- Solana bulls did well to hold the $210 support but selling pressure was rising.

- The market structure and momentum were in favor of the bears.

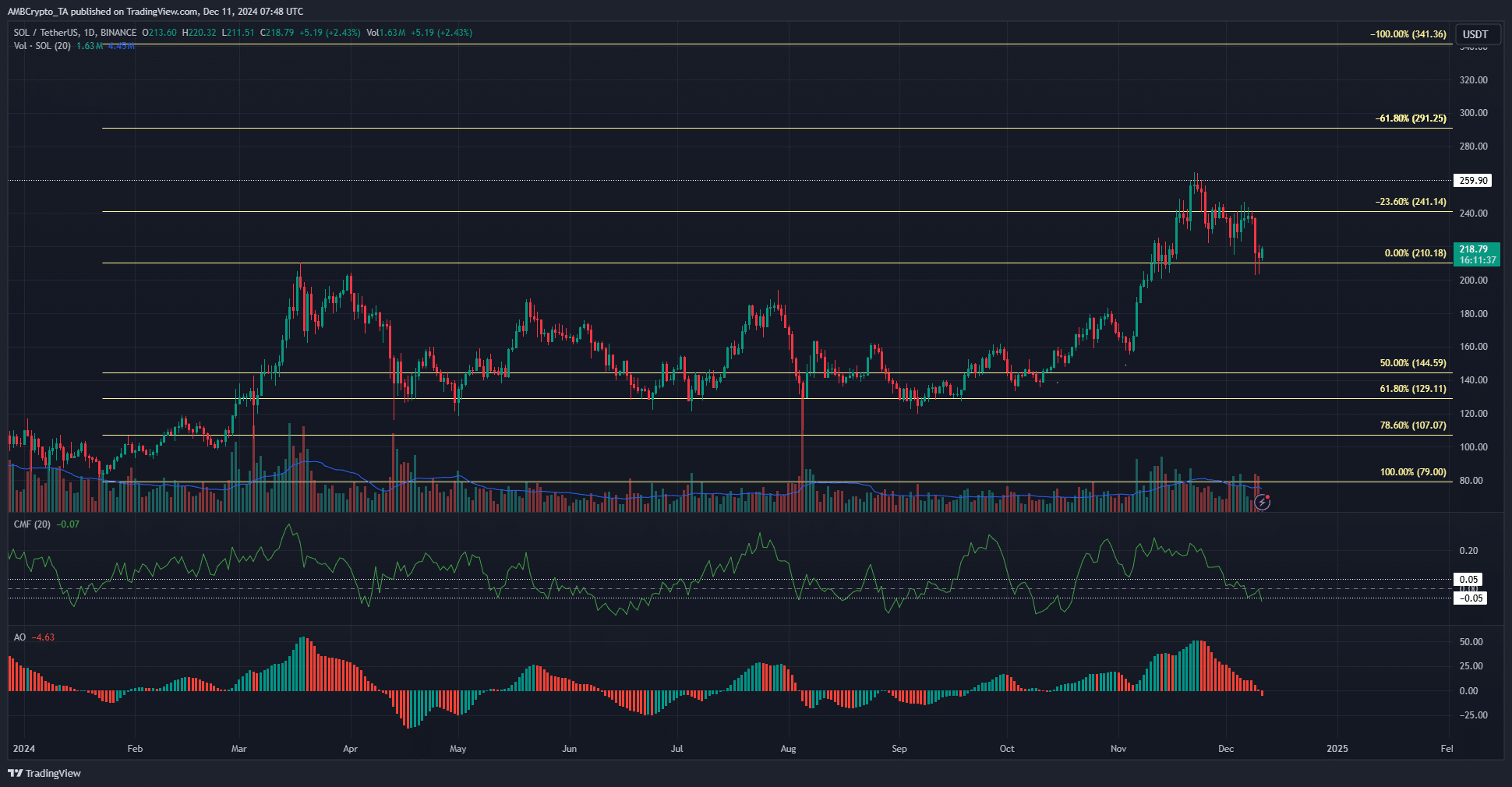

Solana [SOL] bulls have defended the $210 support over the past two days and managed to drive a price bounce. Yet, the technical indicators showcased bears were gaining the upper hand. The indecisive price action of Bitcoin [BTC] also lent little support to Solana.

Over the next few days, consolidation between the $210-$230 region is expected. Below $210, another key level was highlighted. A move below this level could see SOL shed another 10% in value.

Solana bounces 4% from support

On the daily timeframe, Solana exhibited a bearish market structure. This came after the price set a series of lower highs in the past two weeks. The March highs at $210 were defended over the past two days.

Yet, the indicators have shifted and now reflect bearish pressure. The CMF fell below -0.05 to signal significant capital flow out of the market. The Awesome Oscillator also formed a bearish crossover to signal downward momentum was building.

It is expected that bulls would defend the $210 key support for Solana. There is a high chance for volatility in the short term.

If SOL closes a daily session below $202-$203, it would be a firm indication that more losses are ahead. In that scenario, a move to $180 can be expected.

Volatility expected between $210-$230

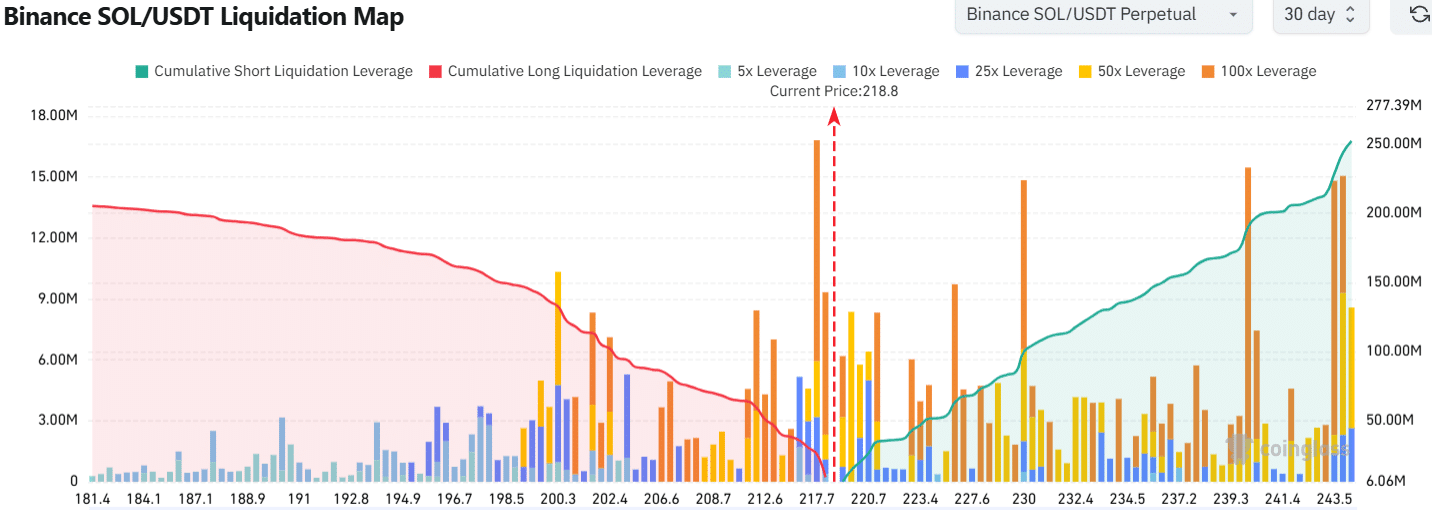

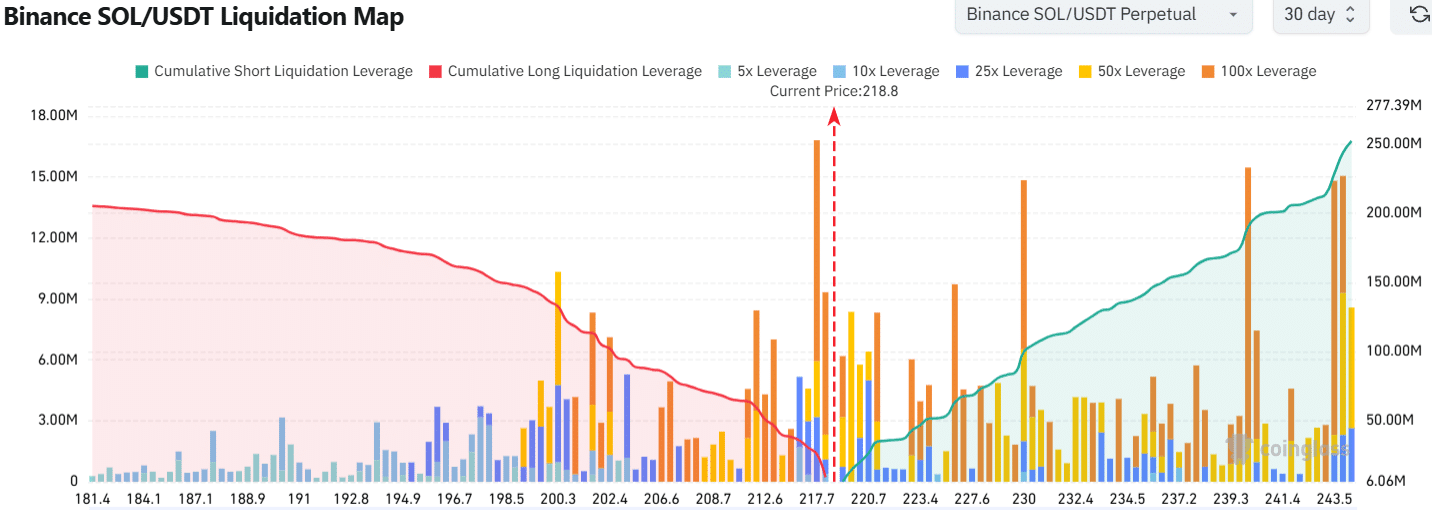

Source: Coinglass

The liquidation map showed that there was a collection of high-leverage long positions from $210.5 to $218. It is likely to be revisited as prices are drawn to liquidity. To the north, the $220-$230.3 zone also has a sizeable cumulative leverage.

Is your portfolio green? Check the Solana Profit Calculator

It is anticipated that Solana will bounce between $210 and $230 levels in the coming days before it can resume its previous uptrend. The chances of an uptrend would decrease if Bitcoin fell below $94k and $90.5k.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion