Ripple’s native token XRP, is posed for a price decline as whales dump millions of XRP tokens while the price retests the breakdown level of $0.545. On September 12, 2024, the transaction tracker Whale Alert made a post on X (Previously Twitter) that Ripple whales have offloaded 39.32 million XRP tokens, worth $21.13 million to Bitstamp.

Ripple Whales Recent Action

This XRP dump by whales has made the overall sentiment more bearish, as it occurred when the price retested its breakdown level of $0.545.

At press time, XRP is trading near $0.535 and has experienced a price drop of over 1.12% in the last 24 hours. Meanwhile, its trading volume has increased by 25% during the same period, indicating higher participation from traders despite the price decline.

XRP Price Prediction

Expert technical analysis warns that XRP appears bearish, as it is trading below the 200 Exponential Moving Average (EMA) on a daily time frame. Currently, it is receiving decent support at the $0.531 level. If XRP fails to hold this support level, there is a high possibility it could plunge by 10% to the $0.475 level.

Additionally, XRP’s Relative Strength Index (RSI) is in oversold territory and is flashing a potential price reversal.

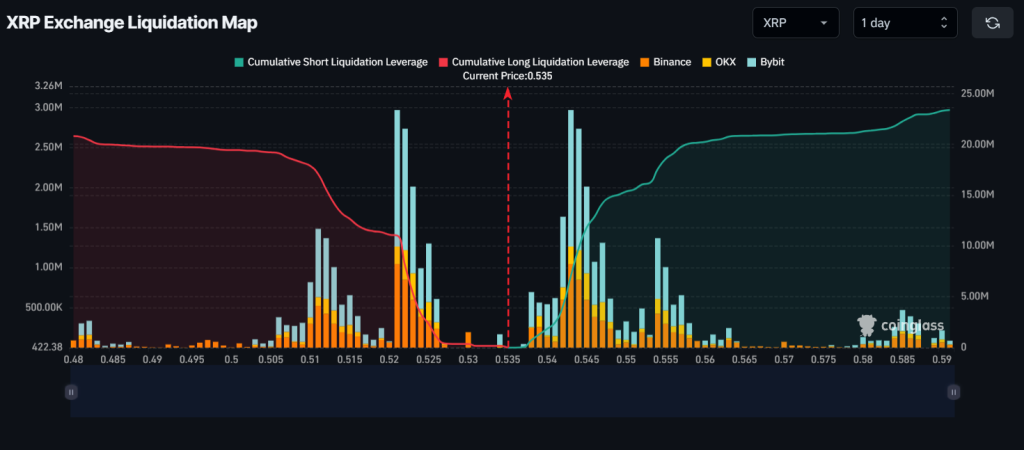

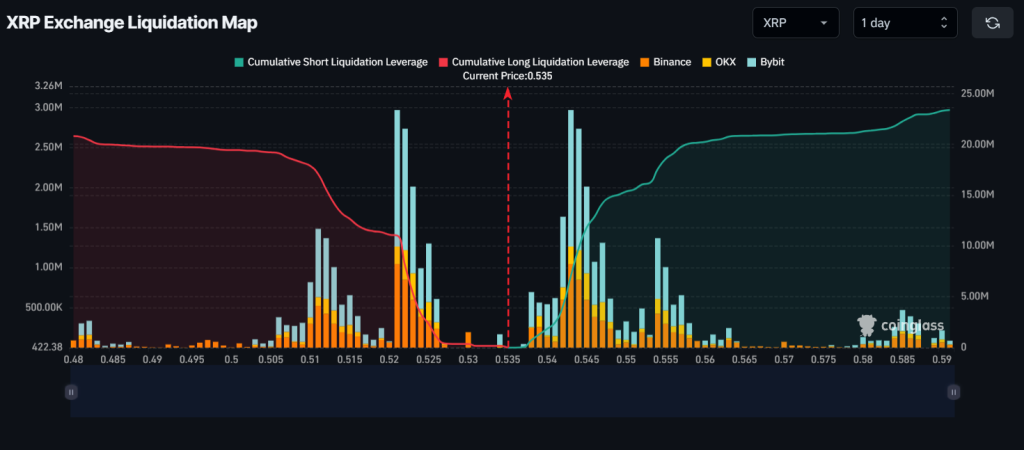

Major Liquidation Levels

As of now, the major liquidation areas are near the $0.521 level on the lower side and $0.543 on the upper side, as traders are over-leveraged at these levels, according to Coinglass.

If the sentiment remains bearish and the XRP price falls to the $0.521 level, nearly $11.04 million worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price rises to the $0.543, approximately $7.07 million worth of short positions will be liquidated.

Coinglass’s XRP Long/Short ratio data shows that, in the past four hours, 53.64% of top XRP traders have taken short positions, while 46.36% have taken long positions.

Combining all these data, it appears that bears are controlling the asset and have the potential to increase selling pressure.