Tether, the largest stablecoin and third-largest cryptocurrency by market cap, reported a net profit of $5.2 billion for the first half of 2024. This strong performance is mainly due to Tether’s investments in traditional markets, particularly US Treasuries.

While Tether’s short-term growth hasn’t matched some of its competitors, the company’s focus on transparency and financial stability seems to be paying off. Rewrite this in paras with a main heading

Tether Reports Record Profits and Major Treasury Holdings

Tether’s financial report for the first half of 2024 reveals a net profit of $5.2 billion, driven by substantial income from investments in traditional assets. The company achieved a record net operating profit of $1.3 billion for the second quarter, setting a new high for quarterly earnings.

Tether has become one of the largest holders of US Treasuries, surpassing countries like Germany. As of the end of the second quarter, Tether held $97.6 billion in T-bills, significantly boosting its revenue and demonstrating strong financial stability.

Additionally, Tether reported its highest-ever group consolidated equity, reaching $12 billion as of June 30. This impressive performance underscores the company’s commitment to maintaining a substantial reserve of traditional assets and transparency.

Tether’s Market Position and Stablecoin Sector Growth

The overall stablecoin market has expanded notably since the collapse of Silicon Valley Bank (SVB). In July, Tether surpassed a circulating supply of $113 billion for the first time since the banking crisis, and its supply has now exceeded $114.4 billion, according to CoinMarketCap. Data from IntoTheBlock shows the total market cap of stablecoins grew from approximately $120 billion in August 2023 to over $160 billion by the end of July 2024.

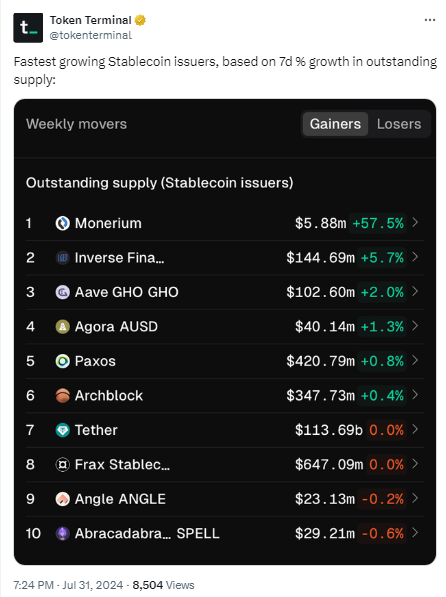

Token Terminal (@tokenterminal) July 31, 2024

Despite Tether’s leading position in the stablecoin market, its short-term growth has not matched that of some competitors. For example, Monerium reported a 57.5% increase in just a week, and Inverse Finance saw a 5.7% bump. Tether’s growth has stalled recently, with its supply remaining unchanged over the past week, reflecting its focus on stability rather than rapid expansion.

In a related development, a significant transfer of 70 million USDT from Binance to an undisclosed wallet occurred. Tether’s market liquidity ratio stands at around 45% over the past 24 hours, according to CoinMarketCap. While Tether’s growth rate may be slower compared to some rivals, its strong financial performance, including record profits and substantial reserves, positions it well within the stablecoin market.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News