Bitcoin’s (BTC) price has had a decent market performance over the past 24 hours, pushing through the $57k mark and almost hitting $58k for a little while.

Crypto analyst “@CryptoQuant_com” on X shared with his 235.9k followers stating that the next bull run may be on the horizon, and two critical indicators drive this.

CryptoQuant emphasized that the shifting balance between Bitcoin reserves and stablecoins could ignite a price rally. As investors withdraw Bitcoin from exchanges and stablecoin inflows rise, buying pressure is likely to push Bitcoin’s price higher.

Read Also: AAVE Price Surges Past $145 Resistance: Is Injective (INJ) Primed for Rally?

Rising Stablecoin Reserves and Netflows

The initial chart from CryptoQuant showcases Bitcoin’s price movements with stablecoin reserves and netflows across exchanges.

Right now, Bitcoin is trading around $57,140.64, with signs of a potential price recovery after a period of decline. The chart indicates a 1.07% rise in stablecoin reserves (ERC20), reflecting an increase in liquidity that may flow into Bitcoin soon.

Image Source: X/CryptoQuant

Furthermore, a notable net inflow of stablecoins (+24.48%) adds further confidence to this outlook. These stablecoins are often used to purchase Bitcoin, suggesting that buying power is building on exchanges. This divergence between rising stablecoin reserves and Bitcoin’s stable price points to a possible rally.

Celebrate Dogecoin and Make Big Gains with Doge2014!

Doge2014 raises 300K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Decreasing Bitcoin Exchange Reserves

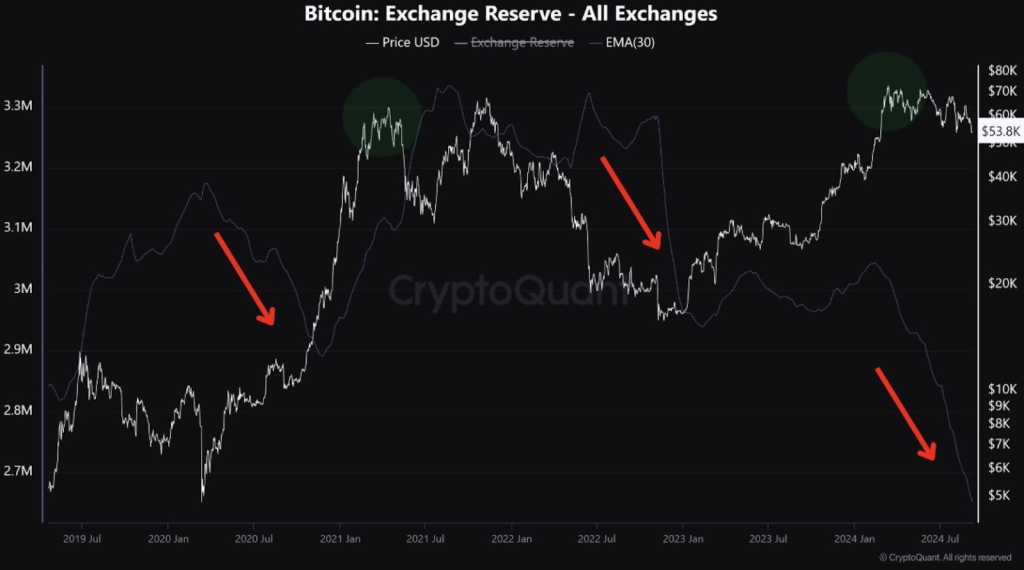

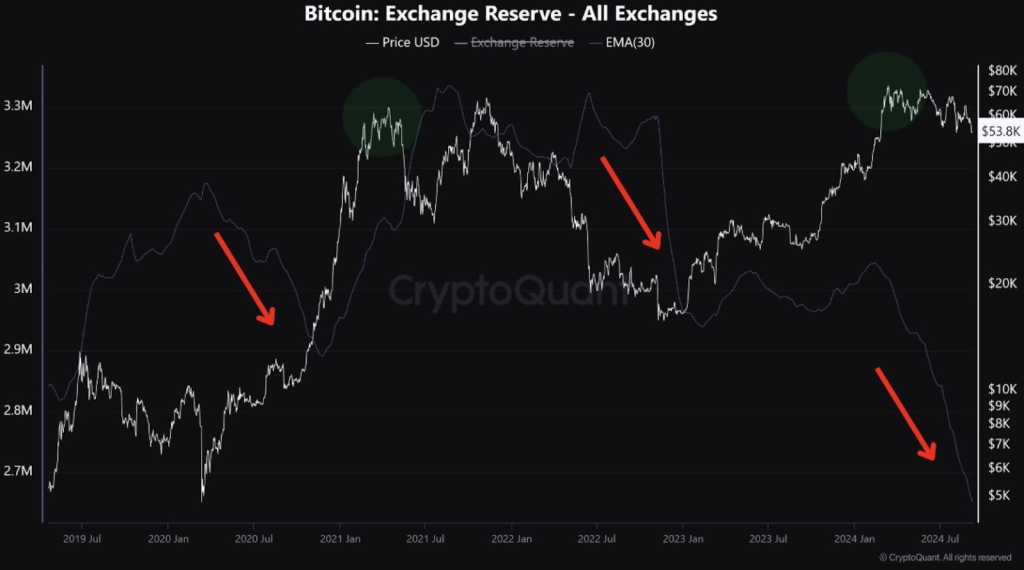

This next chart reveals a significant reduction in Bitcoin reserves held on exchanges, a trend that has historically preceded major price increases.

Image Source: CryptoQuant.com

The analysis indicates several instances in past cycles where a sharp drop in exchange reserves coincided with an upward trend in Bitcoin’s price.

Finally, as more people move their Bitcoin off exchanges, there’s less Bitcoin available to buy and sell. This makes the token more rare and valuable. This pattern was observed during previous bull runs in 2020 and 2021. Right now, the amount of Bitcoin in reserves is low. This could mean BTC may experience a pump soon.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link