- Cryptocurrency seemed to be nearing a potential rally as it approached a key bullish confluence zone on the chart

- Metrics such as buy volume sustained bullish momentum, despite recent declines

Although TAO has seen a 22.01% drop over the past week and a 5.24% decline on the daily chart, it has not yet fully entered a bearish trend. The bears have not completely dominated the market, indicating the possibility of a rebound.

In fact, AMBCrypto’s analysis revealed that bearish sentiment is beginning to wane, and TAO might resume its bullish trajectory soon.

Double pattern formation and a potential bounce for TAO

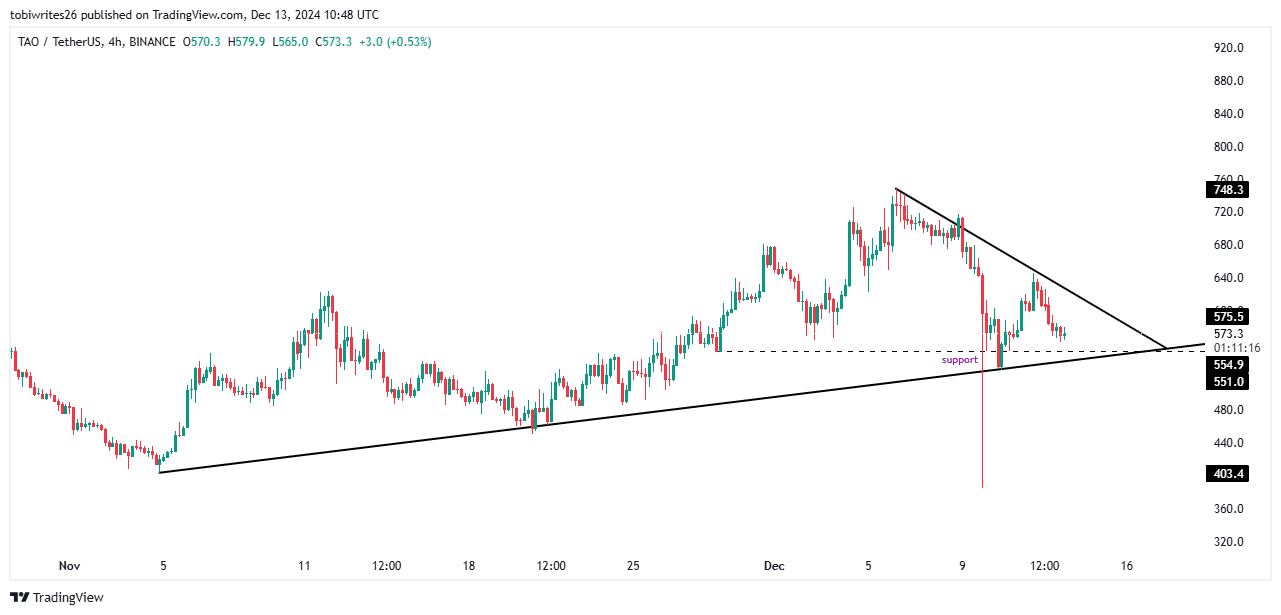

TAO, at the time of writing, was trading within a bullish pattern, a phase that will end once it breaks through its upper resistance line.

Before that happens, TAO is likely to experience a slight drop to the support level at $551.00. This level is critical, as it is likely to provide the momentum needed for a bullish rebound. It also aligned with the support of the bullish symmetrical pattern in which TAO seemed to be trading.

A successful push from this support level could drive TAO to new heights, potentially hitting the peak of the pattern at $748 as the bullish momentum takes hold.

Bullish momentum remains strong for TAO

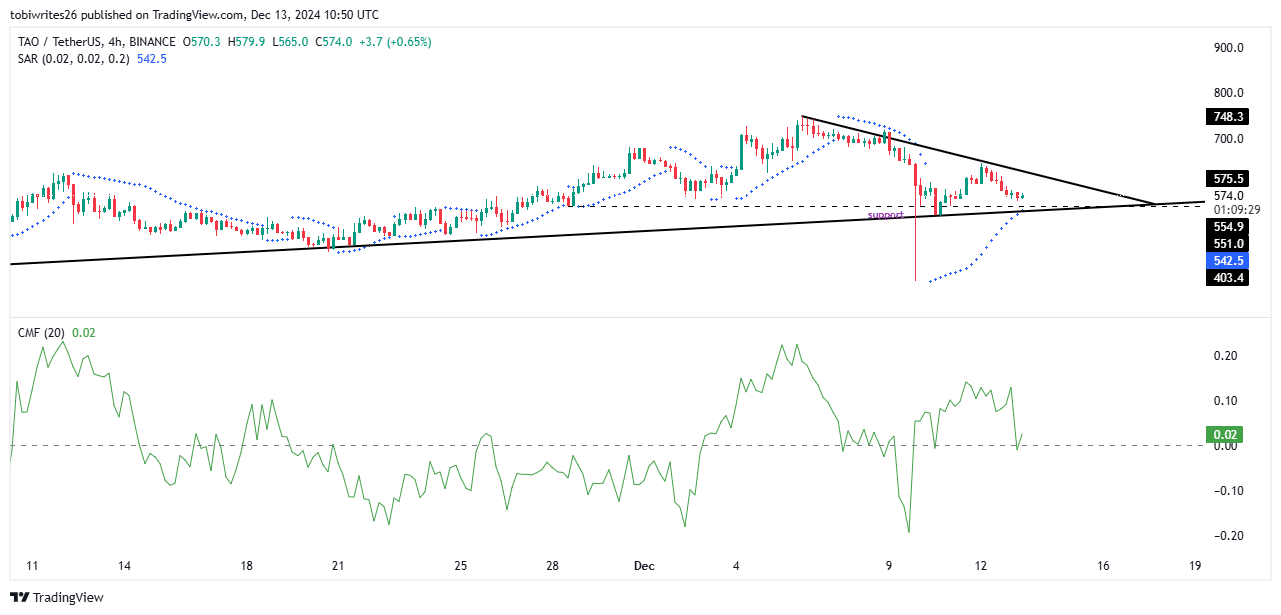

Although TAO has seen a decline recently, the Parabolic SAR (Stop and Reverse) indicator has remained bullish throughout this period, with its dots consistently appearing below the asset’s price.

The Parabolic SAR is a technical indicator used to identify the direction of a trend and potential reversal points. It places dots above the price in a downtrend and below the price in an uptrend.

The sustained presence of dots below the price as it dropped indicated ongoing accumulation. This is expected to positively impact TAO’s price and may drive the asset higher from its press time level.

To confirm this bullish trend, the Chaikin Money Flow (CMF) revealed that buyers have had the upper hand.

The CMF line recently bounced off the zero level and moved up to 0.03, with the uptick line remaining dominant. This suggested that TAO is likely to continue its upward momentum.

Gradual re-entry into the market for TAO

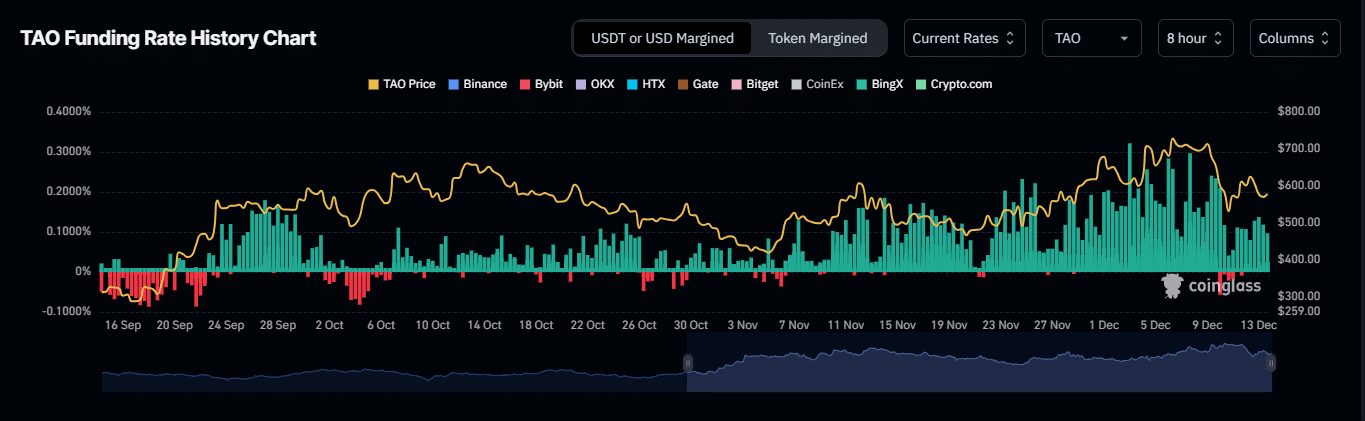

TAO’s bullish run is not fully established yet though, as market participants are gradually re-entering the market. Two key metrics—Open Interest and the Funding Rate—highlighted this trend.

Open Interest, which tracks the number of unsettled derivative contracts to identify the dominant cohort in the market, rose by 0.25% – Bringing its value to $230.37 million.

This hike seemed to be in line with the rising Funding Rate, with the same at 0.0168% on the 8-hour chart.

This indicated sustained buying activity among bulls, who have been maintaining market stability—A move that could drive TAO’s price higher in the coming sessions.