Record-Breaking Number of Investors Holding Bitcoin for a Year or Longer, Reveals Glassnode.

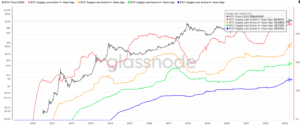

According to data from Glassnode, an all-time high of 68% of Bitcoin has been held by investors for at least a year. Additionally, 55% of Bitcoin has been held for two years or more, while 40% has been held for three years or longer.

A significant number of analysts view it as a positive sign when Bitcoin remains inactive, suggesting that investors are opting to hold onto their Bitcoin instead of selling it. This “buy-and-hold” approach in the crypto market stands in contrast to the current trend in the U.S. stock market, where investors tend to hold assets for much shorter periods compared to the past.

BTC: supply last active 1yr + age bands (Glassnode)

According to Sean Farrell, who leads digital assets research at FundStrat, the practice of being a long-term holder of Bitcoin has been increasingly favored over the years. However, there is an exception to this trend when markets become excessively exuberant, leading investors who purchased during market downturns to sell their older coins to enthusiastic buyers.

Sean Farrell stated that the ongoing trend of Bitcoin HODLing is considered bullish because it indicates the likelihood of higher prices in the current cycle. Additionally, the reluctance of current HODLers to sell their Bitcoin could potentially lead to a shortage in supply, creating a situation where demand exceeds availability, thus pushing prices even higher.

Also Read This Related: Bitcoin Price Reaches Crucial Point: Factors That Could Spark Significant Surge

He further mentioned that relying on long-term holder supply metrics may not provide valuable insights for short-term price indicators.

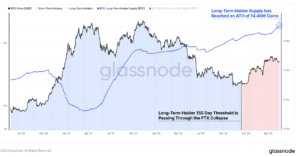

Glassnode’s Long-Term-Holder Supply, which refers to coins held for more than 155 days, has reached a new record high of 14.46 million bitcoins. The report suggests that this increase reflects the transformation of coins acquired shortly after the FTX failure into long-term holdings.

Bitcoin long term/short term holder threshold (Glassnode)

Glassnode’s Liveliness metric, which measures the balance between holding onto Bitcoin and spending it, indicates that investors are holding onto their coins. The metric has dropped to its lowest level since December 2020, indicating a decrease in spending behavior and a preference for HODLing among investors.

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.