Terra Classic (LUNC), the first token of the Terra blockchain, is facing a significant decline. The price has dropped by 20%, occurring shortly after the community finished upgrading the network to v2.3.2.

The impact extends to related tokens, with both Terra Classic USD (UST) and Terra (LUNA) experiencing equal price decreases.

Terra Classic Token Faces Fluctuations After a Month of Surging Prices

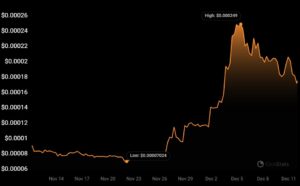

Over the last month since November 11, Terra Classic Token (LUNC) has experienced a remarkable parabolic surge. The token’s value soared by approximately 200%, escalating from $0.00008355 to $0.000249, as reported by CoinStats.

Terra Classic (LUNC) monthly price chart. Source: CoinStats

This substantial price action brought renewed optimism to investors who had held onto the token despite the Terra ecosystem’s significant collapse in May 2022.

While LUNC is a considerable distance from its all-time high of $119 on April 5, 2022, investors remain optimistic about its recovery. The prospect of approaching $1 is seen as a significant milestone, potentially triggering a Fear of Missing Out (FOMO) buying frenzy.

To further stoke enthusiasm, fans continue to actively burn LUNC tokens, with reports indicating that Binance alone has burned over 43 billion tokens. However, the recent rally now faces a threat as the price of Terra Classic Token has plunged by over 20% in the past 24 hours, introducing a new element of uncertainty into the token’s recent performance.

Terra Tokens Face Value Decline Amidst Broader Market Shift

The recent value decline extends beyond Terra Classic Token (LUNC), affecting its algorithmic stablecoin, TerraClassicUSD (UST), which had previously depegged, contributing to the Terra ecosystem crash. According to CoinMarketCap, UST’s price has fallen from $0.05103 to $0.04079, marking a significant dip of over 20%.

Adding to the challenges, Terra (LUNA), the new token introduced following the network’s crash, is also experiencing a decline. Its price has dropped from $1.1629 to $0.9366, reflecting a roughly 20% decrease at the time of writing. This downturn follows a prior impressive 30% rally in LUNA’s price over the past month.

With all Terra tokens currently under selling pressure, the sustainability of their recent gains remains uncertain. The broader market shift raises questions about the resilience of Terra’s tokens in the face of current market dynamics.

In parallel developments, Do Kwon, the founder of Terraform Labs, faces extradition from Montenegro to the United States. This comes amidst the broader challenges and uncertainties faced by the Terra ecosystem and its associated tokens.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News