- BTC halving cycle relevance will be over by 2028, says exec

- Analyst projected this cycle’s top target of $200k-$260k, possibly by 2025-end

Previous Bitcoin halving cycles have been followed by BTC’s price rallying explosively. This phenomenon has made most cycle analysts and the overall market expect a parabolic price rally after every event.

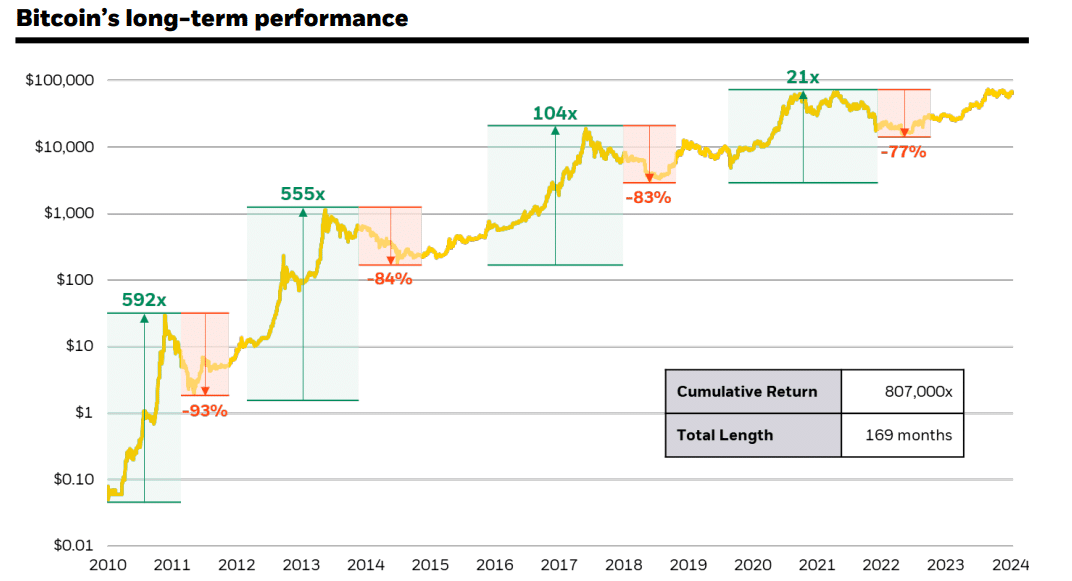

According to a recent Blackrock report, BTC’s value has risen by 592x since its debut in 2009. Subsequent exponential returns were recorded after each of the past three halving events too.

In 2013, for instance, BTC saw 555x returns, while in 2017, investors saw 104x gains. After the 2020 halving, it posted another 21x returns. And, the trend is expected to repeat after 2024’s event.

The last impactful BTC halving?

However, Charles Edwards, founder of crypto VC firm Capriole Investments, believes this might be the last halving event that drives a parabolic BTC rally. He said,

“This is the last Halving cycle that matters.”

Edwards argued that the next halving cycle won’t impact BTC because it’s already the hardest asset, with a very low inflation rate below gold.

“The next halving won’t matter much because the inflation rate of BTC is below gold. So, a massive price drop won’t affect it much.”

Edwards acknowledged though that the current cycle is not yet priced amid potential nation-state adoption. However, he noted that the halving cycles will be irrelevant by 2028.

“You’re not going to get massive price rallies because the halving events are so well known, and the BTC mining industry is so efficient now. I think the 4-year halving cycles will not be relevant in four years.”

Here, it’s worth noting that market cycle analyst Stockmoney Lizards projected a possible price target of $200k—$260k per BTC for this cycle top. This could happen by Q4 2025.

In short, there is still more room for BTC growth before it hit this cycle top.

The world’s largest digital asset retested $66k on Friday and was valued at $65.9k at press time. That puts it only 8% away from its range-high at $71k.