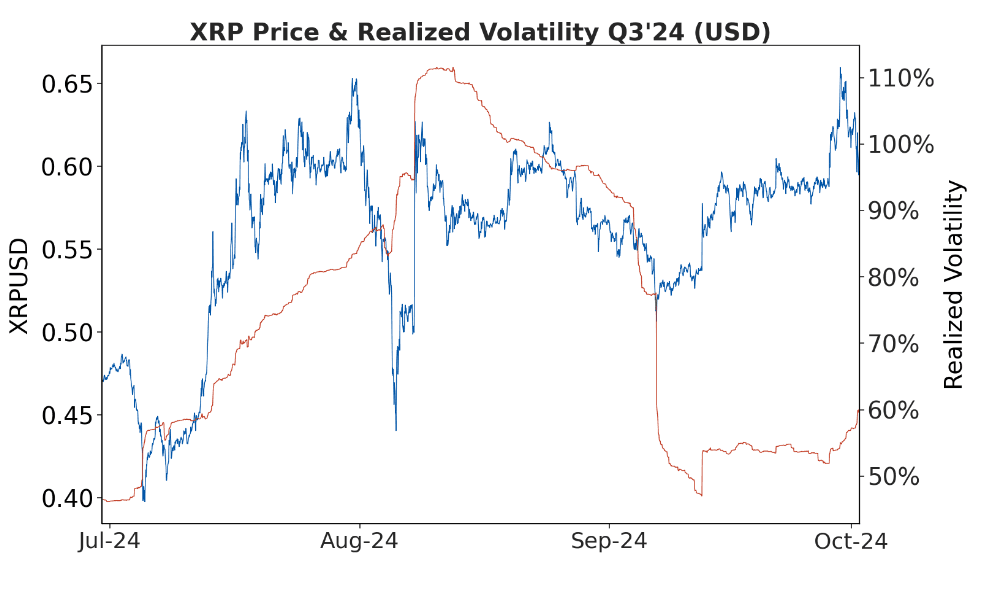

Price swings between 40 and 65 US cents drove realized volatility for XRP to rise in the first half of Q3 and reach above 110% in mid-August. This increased engagement highlighted a moment of really strong market action. Price swings calmed down to about 60% by the second half of the quarter, allowing a more steady range.

With Binance, Bybit, and Upbit registering significant activity, trading volumes stayed strong relative to past quarters. Early Q3 saw daily averages reach $750 million, which stabilized mid-quarter and climbed once more toward the end of September.

These numbers highlight the dynamic character of market activity, therefore showing both resilience and investor confidence among more general macroeconomic changes and legislative developments.

Court Rulings and Global Regulatory Advances Shape Market Dynamics

Notwithstanding the continuous legal obstacles, on August 7, the court compelled Ripple to pay $125 million for certain unregistered XRP sales to sophisticated third-party entities. Especially, this amount was noticeably far less than the $2 billion the SEC first sought, underscoring the proportionality of the settlement.

Crucially, the court conclusions omitted any charges of fraud or carelessness directed against Ripple, therefore highlighting its efforts at digital asset market compliance.

Another equally important development of ripple into the global market is the rise in ETF proposals, and Grayscale’s new XRP-oriented trust shows the growing institutional interest in XRP, therefore indicating the token’s cementing importance in the crypto ecosystem.

Outside the United States, meanwhile, Asian and European regulatory systems are becoming clearer, opening the path for more general acceptance and integration of digital resources. Experts predict possible changes in crypto rules with the approaching U.S. presidential election, which would add yet another level of mystery to the direction the market may take.

Beyond the particular market and legislative changes, Ripple’s larger approach now consists of supporting actions for financial institutions investigating digital asset technologies.

According to a CNF prior report, Ripple has unveiled a thorough guide meant to help banks and other financial institutions negotiate the growing $20 trillion digital asset custody market.

Considered Ripple Custody, this service is trusted by big financial institutions and covers custodial banks, exchanges, and corporate clients spread across more than 15 countries worldwide.

Meanwhile, XRP is trading about $0.5124 at the time of writing, down 1.05% over the last 24 hours. Its market cap has likewise dropped, below the $30 billion mark.