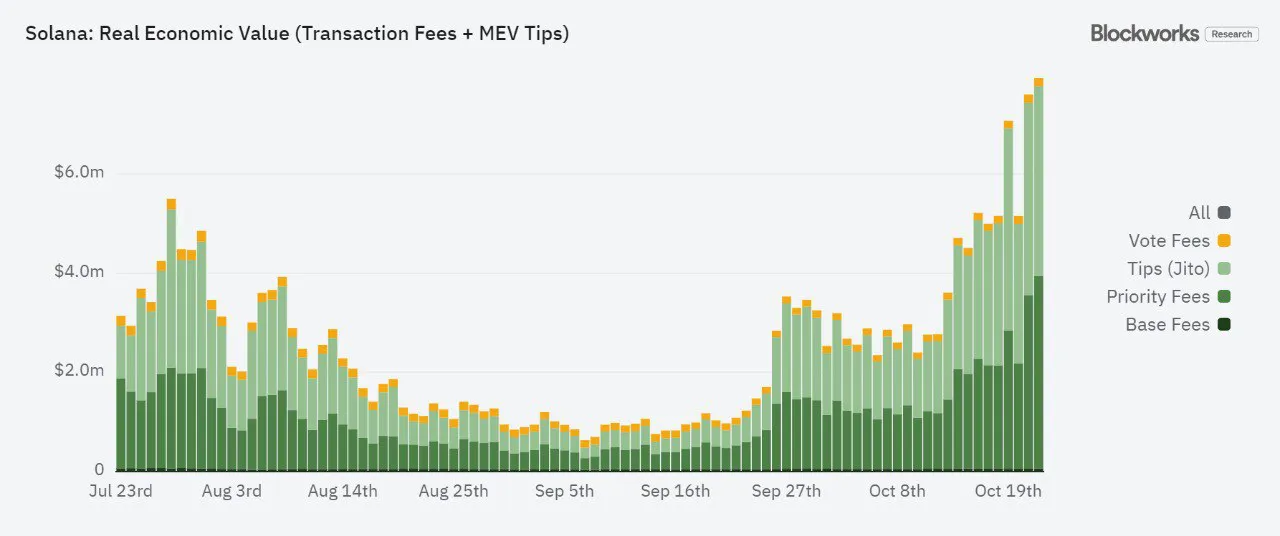

Solana’s daily economic value, including transaction fees and MEV tips, peaked yesterday at an all-time high of $7.93 million. The network has registered a progressive exponential increase in economic value since late September.

Solana achieved a major milestone by recording the highest revenue generation count in its history. The network’s real economic value, including MEV tips and gas fees, peaked at an all-time high of $7.9 million on October 22nd after steadily increasing since late September.

Solana’s real economic activity surges to new all-time highs

The network recorded a previous all-time high of $7.07 million on October 19th before dipping to $5.1 million the following day. On 21st October, the revenue count surged to a new all-time high of $7.6 million before seeing a new all-time high on 22nd October.

According to data from Blockworks Research, a blockchain analytics firm, the main economic value of the Solana blockchain emanates from tips (Jito) and priority fees. The two revenue sources cumulatively account for more than 90% of the network’s daily economic activity. Base fees and vote fees have the smallest share of the network’s recorded figures.

As of October 22nd, tips (Jito) accounted for 48.3% of the revenue generated on Solana. Priority fees made up 48.9% of the activity revenue. On the other hand, base fees and vote fees only accounted for 0.8% and 2%, respectively.

On October 21st, tips made up the majority of the revenue, accounting for 50.9%. Priority fees followed closely with 46%. Base fees equated to 0.8%, while vote fees made up 2.3% of Solana’s real economic value.

SOL stakers get the most revenue allocation

Data from BlockWorks Research also reveals that stakers, SOL burn, and validators get the most revenue share, while Jito Labs gets the least share of the proceeds. On October 22nd, stakers got the lion’s share of 41.6%, followed by validators, who received 30.1%.

SOL burn got 25.8%, while Jito Labs received 2.4%. On October 21st, the network’s stakeholders also received the most share, accounting for 43.9%, followed by validators, who received 29%. SOL burn received 24.5%, while Jito Labs trailed last with an allocation of 2.5%.

BlockWorks Research data also reveals that the Solana burn ratio surged significantly in October from a high of 10% recorded at the end of September. The current percentage of emissions offset by burned transaction fees has surged to 18.0% from 2.8% recorded on September 21st. SOL burn has also crossed the $2 million mark and has been steadily increasing since the low of $606k recorded on October 10th.

The news comes after Solana outperformed the entire Ethereum ecosystem in transaction volume despite concerns around the unfolding FTX asset distribution process. Solana has outshone Ethereum and its layer 2 scaling solutions, such as Optimism, Arbitrum, and Base, with over $1.6 billion in volume having added 42% in the last week.