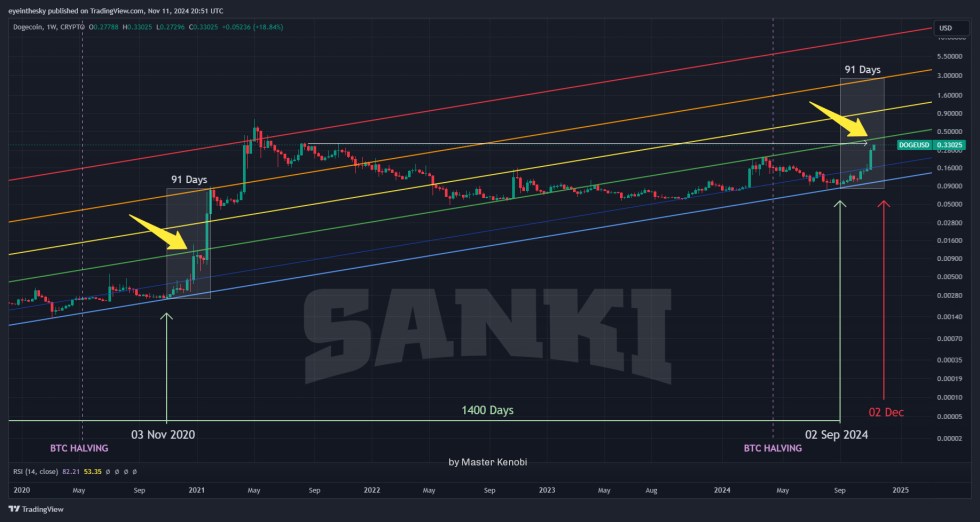

Solana (SOL) is demonstrating technical strength as it challenges a crucial resistance level. Some analysts are suggesting a potential breakout toward the $202 mark.

Rekt Capital Identifies Critical Development

Prominent crypto analyst Rekt Capital has identified a critical technical development in Solana’s price action.

The cryptocurrency has been grappling with a diagonal trendline resistance that has served as a rejection point for several months.

– Advertisement –

However, recent price action suggests this resistance is weakening. This means that SOL is setting the stage for an upward movement.

The analysis highlights how SOL successfully bounced from the $159 support level, demonstrating strong buying pressure.

This rebound has pushed the price toward a confluent resistance area, marked by both a horizontal red box zone and the descending blue diagonal trendline.

More importantly, SOL has shown the ability to break beyond these previously challenging resistance levels.

Solana shows diminishing selling pressure

The weekly price action has been particularly telling, with SOL’s behavior around the blue diagonal resistance changing notably.

Previous encounters with this trendline resulted in sharp rejections. However, recent price action shows diminishing selling pressure at this level. Rekt Capital noted in their analysis,

“Last week’s rejection and this week’s strong reaction just demonstrates how the blue diagonal has weakened as a point of rejection”

Solana pushes above $190

Solana’s impressive performance metrics underscore the strength of its current market position.

According to CoinGecko data, SOL has recorded a 5.5% increase in the last 24 hours and a substantial 37% gain over the past month.

Even more remarkably, the cryptocurrency has surged by 365% over the last year.

Looking ahead, the analyst suggests that SOL needs to achieve a weekly close above the confluent resistance area to confirm the bullish outlook.

This would likely be followed by a retest of the broken resistance, which could then serve as support for a potential move toward the $202 target.

The weakening of the diagonal resistance suggests a shifting market structure that could support higher prices.

However, traders should note that the path to $202 may not be linear. A successful transformation of the current resistance into support would be crucial for sustaining the upward momentum.