- TON climbs 11% weekly to reach $5.5, highest since October 21

- Historical In/Out of Money shows 21.91 million addresses now profitable

- TON could rally to $6.15 with support at $4.92

Toncoin demonstrates renewed market strength as profitability metrics improve amid broader market recovery.

Recent price action suggests potential for continued appreciation as technical indicators align with improving holder statistics.

Toncoin on-chain metrics

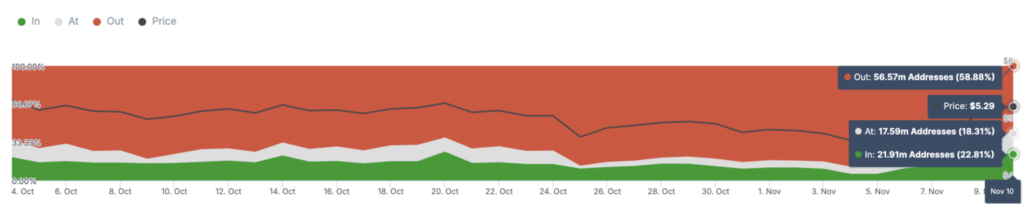

Toncoin wallet analysis reveals significant shifts in profitability distribution, with 22.81% of addresses currently showing unrealized gains while 18.31% reach breakeven status.

The remaining 58.88% of holders await price recovery to reach their entry points, potentially providing future buying pressure.

Money Flow Index readings indicate strengthening buy-side momentum on daily timeframes, supporting the recent price appreciation. This technical confirmation aligns with improving market sentiment as total cryptocurrency market capitalization approaches $2.75 trillion.

Toncoin price activity encounters immediate resistance at $5.28 while maintaining crucial support levels at $4.92 and $4.78, according to Fibonacci retracement analysis. These technical levels provide the foundation for potential continuation toward the $6.15 target, assuming the current market structure holds.

The convergence of improving holder profitability and technical formations creates compelling evidence for sustained recovery in TON’s market position.

These factors suggest careful monitoring of volume patterns remains essential for confirming momentum continuation.

Trading dynamics around established support levels will likely determine TON’s ability to maintain recent gains as market participants balance improving fundamentals against potential profit-taking at resistance zones.

Market participants now focus on defense of key support levels at $4.92 and $4.78, recognizing potential invalidation of bullish scenarios could trigger retracement toward $4.46.