The amount of Terra Luna Classic (LUNC) tokens staked on the network has now surpassed 1 trillion, driven by recent burn initiatives and increasing interest. According to the Terra Classic Foundation, the staking ratio has exceeded 15%, indicating that a substantial portion of the token supply is currently staked.

This development, along with significant token burns by Binance, has raised optimism about the future performance of the cryptocurrency.

Terra Luna Classic Staking and Burn Update

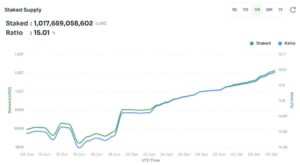

According to the latest data from the Terra Classic Foundation, over 1.017 trillion LUNC tokens are now staked on the network, valued at $70.15 million at the current price. The staking ratio has surged to 15.01%, up from 14.83% a few days ago.

Terra Classic Staking Ratio, Source: Terra Classic Foundation | X

Recently, on July 1, Binance, the world’s largest cryptocurrency exchange, completed its 23rd LUNC burn batch, incinerating 1.7 billion tokens. To date, Binance has burned nearly 62 billion LUNC tokens, with the Terra Luna Classic community’s total exceeding 125 billion tokens burned.

Binance’s ongoing support for Terra Luna Classic’s revival, including its monthly burn mechanism, plays a crucial role in reducing the overall token supply. The latest burn batch covered the period from May 31 to June 29 and was funded by trading fees. Binance alone accounts for over 50% of the total LUNC burned by the community.

The increase in the staking ratio can have a positive impact on LUNC’s price. Higher staking ratios often reflect strong community confidence and a reduced supply available for trading, which can decrease selling pressure and lead to price appreciation. By locking up tokens, staking reduces the circulating supply, potentially increasing demand and attracting more investors.

Terra Luna Classic Faces Market Challenges and Rebounds

This week, the crypto market experienced supply pressure due to a Bitcoin price correction, influenced by liquidations from the Mt. Gox exchange and the German government. Bitcoin’s price fell to a four-month low of $53,550, creating bearish momentum that extended to the altcoin market and impacted Terra Luna Classic (LUNC).

As a result, LUNC’s price dropped below its seven-month support level. The correction began in early March when the price fell from $0.00025. By July 5, LUNC had decreased by 73.6% to $0.0000673. However, on July 7, LUNC saw a rebound with gains of over 7%, trading at $0.00006898.

This rebound indicates that a further decline to $0.000052 might be avoided. To prevent additional downturns, LUNC’s price needs to break above $0.00007 and maintain that level. Currently, LUNC’s market cap stands at $376.43 billion. Additionally, reduced token supply from Binance’s burns and community staking efforts could help boost Terra Luna Classic’s price.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News