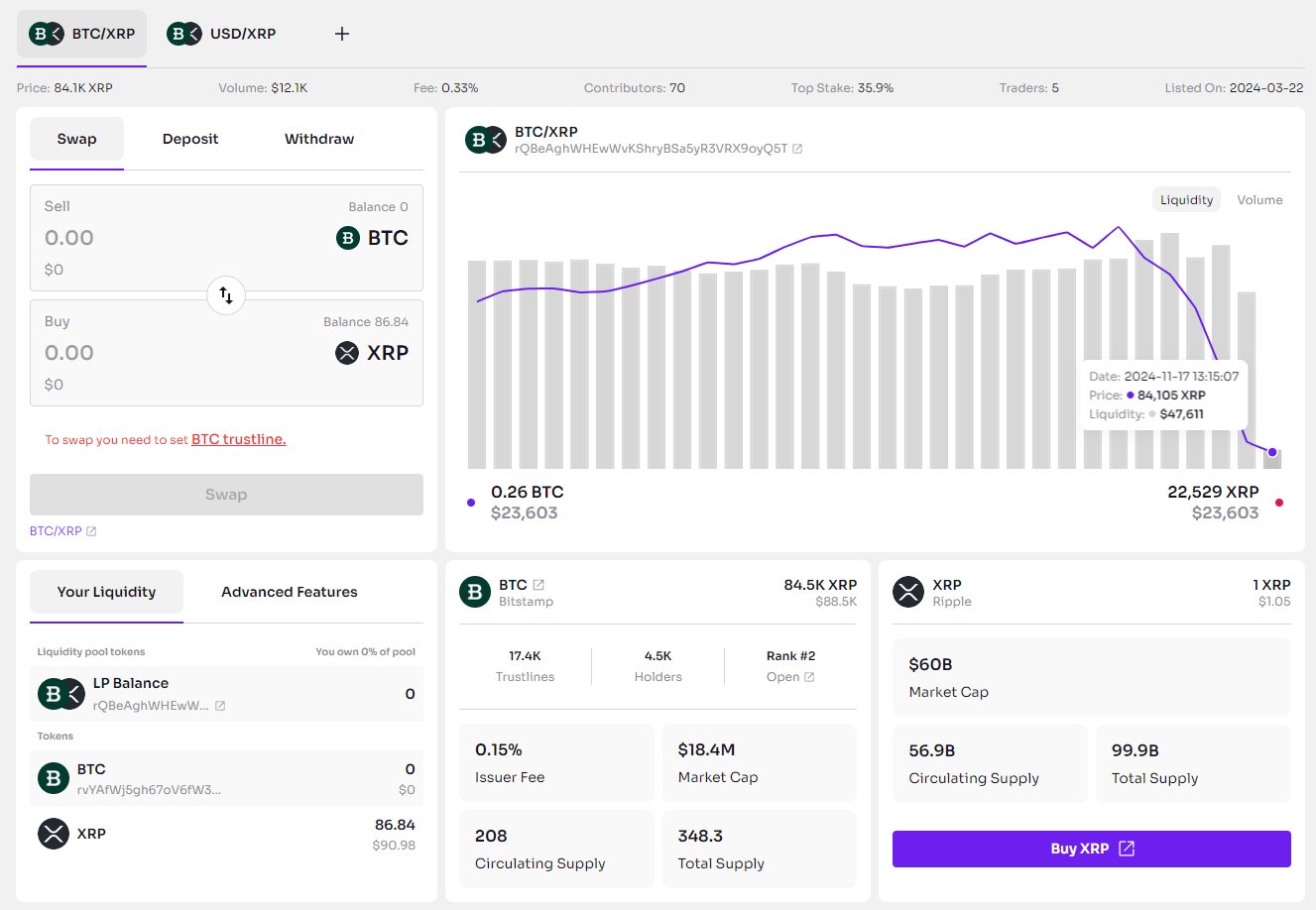

Terra Classic (LUNC) has recently rebounded from the support level around $0.00018, indicating the formation of a potential bull flag pattern. If this pattern continues, there is a target breakout expected at $0.00025.

The crypto market is experiencing a pullback, with several altcoins seeing double-digit declines. Terra Classic’s price, after reaching highs of $0.000278, has retraced by 36% and is currently trading at $0.00018 on Monday.

Bitcoin and Ethereum are also facing downward pressure, with losses of 3.2% and 3.8%, trading at $42,356 and $2,246, respectively. Solana (SOL) dropped below the $70 support level, while Cardano (ADA) is at $0.55, reflecting a 6.5% decline in the last 24 hours. Overall, the market cap has decreased by 3% to $1.65 trillion.

Decoding Terra Classic (LUNC) Price Trends for December

The Terra Classic community expressed optimism at the end of November after a proposal aimed at revitalizing ecosystem tokens LUNC and TerraClassicUSD (USTC) was approved. This positive sentiment led to a bullish breakout for LUNC, lifting it from lows around $0.00007 to highs just above $0.00007. Traders and investors showed interest in the 63rd largest crypto, anticipating a larger breakout to $1.

However, in typical market fashion, corrections occurred as profit-taking became prevalent, providing a necessary pause in the uptrend. These pullbacks, while causing short-term declines, also create opportunities for new investors to enter the market, contributing to momentum for the next move.

As of now, Terra Classic is maintaining support above $0.00018 but is encountering resistance from the 50 Exponential Moving Average (red) at $0.0001818 and the 21 EMA (blue) at $0.0001933.

Anticipating a Potential 38% Surge in Terra Classic (LUNC) Price

The four-hour chart for Terra Classic (LUNC) displays a bull flag pattern, hinting at a possible breakout. Bull flag patterns typically occur after a significant uptrend, providing a brief consolidation period before another potential surge.

Terra Classic price chart | Tradingview

To confirm this breakout, Terra Classic needs to surpass the upper trendline of the flag, with a corresponding increase in trading volume to support the momentum. If successful, investors might witness a substantial upward move, potentially reaching heights around $0.00025.

It’s essential to note that the Relative Strength Index (RSI) currently stands at 40, indicating that bears still exert some influence. The RSI had surged to 94 in early December, signifying overbought conditions. While the current RSI suggests the possibility of further declines, a bounce-back around $0.00015 could precede the next breakout. Investors are keeping a keen eye on these indicators for potential opportunities, hoping for a positive trend into the new year.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News