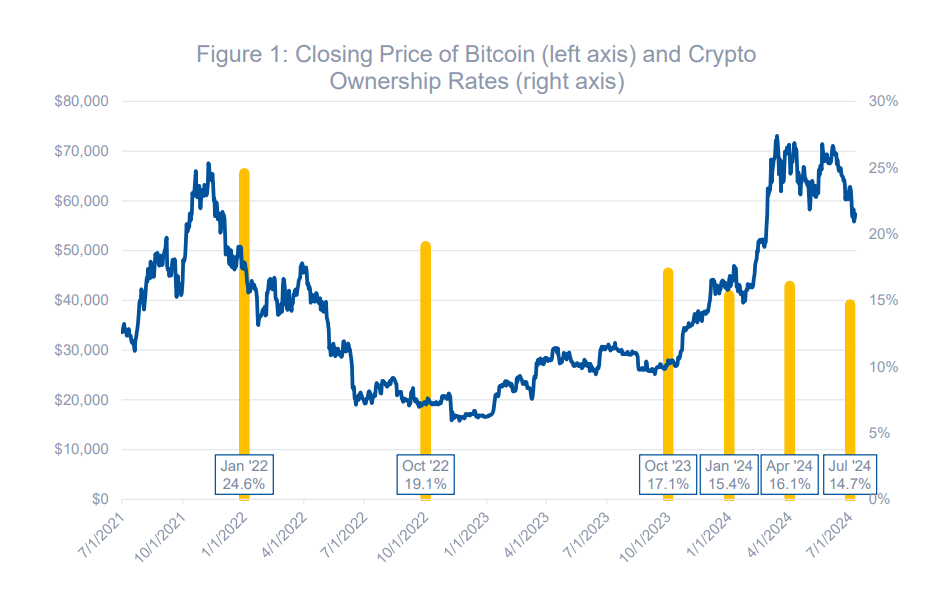

New crypto buyers find bull markets more persuasive. After a hiatus in 2022, nocoiners showed interest in acquiring crypto at a much higher rate during the 2024 bull market.

Polls by the Federal Reserve Bank Philadelphia show bull markets are the most persuasive factor when it comes to new crypto owners. In April 2024, interest from nocoiners more than doubled compared to the bear market of 2022.

The Consumer Finance Institute of the Fed in Philadelphia held a series of six surveys to gauge the levels of crypto ownership and first acquisitions. The research targeted the aftermath of the Covid pandemic, as well as periods following the 2022 bear market.

The low point for first-time crypto buyers, or ‘nocoiners’, was in October 2022. At that time, the market had already stalled following the crash of FTX. Only 4% of queried users acquired crypto for the first time during that period.

Crypto recovery increased the pool of potential buyers

From October 2023 onward, the CFI opened the quarterly LIFE survey on lifetime crypto ownership. The most recent survey session concluded in April 2024. While crypto prices recovered from the end of 2023 onward and peaked in March 2024, the study reveals there is no hype or rush to acquire more crypto, at least among the selected respondents.

Nocoiners still showed increased interest in crypto as of April 2024. The CFI included a question on intended future crypto ownership. The metric rose to 13.4% of respondents as of April 2024, compared to 4% during the 2022 bear market.

Crypto veterans were more likely to acquire more assets – 21.8% of all respondents that ever owned crypto said they were likely to buy more in the near future.

The survey also saw no significant change in the number of crypto owners. During the April 2024 session, crypto owners made up 16.1% of respondents. That number was not a significant change from the October survey period. Between April and July, however, there was a statistically significant shrinking of crypto ownership to 14.7%. That period was also marked by retail selling and whale buying, as coins consolidated in larger wallets.

Crypto ownership among retail respondents actually shrank slightly as the year progressed. The CFI research focused on BTC prices, but the surveyed period also included a series of other types of coins and tokens, especially meme assets. Those types of purchases were not part of the research, despite the data showing memes were one potential to onboard new users.

Crypto ownership remains globalized

The Fed’s ICF takes a snapshot of US-based owners who view crypto as an investment. But usage and ownership are far more globalized, focusing on different types of assets and activities.

Chainalysis shows crypto usage is globalized, but there are hotspots of activity. One of the drivers for crypto adoption remains financial turbulence, especially currency debasement. Statista data shows Argentina is at the top of adoption trends, raising its share of ownership from 14% in 2020 to 30% in 2024.

India is also a growth region, with 8% crypto adoption in 2020 and 22% this year. Chainalysis also puts the country at the highest levels of its usage index, based on on-chain data and transaction records.

Indonesia is the leader of value sent and received through DeFi protocols. The US us ahead in the charts, within the top 5 of both DEX retail and centralized service usage. China, formerly a hotspot of crypto activity, is ranked 20th for all categories of crypto usage.

Chainalysis also shows another trend, the falling away of P2P marketplaces. With the advancement in other tools and platforms, P2P coin swapping and markets have decreased. More secure swapping options now exist, especially DEX and hubs to swap stablecoins. Direct stablecoin payments have also increased, removing the need for exchange services for BTC and ETH.

Global crypto ownership and usage is concentrating in Central and Southeast Asia and Oceania, with multiple countries leading in crypto usage categories. The region draws in more than 16% of crypto value worldwide, but is a hotbed of innovation in Web3 and other retail use cases. The region hosts professional activity with transactions between $10K and $1M in value, while institutional-grade finance is more prevalent in the US and Europe.

Cryptopolitan reporting by Hristina Vasileva