🚀 Stay Ahead with AltcoinDaily.co! 🌐

The United States Department of Treasury has cast a fresh spotlight on digital assets in its latest report developed for the Treasury Borrowing Advisory Committee. The report explored the evolving digital asset landscape and its ripple effects across traditional finance. The executive department highlighted that these crypto assets create a modest yet intriguing demand for short-term government debt.

The Evolution of Digital Assets: From Bitcoin to Stablecoins

The Treasury report tracks the rise of digital assets, which started with pioneering assets like Bitcoin and has evolved to include stablecoins. While Bitcoin and Ethereum continue to capture public attention, stablecoins are emerging as financial tools with potential long-term implications for Treasury investment.

The Treasury notes that while digital assets have grown rapidly, their overall market size remains modest compared to other financial sectors. This means that while digital assets are emerging, their influence on Treasuries is still limited.

🌟 Unlock Crypto Insights with AltcoinDaily.co! 💰

Stablecoins and Treasury Investment: An Unlikely Match

The report highlighted stablecoins as a key driver behind recent short-term U.S. Treasury Bill investments. It was estimated that stablecoins hold about $120 billion in Treasury collateral. Tether, the world’s largest stablecoin issuer, leads the pack with a remarkable $81 billion invested in the U.S. Treasuries.

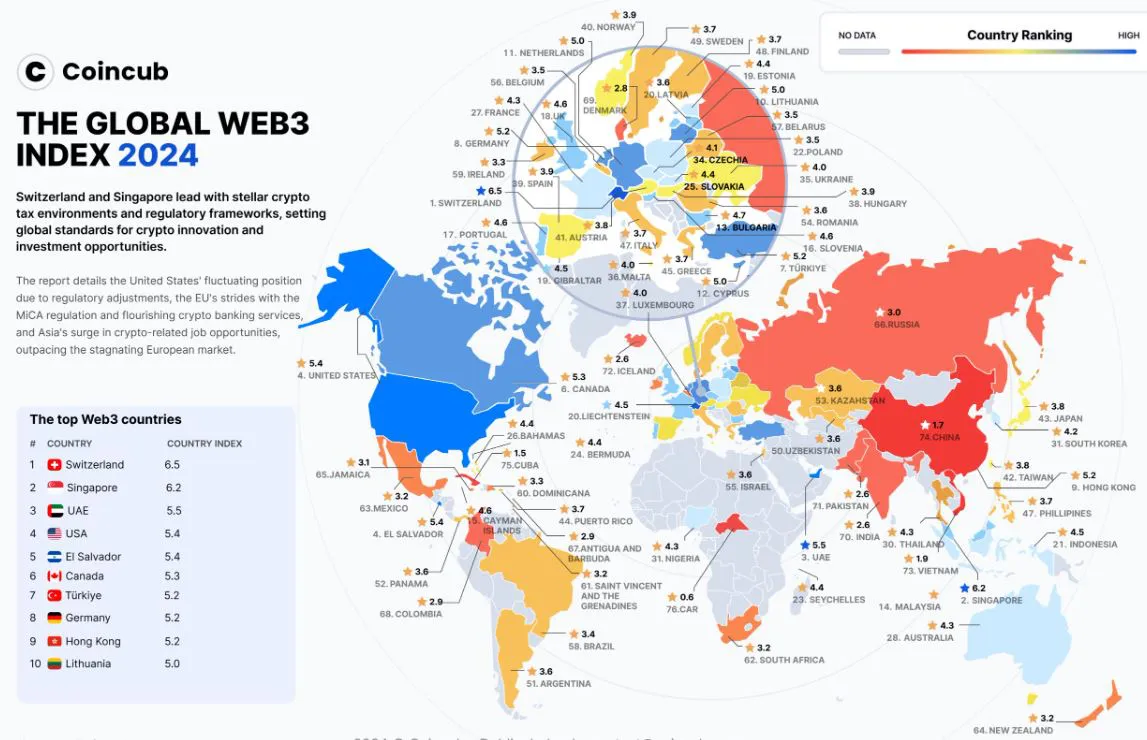

Tether’s CEO, Paolo Ardoino, has stated that Tether’s U.S. Treasury holdings exceed those of countries such as the United Arab Emirates, Australia, and Spain. Stablecoins have proven essential for facilitating trades within crypto markets, with over 80% of all crypto transactions now incorporating a stablecoin.

As stablecoins help streamline transactions, they also contribute to an expanding demand for Treasuries, albeit on a modest scale. The Treasury’s data points to stablecoins as not only transaction intermediaries but also pivotal players in maintaining liquidity across the crypto ecosystem. While stablecoins seem poised for further growth, the Treasury warns that upcoming policy decisions could either accelerate or constrain their trajectory.

🦂 AltcoinDaily.co is your trusted source for the latest in crypto news and insights. 🚀

Bitcoin’s Role in Treasury Demand

Bitcoin is not directly tied to Treasuries, albeit as a more indirect influence. As Bitcoin’s market value grows, investors could increasingly look to the U.S. Treasuries as a secure option to counter the volatility of the crypto market.

Treasuries might serve as a haven for investors seeking stability alongside the high-risk, high-reward nature of Bitcoin and other cryptocurrencies. This dynamic could gradually boost demand for Treasuries as the digital asset market expands.