- SOL bulls maintain dominance, pushing past resistance, leaving a trail of short liquidaitons.

- Open interest soars to levels last seen in April, underscoring strong activity in the derivatives segment.

Solana [SOL] bulls have been dominating for the last two weeks and this led to expectations of sell pressure earlier this week. There was a surge in the number of shorts as well as liquidations this week as sellers anticipated a retracement.

SOL has been experiencing a surge in sell pressure in the last five days. Note that the cryptocurrency has been rallying for the last two weeks, suggesting that the pressure to secure profits is intensifying. This has consequently led to a surge in shorts.

Coinglass on-chain data revealed that over $7 million worth of short positions were liquidated in the last 24 hours. It also revealed that short positions dominated at 64.54% compared to long positions during the same period.

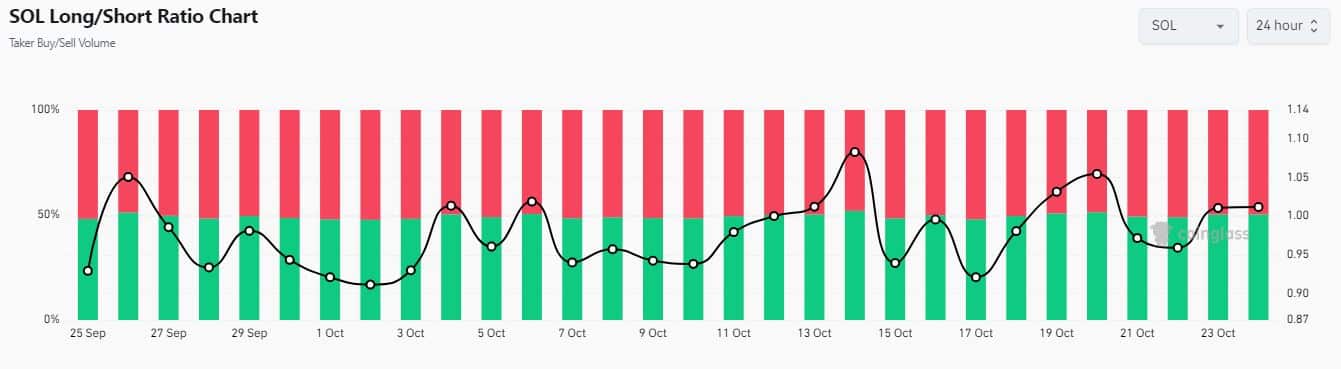

SOL’s long/short ratio dipped considerably form 1.05 on 20th September, to 0.95 and has since pushed higher to 1.1 in the last 22 hours.

The decline in the SOL long/short ratio since 20th October suggests that there was a surge in short positions compared to longs. This was not a surprising outcome and for multiple reasons.

Most of the top coins bowed to sell pressure since 20th October and have since experienced some pullback. Also, SOL retested a short term resistance level at around the same time.

Solana aims for the next resistance zone as bulls retain dominance

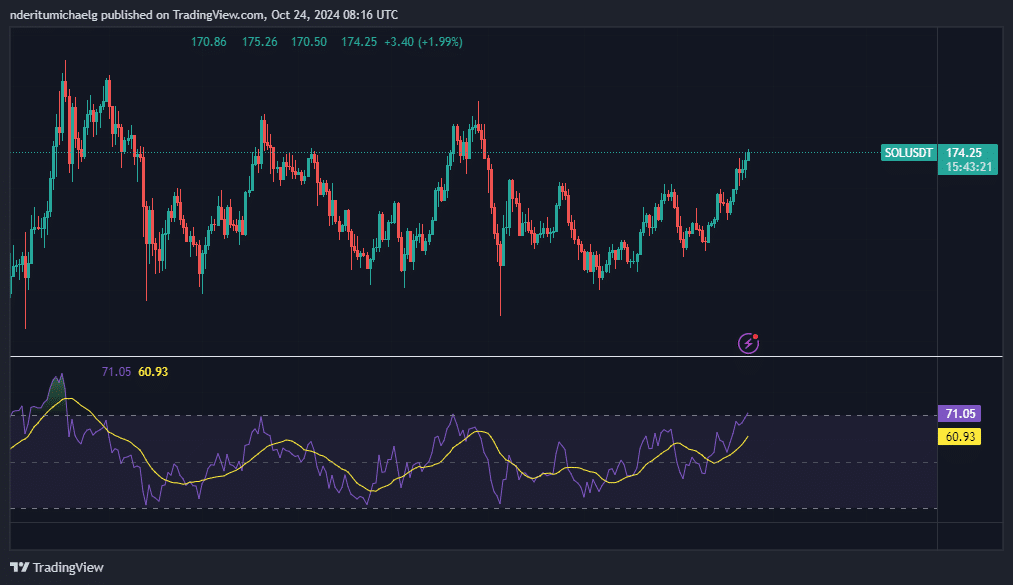

The resistance range in question was between $161 and $163. SOL blew past these levels and continued to push higher. The surge in short liquidations has occurred above the resistance range.

Meanwhile, SOL has since pushed to a $174 price tag at press time, and is now overbought according to the RSI.

The overbought condition suggests a higher probability of sell pressure intensifying. However, there could still be room for more upside in the coming days. SOL’s next resistance range is at the $185 price level.

The higher than anticipated SOL price move formed a short squeeze scenario. Especially considering the surge in open interest observed so far this week.

Read Solana’s [SOL] Price Prediction 2024–2025

Open interest soared to $3.26 billion in the last 24 hours. The last time that it was this high was at the start of April.

Source: Coinglass

SOL’s push higher confirms breakout momentum which may encourage more traders to go long. However, this also underscores a potential pivot in favor of long liquidations once the short liquidity sweep is complete.