Solana price has fallen for two consecutive days, dropping 7.8% from its highest level this week.

Solana (SOL), the fourth-largest cryptocurrency, fell to $207 on Nov. 13, down from this week’s high of $225.

Its retreat mirrored that of Bitcoin (BTC) and other cryptocurrencies like Ethereum (ETH) and Cardano (ADA).

Despite the sell-off, one analyst believes it is too risky for traders to short SOL at the current prices. In an X post, Kingpin Crypto, an analyst with over 27,000 followers, warned that shorting the coin could be risky. He cited the fact that Solana was breaking out of an eight-month trading range.

Additionally, Solana maintains solid fundamentals as it has become a major player in the crypto industry. For example, it has become the blockchain of choice for developers who are building meme coins.

According to CoinGecko, the total market cap of all Solana meme coins has jumped to over $17.8 billion. Dogwifhat has a market cap of $3 billion, while Bonk, Peanut the Squirrel, and Popcat each have valuations of over $1 billion.

Solana has also overtaken Justin Sun’s Tron to become the second-largest chain in the decentralized finance industry. Its total value locked has jumped to over $7.58 billion, with the biggest players in the network being Jito, Kamino, Jupiter, and Raydium.

After dominating Ethereum in DEX volume in October, Solana is repeating the same trend this month. Its volume has risen by 91% in the last seven days to $24.55 billion, mostly due to several trending Solana meme coins like Department of Government Efficiency and Happy Coin.

Solana price to form break and retest before roaring back

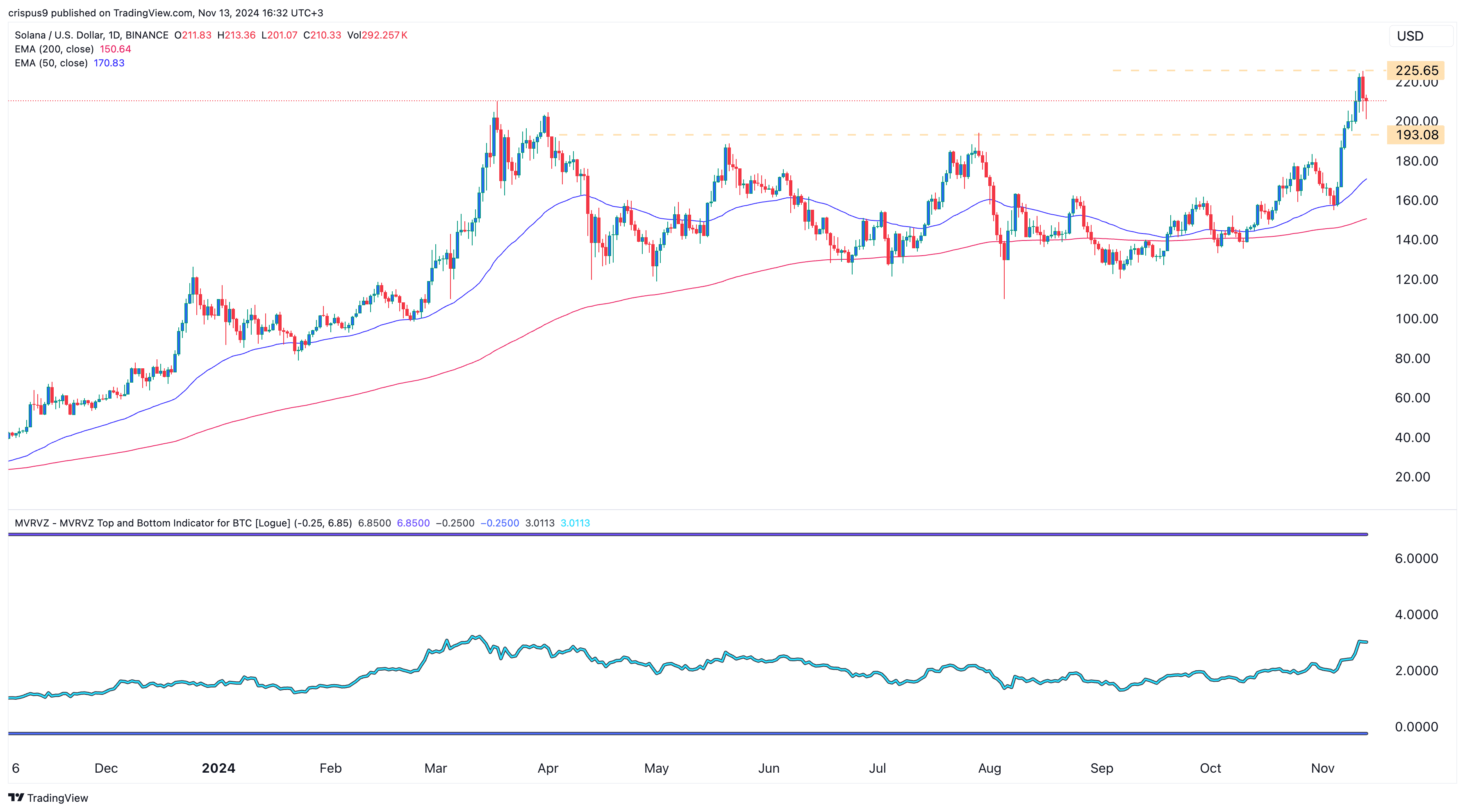

The daily chart shows that the SOL price has pulled back after soaring to $225 on Tuesday. It has remained above the 50-day and 200-day moving averages, which is a bullish sign. Also, the MVRVZ indicator has moved sideways after rising to its highest level since March.

Most importantly, there are signs that Solana is about to form a break and retest pattern by moving to the key support at $193, its highest level on June 29. A break and retest happens when an asset rallies above a key level, retests it, and then resumes the bullish trend. If this is correct, there are high chances that Solana will rebound and retest $250 in the near term.