- Increased TON Masterchain activities painted a bullish weekly outlook.

- TON set to break out as global liquidity and trading volume surge.

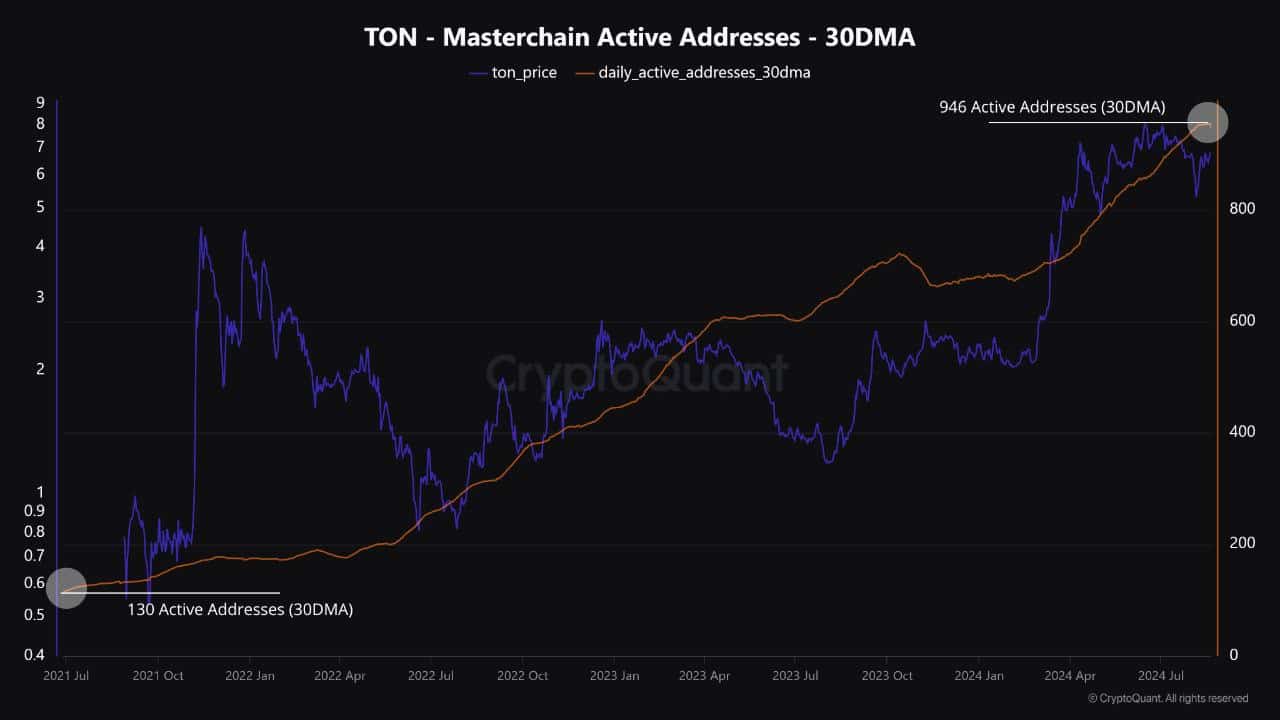

The TON Masterchain has reached a record of 946 daily active addresses, a 7x increase since July 2021, as Kyledoops noted on X (formerly Twitter).

This growth reflected rising network activity, the expansion of dApps and work chains, and potential higher demand for Toncoin [TON].

Although some analysts suggested that the TON blockchain might be a bubble due to its low daily active user count, broader market metrics challenge this view, indicating the network’s solid progress and potential in the long-term.

First, Toncoin has shown strong potential as a top coin to hold on the support.

The TON/USDT weekly chart revealed a reversal candle with a long tail, indicating bullish pressure, supported by growing volume in recent weeks.

Moreover, Bollinger Bands are tightening, suggesting a potential squeeze, but the best bet lies in the breakout to the upside.

On the daily time frame, Toncoin was nearing a breakout above 100 simple moving average, which has posed some resistance.

However, it’s likely that TON will soon break this level and stay above it.

A potential 50-60% bullish wave is expected in the near future, with $10 per TON being a realistic target for traders and investors, suggesting strong upward momentum ahead.

Altcoins set to break out

Aaltcoins are poised for a significant breakout after retracing above the range. This retracement has formed a bull flag, a pattern often linked to upcoming bullish runs.

The market is gearing up for an altcoin season, with new memecoins like DOGS, created by Pavel Durov, CEO of Telegram, already being used to generate liquidity in TON.

The stage is set for a strong rally across the altcoin market.

Global and TON liquidity surges

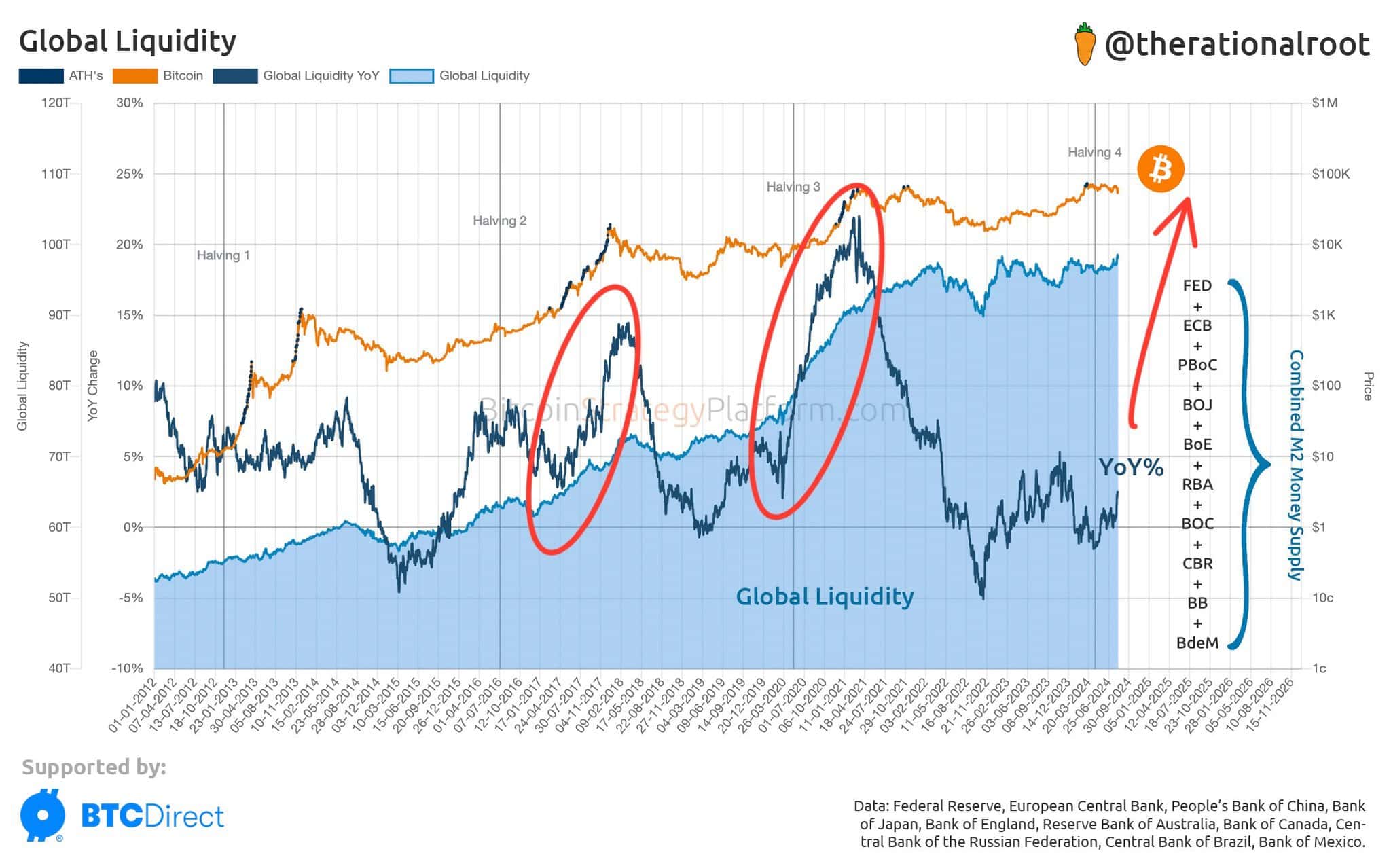

Global liquidity is on the verge of a breakout, with Bitcoin [BTC] and altcoins set to surge. According to data from the Bitcoin Strategy Platform, liquidity has dropped to over $80 trillion.

Combined with USDT minting, this could cause significant gains for TON and other crypto assets. Expect major price increases in late Q3 or early Q4 of 2024.

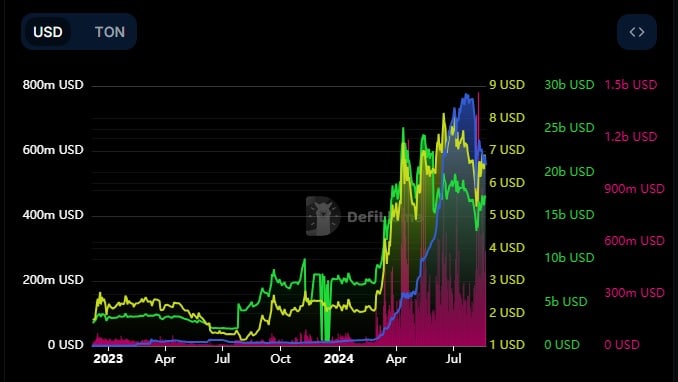

TON’s market cap was $16.82 billion at press time, with a fully diluted market cap of $34 billion.

Is your portfolio green? Check out the TON Profit Calculator

The trading volume in the last 24 hours was $227 million, and the volume-to-market cap ratio was 1.4%, indicating adequate liquidity.

At press time, the circulating supply stood at 2.53 billion out of a total of 5.1 billion TON tokens.