Key Points

- Bitcoin’s fractal patterns suggest holders are positioning the asset for sustained growth, despite short-term bearish trends.

- Analysts believe Bitcoin is far from its cyclical market peak, indicating potential for significant price gains.

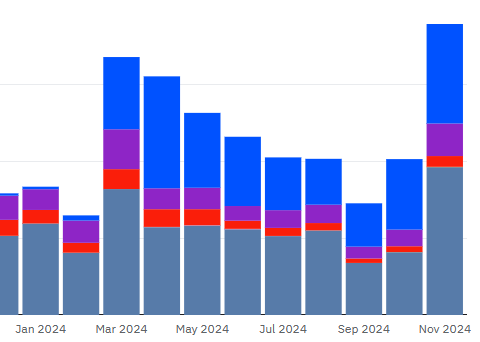

Bitcoin’s fractal patterns are being interpreted by some analysts as evidence that the cryptocurrency is being positioned for sustained growth. Despite a drop of 1.53% in the past 24 hours, the broader market indicators suggest this is a temporary setback.

Market Outlook

Analyst James Van Straten likens the current market situation to late 2020, when Bitcoin dropped to $10,000 before soaring to $60,000. He points to the Short-Term Holders’ Realized Profit (STH RP) as a crucial support level, observing that historically, buying activity picks up whenever Bitcoin retraces to this level.

When long-term holders’ realized profits remain flat or decline, it often signals confidence in the asset’s long-term value. Such behavior can stabilize the market and support bullish momentum. If this trend continues, Bitcoin is likely to recover from its recent dip.

More Room for Gains

Crypto analyst Ali Chart sees good upside potential for Bitcoin. Based on the Market Value to Realized Value (MVRV) Z-Score, he believes Bitcoin is far from reaching a cyclical market top. If the MVRV Z-Score begins trending upward, Bitcoin’s price is likely to follow, potentially indicating the start of a sustained rally.

Some analysts suggest that if Bitcoin continues to gain value relative to gold, it may eventually surpass the precious metal in dollar terms. This could happen if Bitcoin breaks through its current support level. Such a development could change market sentiment, with more investors viewing digital assets as a serious economic force, which would be bullish for Bitcoin.