On Monday, the cryptocurrency market witnessed a sharp decline in prices following the legal action taken by the U.S. Securities and Exchange Commission (SEC) against the crypto exchange and its CEO, accusing them of numerous violations of federal securities laws.

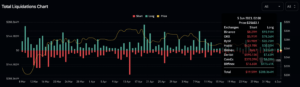

According to data from CoinGlass, cryptocurrency traders endured losses amounting to approximately $320 million in liquidations within the last 24 hours. The market witnessed a significant drop in crypto prices on Monday following the Securities and Exchange Commission‘s (SEC) lawsuit against the prominent exchange, Binance, on allegations of violating securities laws.

CoinGlass data reveals that cryptocurrency traders were hit hard with losses totaling around $320 million in liquidations over the past 24 hours. The market experienced a substantial decline in cryptocurrency prices on Monday as a direct consequence of the Securities and Exchange Commission’s (SEC) legal action against Binance, a prominent exchange accused of violating securities laws.

On Monday, the crypto markets witnessed a significant plunge as a direct response to the Securities and Exchange Commission (SEC) lawsuit filed against Binance, the leading cryptocurrency exchange globally in terms of trading volume.

The lawsuit alleges Binance and its CEO, Changpeng “CZ” Zhao, of engaging in activities such as offering unregistered securities, commingling user deposits, and artificially inflating trading volumes.

As mentioned in the lawsuit, several tokens, including Binance’s BNB, solana (SOL), and cardano (ADA), were cited as unregistered securities, which resulted in a notable decline in their prices.

Also Read This Related: Binance CEO and Justin Sun Join Forces Amid SEC Charges

Throughout the day, these tokens witnessed drops of up to 10%. Bitcoin (BTC), the largest cryptocurrency in terms of market capitalization, also experienced a significant decrease, falling below $26,000 for the first time since mid-March, as reported by the CoinDesk Bitcoin Price Index (XBX).

The substantial number of liquidations indicates that the abrupt price decline took the majority of investors by surprise. A staggering total of approximately 119,000 crypto traders faced liquidation within a 24-hour period, as reported by Coinglass.

Bitcoin (BTC) traders incurred the highest losses, totaling nearly $119 million, while Ether (ETH) investors faced losses of $41 million as the token’s price dipped below $1,800.

Binance traders experienced the largest amount of losses among all exchanges, amounting to $105 million, followed by $88 million on OKX and $43 million on ByBit, as reported by CoinGlass. Additionally, approximately $6.5 million worth of BNB trading positions were wiped out as the token witnessed a sharp decline.

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines On Google News:

Join Cryptos Headlines Community: https://linktr.ee/cryptosheadlines.com