- SHIB could soar by 50% to reach the $0.000044 level if it closes a daily candle above $0.0000295.

- The combination of on-chain metrics with the technical analysis hints that traders are confused.

Amid the ongoing bull run, Shiba Inu [SHIB], the second-largest meme coin, has been struggling since the 12th of November, after a major breakout of the descending trendline.

However, data from an on-chain analytics firm suggested that whales and institutions are showing a strong interest in the meme coin, leading to massive accumulation.

Shiba Inu whales increase their holdings

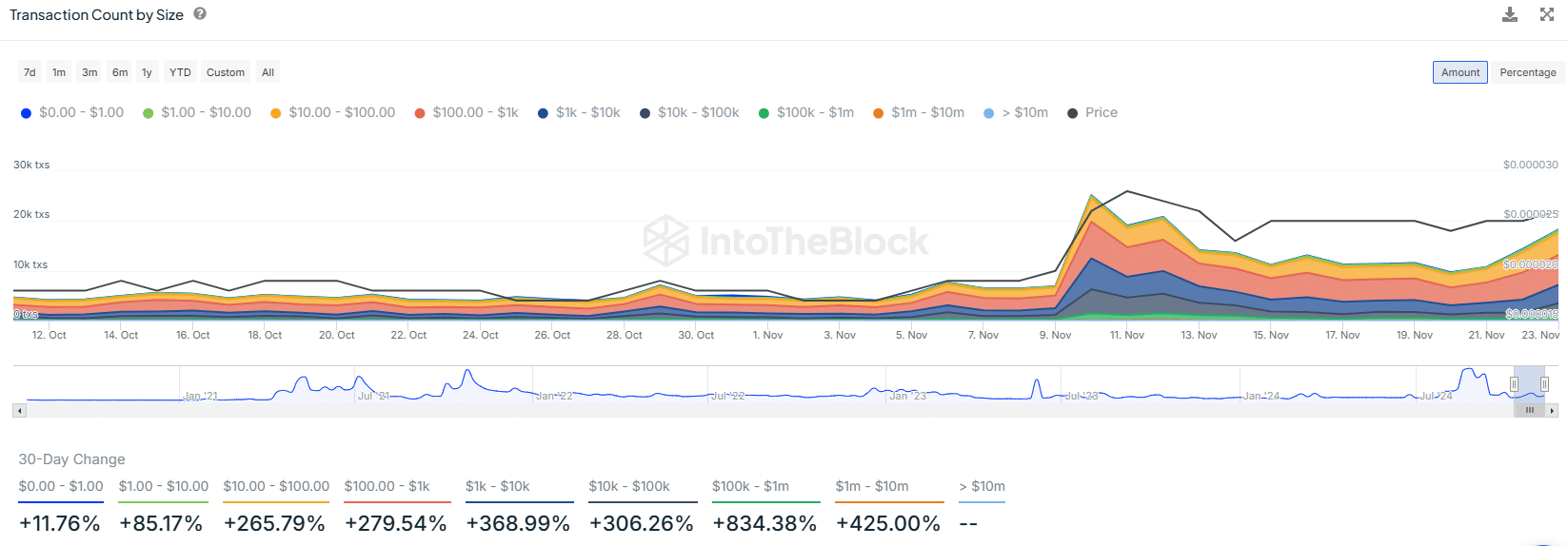

IntoTheBlock, the on-chain analytics firm, reported that whales and institutions holding $1 million to $10 million worth of SHIB tokens have increased their holdings by 425% in the past 30 days. This signaled strong institutional interest during this consolidation phase.

The development meant that big players are preparing for a potential breakout. Additionally, it hints at potential buying opportunities and an upside rally in the coming days.

SHIB technical analysis and key-level

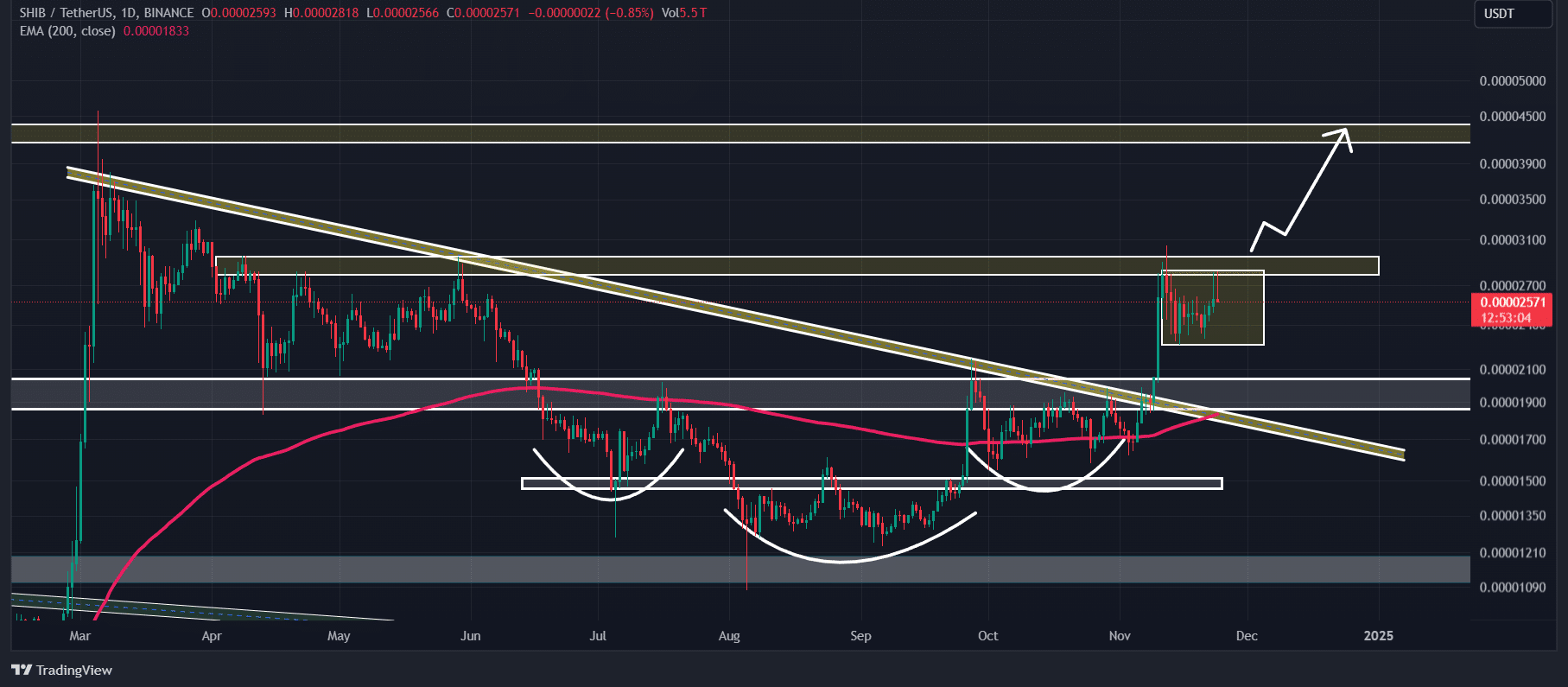

According to expert technical analysis, SHIB is currently consolidating in a very tight range near a strong resistance level of $0.000029. Consolidation near a resistance level is often seen as a potential buy signal, as traders and investors use this level to accumulate tokens.

Based on the recent price action, if SHIB breaks out from this zone and closes a daily candle above the $0.0000295 level, there is a strong possibility that the meme coin could soar by 50% to reach $0.000044 in the coming days.

At present, SHIB is in an uptrend, as it is trading above the 200 Exponential Moving Average (EMA) on the daily time frame. Meanwhile, its Relative Strength Index (RSI) suggests potential upside momentum in the coming days, with its value still below the overbought territory.

Mixed sentiment from on-chain metrics

Despite the bullish technical analysis, SHIB’s on-chain metrics show mixed sentiment among traders. According to Coinglass, the meme coin’s open interest (OI) has dropped by 10.25% in the past 24 hours.

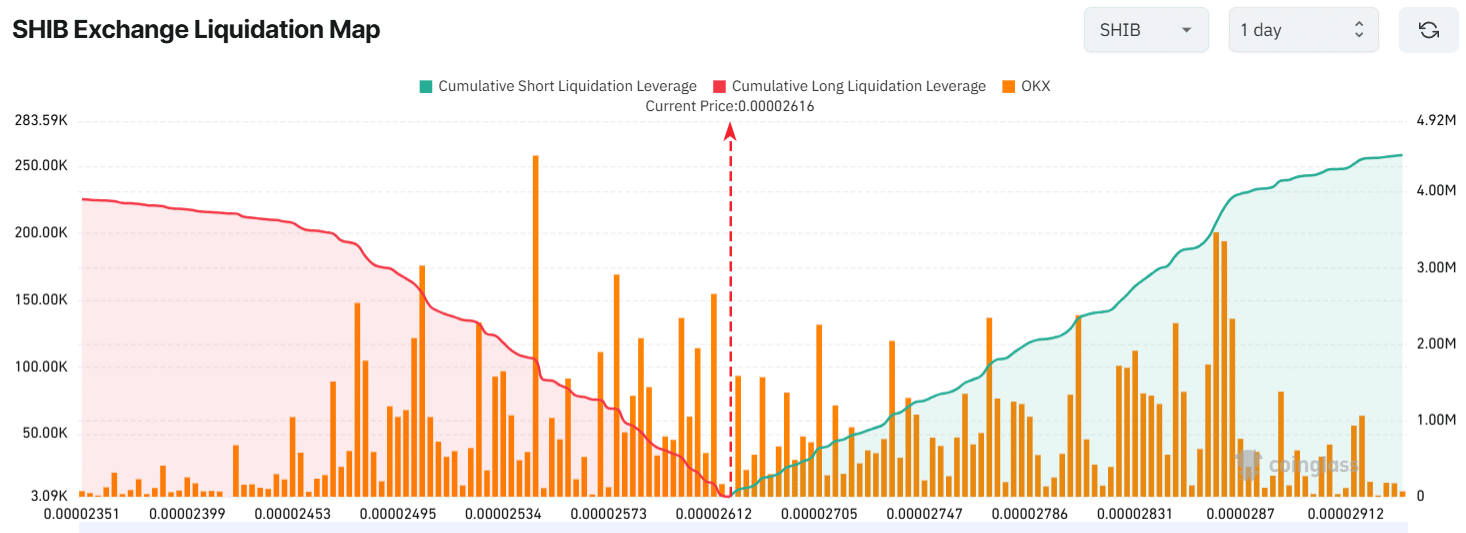

This drop in OI suggests that traders are liquidating their positions as the price continues to consolidate.

As of now, major liquidation levels where traders are over-leveraged are at $0.00002546 on the lower side. At that level traders have built $1.8 million worth of long positions.

Conversely, $0.00002861 is on the upper side, where traders have built $3.6 million worth of short positions.

When combining these on-chain metrics with the technical analysis, it appears that traders are confused. They may also be waiting for the breakout from the consolidation.

Is your portfolio green? Check out the SHIB Profit Calculator

At press time, SHIB was trading near the $0.000026 level and has experienced a price decline of 5.20% in the past 24 hours.

During the same period, its trading volume dropped 17%, indicating lower participation from traders compared to the previous day.