- Stacks has a short-term bullish outlook.

- Increased demand is necessary to break the token out of the three-month range formation.

Stacks [STX] has made rapid bullish progress recently. Since the lows posted on the 16th of September, the token rose by 22%. This followed the bullish market-wide belief of the past two weeks.

From the second week of September, Bitcoin [BTC] has rallied from $54k to $64.5k. This 20% move for the king of crypto has rejuvenated bullish belief, including the sentiment behind Stacks.

STX headed toward the range highs again

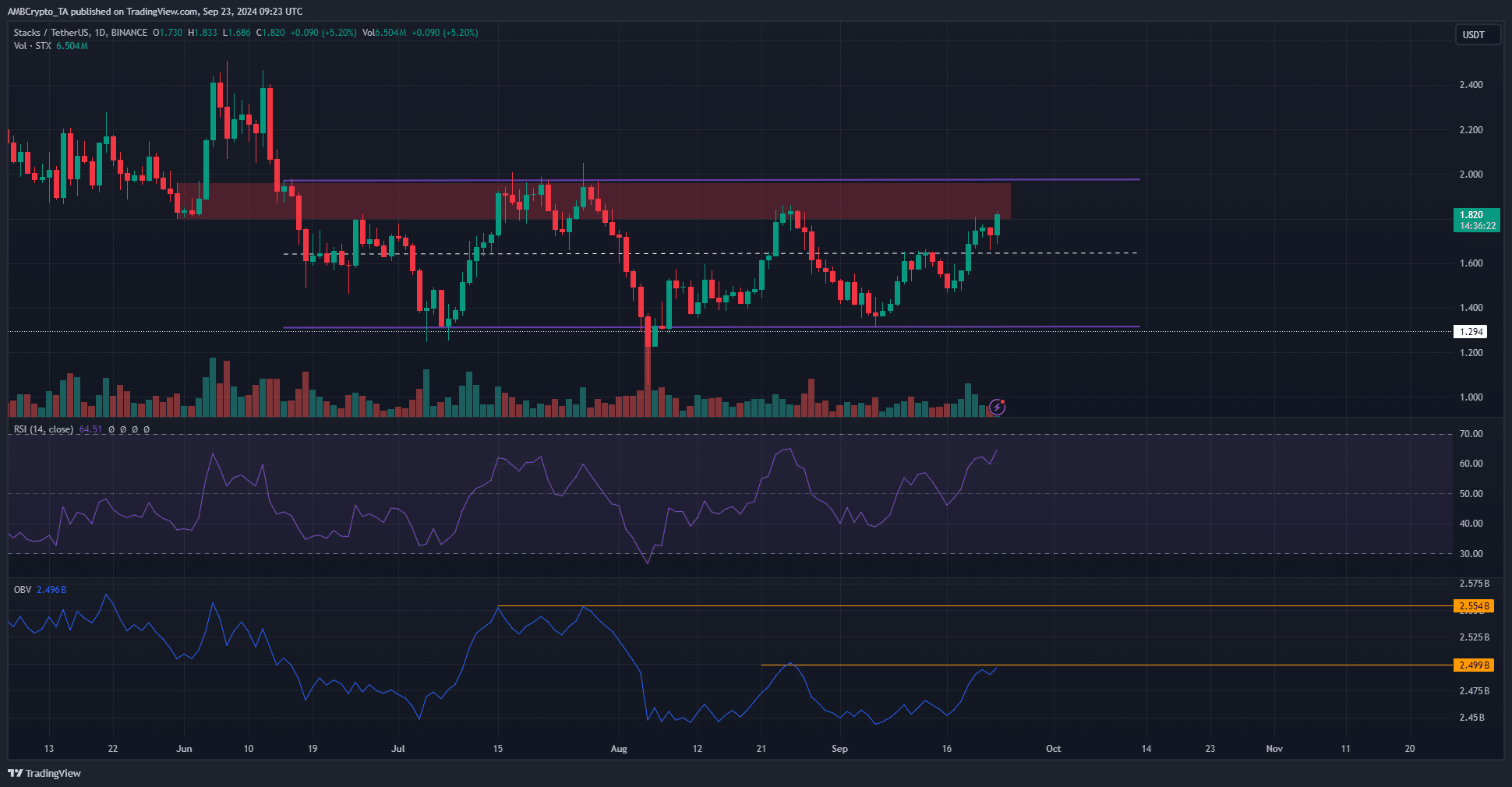

Since the first week of July, Stacks has traded within a range that extended from $1.32 to $1.97. The mid-range level at $1.645 has served as both support and resistance in the past three months.

Earlier in September, STX bulls were rebuffed from the $1.645 resistance before the rally of the past week flipped this level to support.

Alongside the range highs, a bearish breaker block on the daily chart was present below the $2 region. This posed substantial opposition to bullish growth.

A retest of this resistance might not yield a breakout on this attempt either.

The daily RSI was bullish and showed upward momentum. The OBV was at a local high that acted as a resistance over the past month.

Even if the buyers can break this, there’s a local high that the OBV formed in July, which was insufficient to break the range.

As things stand, a large influx of capital is necessary to push Stacks prices past $2. Until this happens, traders can use the range extremes as their targets.

Social sentiment witnessed a massive positive swing

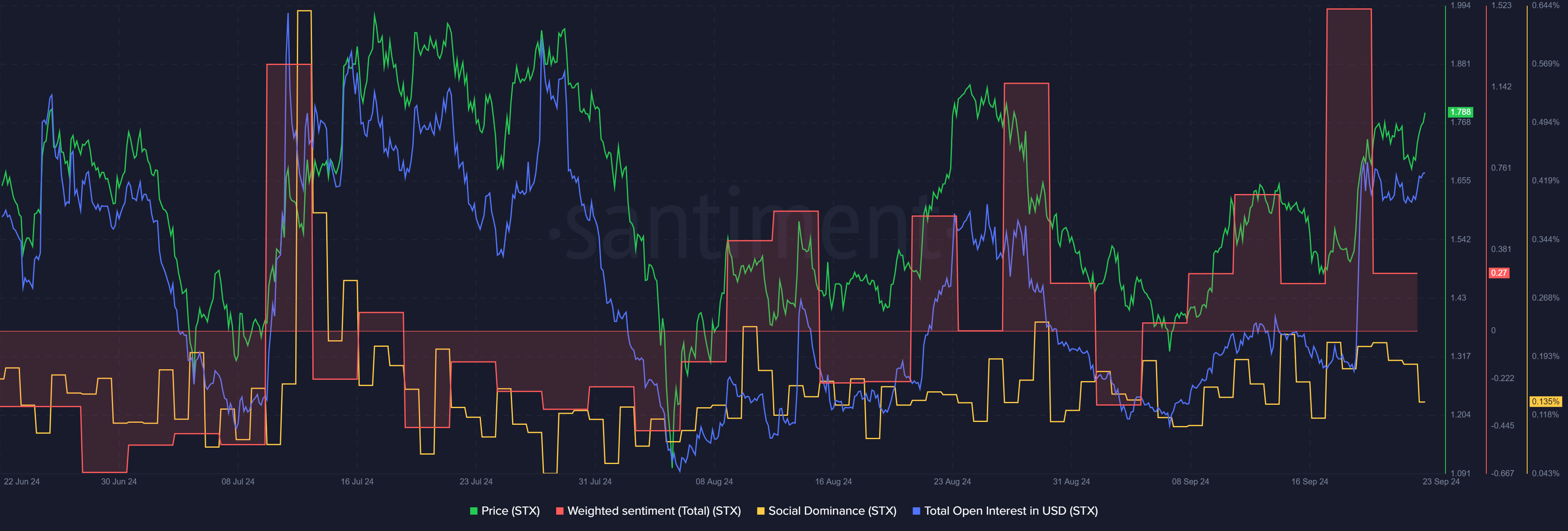

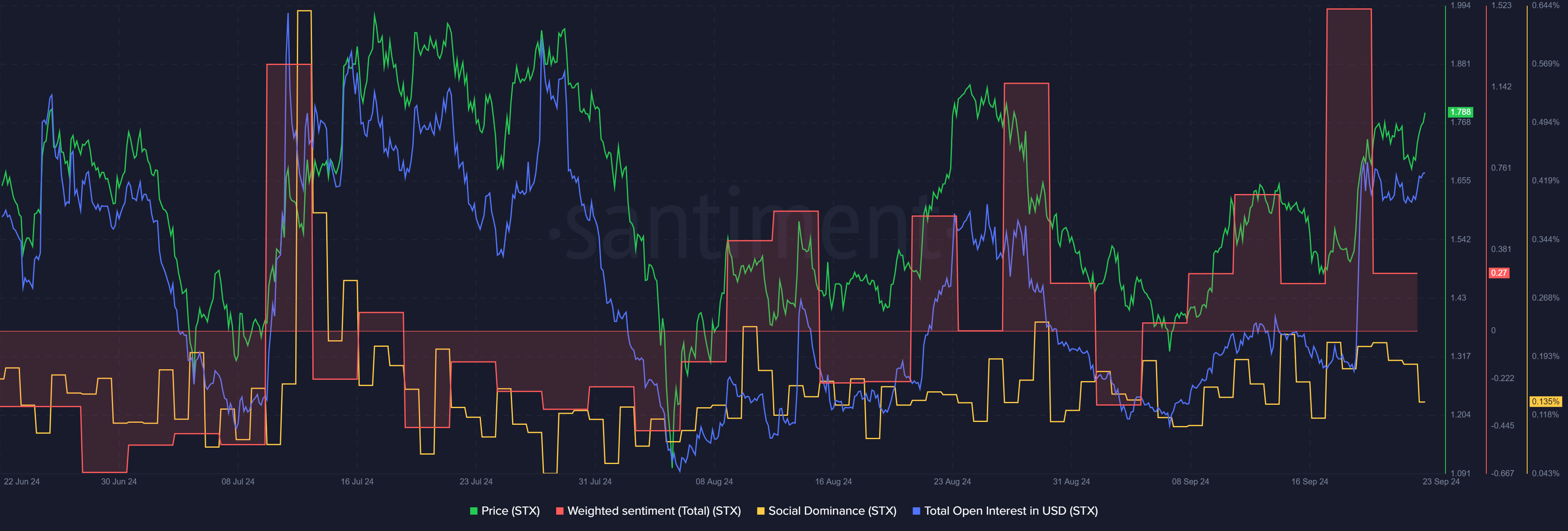

Source: Santiment

AMBCrypto looked at the data from Santiment and noted that the weighted sentiment on social media has been positive throughout September. This saw a spike last week as prices also breached the mid-range resistance.

Realistic or not, here’s STX’s market cap in BTC’s terms

This could be due to the news that Stacks was integrating with the Aptos [APT] network, allowing BTC use in the APT network’s decentralized applications (dApps).

The rise in Open Interest also indicated bullish sentiment was rising in recent days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion