In this bearish market sentiment, the majority of cryptocurrencies have experienced notable price declines. Amid this, a crypto expert hints that Solana (SOL) is flashing a buy signal. On September 6, 2024, a prominent crypto expert shared a post on X (Previously Twitter) that a technical indicator named TD sequential has presented a buy signal for SOL on the daily time frame.

Expert Price Prediction for Solana (SOL)

The expert also noted that since April 2024, Solana (SOL) has been consolidating in a parallel channel pattern, and currently the price is at a lower boundary. Based on the historical price momentum, there is a high possibility SOL’s price could soar to $154 and $187 in the coming days.

Solana Technical Analysis

According to expert technical analysis, SOL is in a downtrend as it is trading below the 200 Exponential Moving Average (EMA) on the daily time frame. Additionally, it is consolidating in a tight range between $126 and $135 over the last week.

In addition to this price consolidation, the technical indicator Relative Strength Index (RSI) has formed a bullish divergence on the daily time frame, indicating a strong trend reversal from downtrend to uptrend.

In the past few days, SOL price has formed lower lows, while the RSI has formed higher lows resulting in a bullish divergence. Traders and investors often view this as a potential buying opportunity.

On-Chain Metrics’ Bullish Outlook

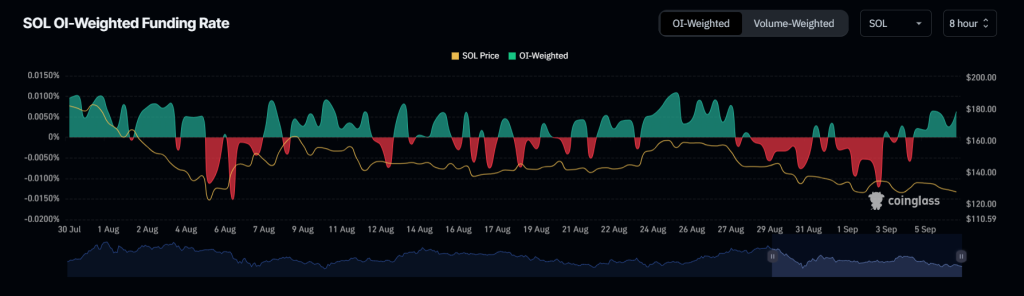

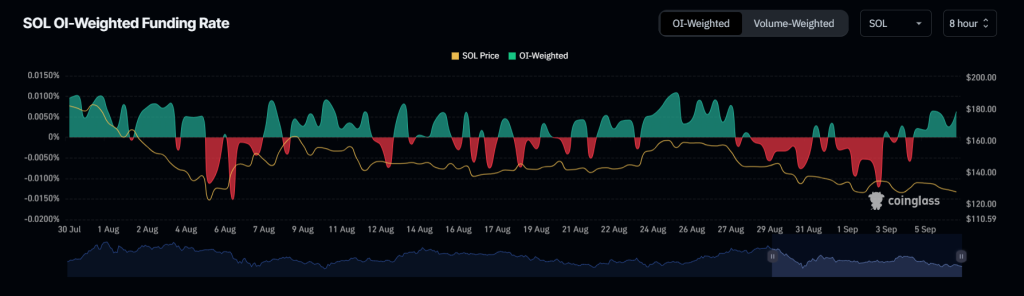

Besides this technical analysis, CoinGlass’s SOL OI-Weighted Funding Rate also supports the bullish outlook. According to the data, the funding rate currently stands at +0.0049, indicating bullish sentiment.

As of now, the major liquidation levels are near $128 on the lower side and $131.5 on the higher side, as traders are over-leveraged at these levels, according to Coinglass data.

At press time, SOL is trading near $129.5 and has experienced a price decline of over 3.5% in the last 24 hours. Meanwhile, its trading volume has increased by 16% during the same period, indicating higher investor and trader participation amid the price drop.