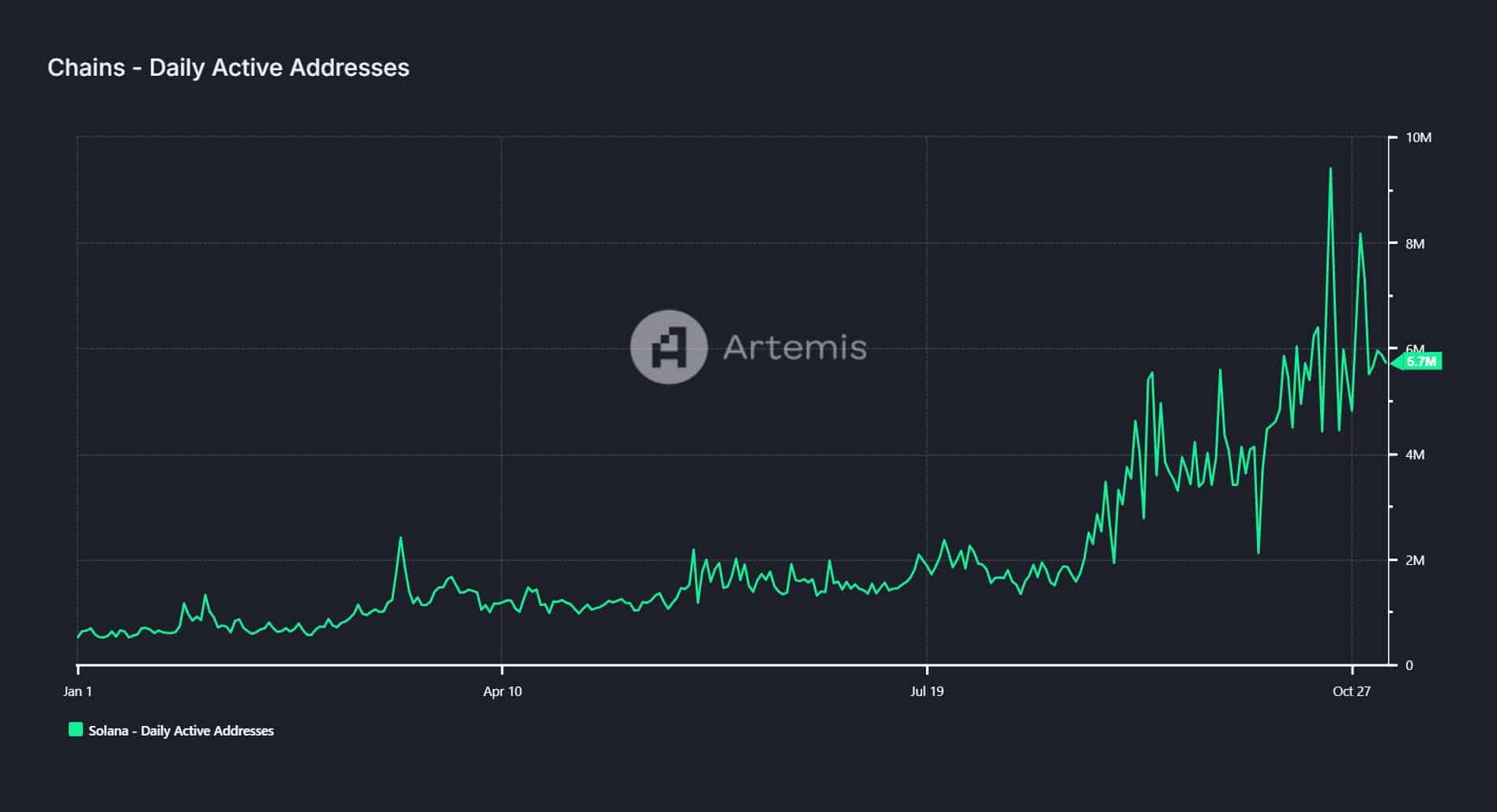

- The number of daily active users on Solana has stayed above 5 million in November.

- SOL has increased by over 11% in the last 24 hours.

Solana [SOL] has seen an explosion in its user base in 2024. Analysis showed that the number of users has exploded, climbing over 100 million as we approach the end of the last quarter.

The memecoins on the platform have influenced the growth, and this has also impacted SOL’s price.

Solana sees a surge in user base

Solana’s user base has shown unprecedented growth year-to-date (YTD), with an impressive surge becoming even more evident in recent months.

Data from Artemis indicated that Solana had approximately 13.8 million monthly active addresses at the start of the year.

However, the network’s active address count has skyrocketed since August, climbing from around 40 million at the end of August to over 100 million in October.

This sharp increase highlighted Solana’s accelerating adoption, with daily active addresses growing by over 970% YTD.

The trend continued strong in November, where the daily active address count has consistently stayed above 5 million.

Memecoin activity boosts Solana’s user growth

A major contributor to Solana’s user growth has been the surge in memecoin activity on the platform.

In 2024, the number of memecoins on the network has seen a notable rise, with even more projects launching over the past few months.

Data from CoinGecko shows that the market capitalization of memecoins on Solana stood at over $12.4 billion at press time.

With the overall memecoin market cap of around $72.2 billion, Solana held a sizable share of more than 17%, highlighting its role in the expanding meme-token ecosystem.

This influx has increased the number of users and diversified Solana’s ecosystem, attracting casual users and serious investors looking for alternative assets within the network’s fast and affordable infrastructure.

Positive momentum for SOL’s price

Solana [SOL] has also shown impressive price performance, with the altcoin trading at $184.91 at press time, reflecting a daily increase of 10.96%.

The recent price action has pushed SOL above both its 50-day and 200-day moving averages, signaling a strong bullish trend.

Since crossing the 200-day moving average in late October, SOL has sustained its upward trajectory, indicating resilient investor confidence in the asset.

Increased trading volume further supports this price momentum, which suggests strong investor interest.

Is your portfolio green? Check out the SOL Profit Calculator

The combination of strong technical indicators and rising volume indicates a positive outlook for Solana’s price in the near term.

If SOL can maintain support above critical price levels, it may continue its upward movement, potentially reaching new highs driven by sustained demand and favorable market sentiment surrounding its expanding ecosystem.