- ETH reclaimed $2500 after last week’s Fed pivot and boosted the ETH/BTC pair.

- Per Cowen, ETH/BTC could bottom if the pair reclaims the 50-day MA short-term trend.

The market has shown less interest in Ethereum [ETH] despite the debut of US spot ETH ETF in Q3. ETH declined by 25% in Q3 and hit a record low on the ETH/BTC pair, which tracks the altcoin’s relative performance to Bitcoin [BTC].

But last week’s Fed pivot tipped the altcoin to reclaim $2500 after rallying for three consecutive days.

The upswing was also marked by a net inflow of $8.2 million in the past two trading days for US spot ETH ETFs.

When will ETH/BTC bottom?

However, crypto analyst Benjamin Cowen was still cautious about ETH strengthening and an ETH/BTC bottom.

Cowen stated that the ETH/BTC bottom could remain elusive if the pair fails to reclaim the 50-day Moving Average (MA), citing 2016 and 2019 trends.

“After #ETH / #BTC broke down in 2016 and 2019, the bottom was in after ETH/BTC got back above its 50D SMA…So as long as ETH/BTC is < 50D SMA, it is still possible for ETH/BTC to go lower.”

But he added that the pair could recover if it bounced above the 50-day MA, which was at 0.04255.

“But once the 50D SMA is surpassed, I think it is more likely than not that the bottom would be in.”

Price action above the 50-day MA typically signals a bullish short-term momentum.

Meanwhile, some whales were taking profits from recent ETH price appreciation. Per Spot On Chain, a familiar whale has sold 15K ETH worth $38.4 million on Kraken. The address has made two other sell-offs in Q3, each leading to ETH’s slight decline.

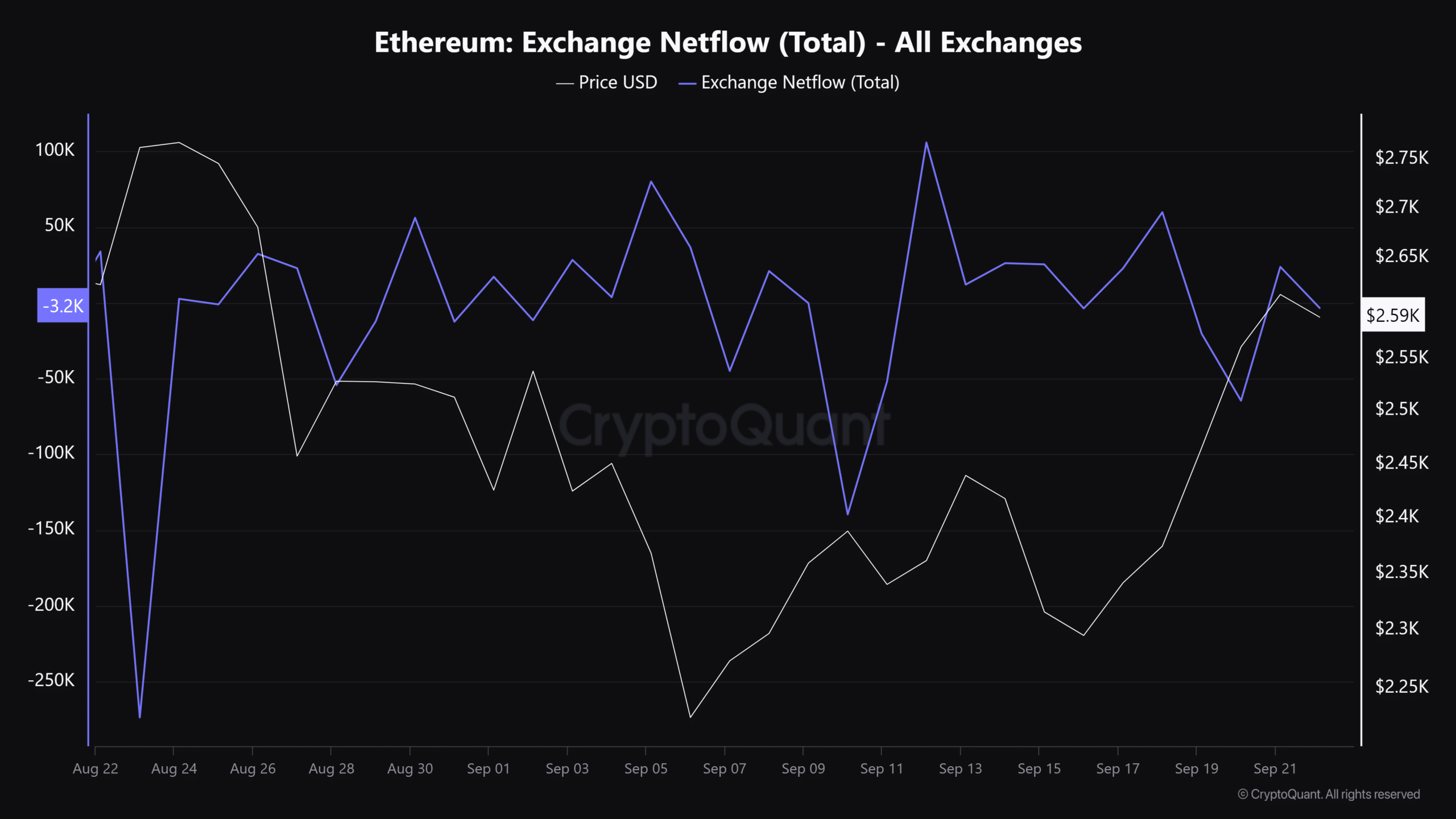

That said, the overall exchange netflow tapered off despite the recent spike. This suggested that sell pressure across centralized exchanges has eased moderately. Ergo, this could allow the ETH price to continue with the recovery.

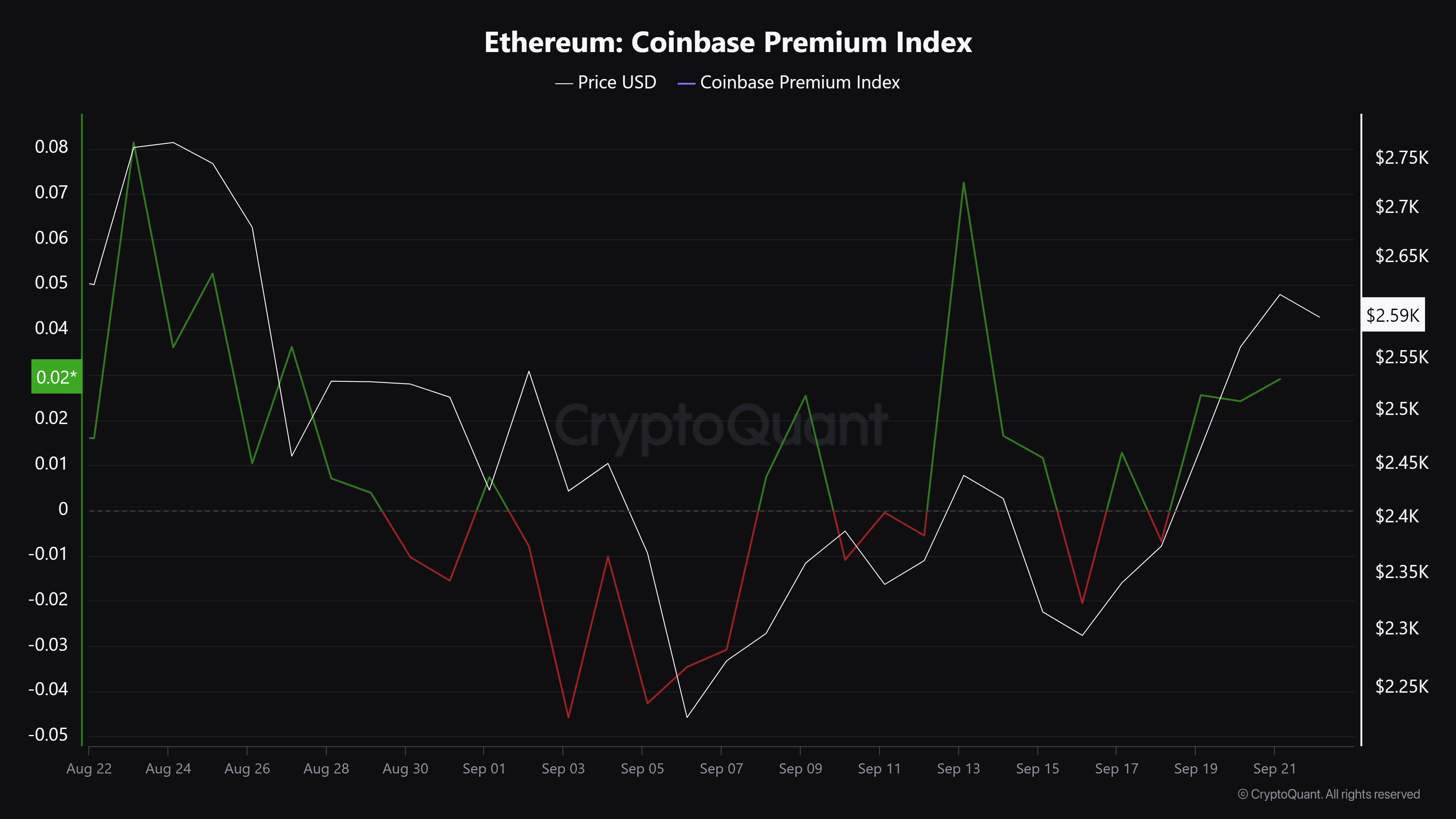

The eased sell pressure coincided with increased demand for Ethereum amongst US investors, as denoted by the Coinbase Premium Index and recent positive US ETH ETF flows.

However, it remains to be seen whether the ETH recovery will continue after the euphoria linked to the Fed rate cut subsided.