In the latest newsletter published by Rekt Capital, the analysts provided updates on two cryptocurrencies, Stacks (STX) and Dogwifhat (WIF), using insightful market analysis.

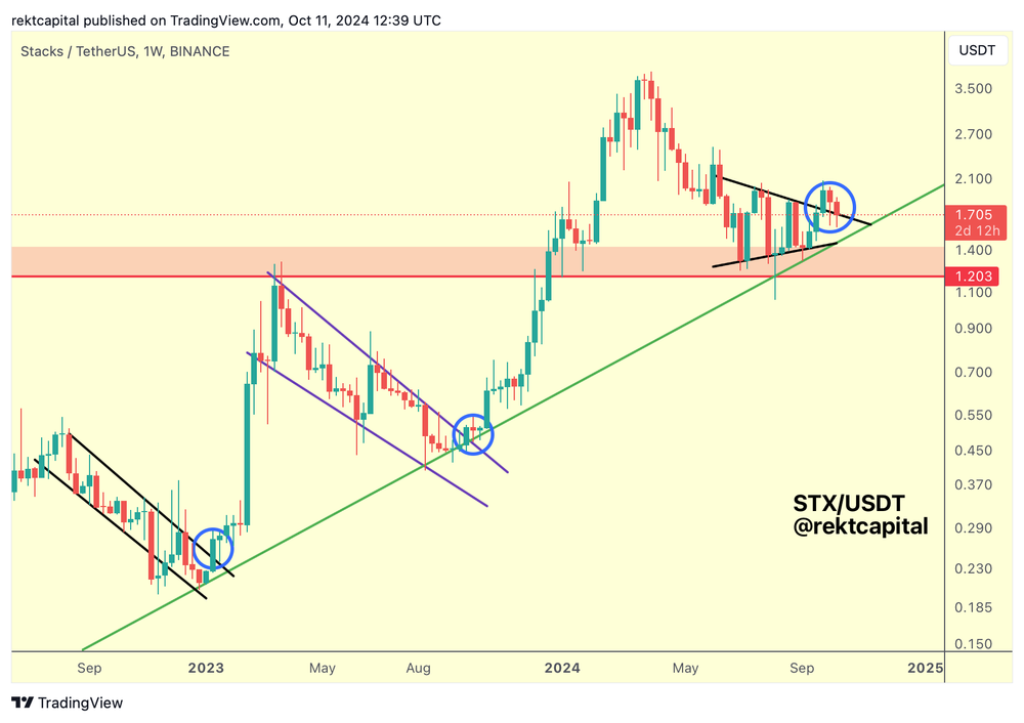

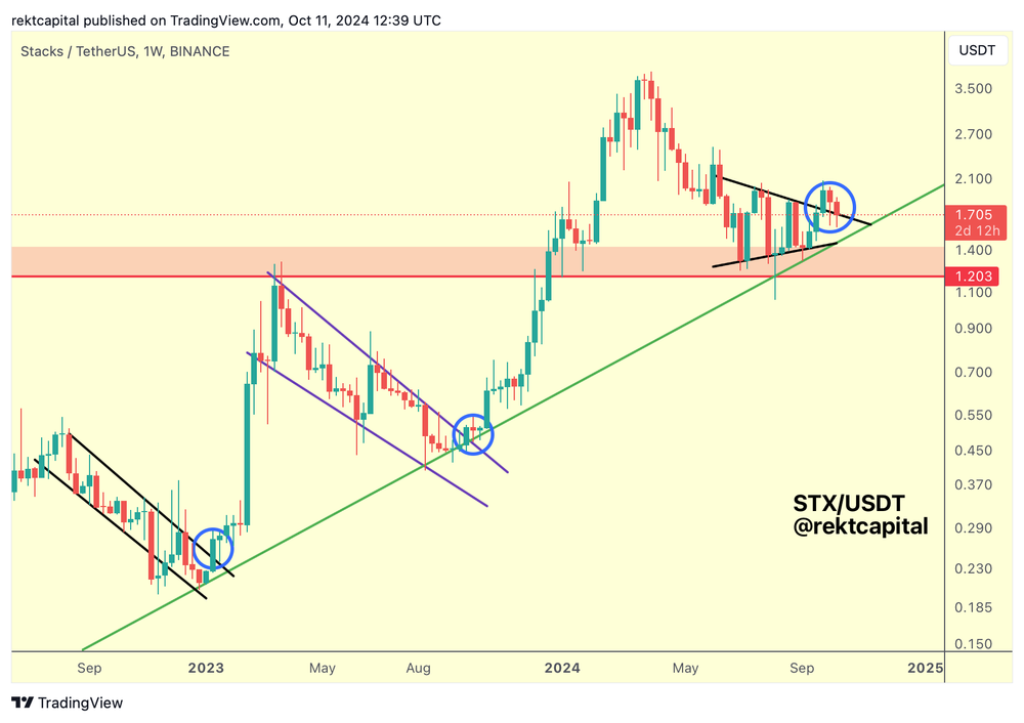

A few weeks prior, the newsletter highlighted how STX typically develops market structures around its Macro Higher Low, which has been established for over 1.5 years.

This recent period followed the same trend, as STX broke out from its primary pattern. The analysts noted that such breakouts usually lead to a retest of the breakout point, which serves to confirm the validity of the breakout.

Last week, they reported a successful retest of the pattern’s top, resulting in a notable +17% price increase. However, after this initial surge, the price showed limited follow-through and returned to the retest point.

\Read Also: Why Is Solar (SXP) Price Pumping?

The analysis indicated that Stacks (STX) is still in the process of this retest, with price wicking below the pattern top yet managing to hold that area as support.

The ongoing stability in this area is considered crucial for potential upside movement, emphasizing the need for STX to maintain a weekly close above the pattern top to align with its historical price behaviors.

Celebrate Dogecoin and Make Big Gains with Doge2014!

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Dogwifhat (WIF) Must Maintain the $0.25 Key Level

In their coverage of WIF, the analysts revisited a discussion from several weeks ago regarding WIF’s preparation for a breakout from its Macro Market Structure.

They identified the red resistance level at $2.52 as a significant hurdle. In this latest update, Dogwifhat (WIF) has successfully broken out upwards, achieving a +26% rally into the $2.52 resistance. The analysts noted that WIF’s weekly close above this resistance suggests an attempt to reclaim this level as new support.

Read Also: Why Is SUI Price Pumping?

The overall goal for WIF is to re-enter the $2.52-$3.22 range, where it had previously consolidated earlier in the year. For WIF to build on its recent rally and aim for a revisit of the range high at $3.22, it will need to hold the Range Low of $2.52 during the ongoing retest.

Overall, both STX and WIF are navigating crucial technical levels that will determine their short-term price movements and potential for future gains.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link