- KuCoin leads August with a massive 171% surge in trading volume, topping all major centralized exchanges.

- Binance and Bybit continue strong, posting 35% and 41% gains in August, boosting overall market activity.

- Despite overall growth, Gate struggled in August, reporting a significant 44% drop in spot trading volume.

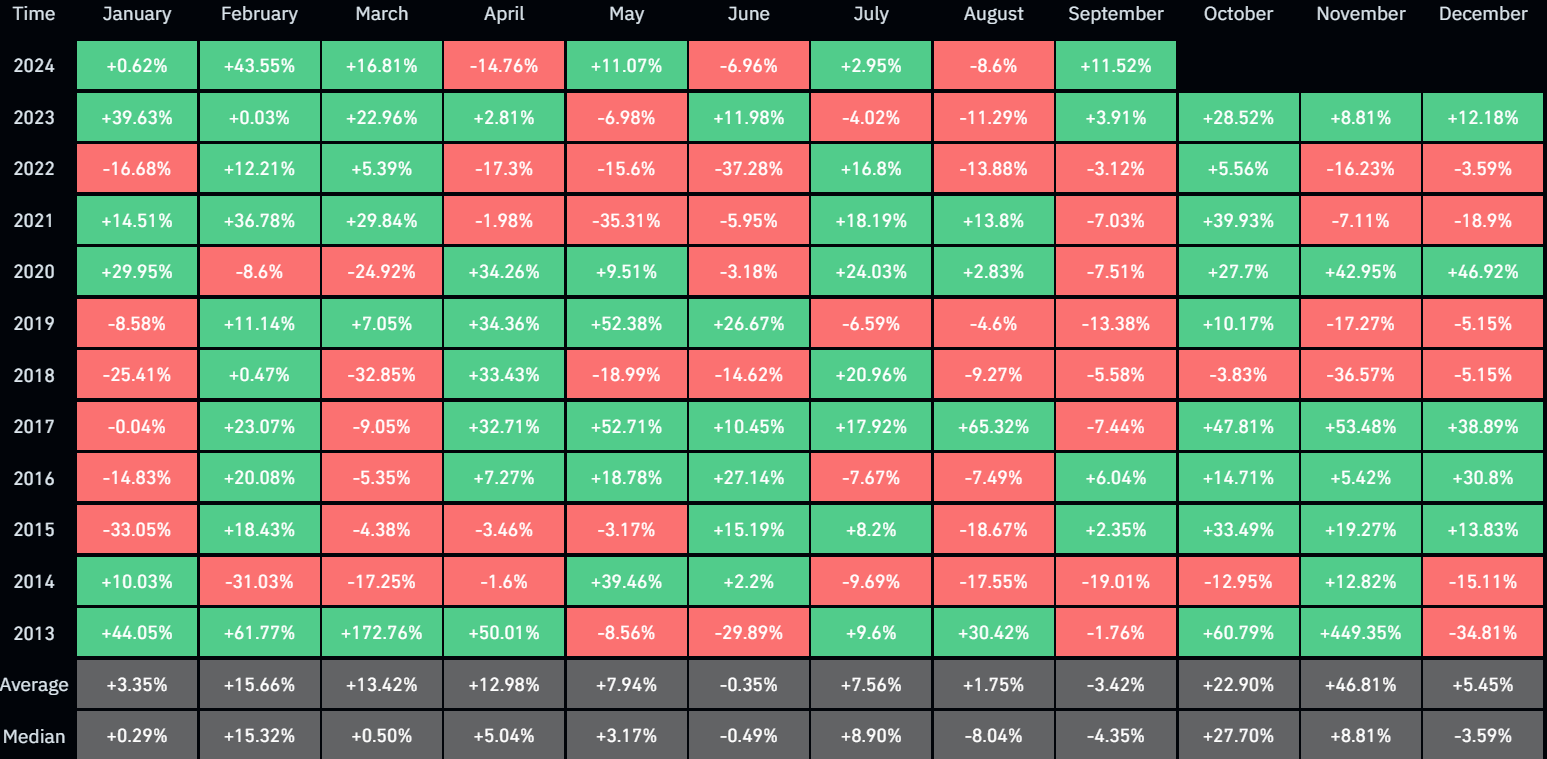

In August, major centralized exchanges (CEXs) experienced a significant rise in spot trading volume, with a month-over-month (MOM) increase of 30%. Binance, the industry leader, reported a substantial 35% growth, alongside Bybit, which saw a 41% uptick in activity. The latest data, compiled by WuBlockchain, shows an overall expansion in the trading environment, as several exchanges benefitted from heightened market participation and new incentives driving trading activity.

Leading Performers in Spot Trading Growth

The most impressive growth was observed on KuCoin, which led the market with a remarkable 171% increase in trading volume. This surge may indicate strategic moves to attract more users, including new features or promotional campaigns. Meanwhile, Crypto.com saw a notable rise of nearly 79%, making it one of the top three exchanges in terms of volume growth.

Other exchanges, such as Bybit and Binance, continued their upward trend with 41% and 35% increases, respectively. Mexc also performed well, registering a 44% growth in its spot trading volume.

Declining Performance on Select Exchanges

Despite the positive trend in overall trading volumes, not all platforms saw gains in August. Gate, for instance, posted a significant 44% decline in volume, indicating possible internal challenges or reduced trading activity among its user base.

Read CRYPTONEWSLAND on

google news

HTX (formerly Huobi) experienced a modest increase of just 4%, reflecting limited changes in user engagement during the period. Upbit saw a moderate rise of 17%, signaling some market participation but not at the level of other leading exchanges.

Derivatives Market and Website Traffic

The report also highlights a 32% rise in derivatives trading volume, driven primarily by Mexc (71%) and Crypto.com (70%). On the contrary, Bybit and OKX posted lower increases of 26% and 27%. Website traffic showed a mild overall increase of 4%, with Mexc leading with a 160% rise, while Bybit saw a 12% drop, highlighting mixed user engagement across platforms.

Crypto News Land, also abbreviated as “CNL”, is an independent media entity – we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.