Even though September was usually a worse month for Bitcoin, in 2024, things changed and we’re seeing a crypto rally debuting at the end of Q3.

Here are the best reasons to stay in the crypto market.

Top 6 Reasons to Stay in the Crypto Market

1. October Is One of the Best-Performing Months

Historically, October is one of the best-performing months of the year; that’s why it’s also called Uptober. The prediction for a bullish October comes mainly from Bitcoin’s historical performance.

Over the past 5 years, Bitcoin has recorded gains between 10%-40% during October.

This year, September turned from bearish to bullish as well, considering this week’s BTC race so far, mainly due to the US Fed’s moves. On September 18, the Federal Reserve decided to cut interest rates to 50 bps, triggering a surge in BTC’s price from around $59,000 to over $62,000.

2. Q4 Historical Yields

Q4 historically yields the highest returns of the year as well.

In an article published this month, experts at Bitwise Investments analyzed Bitcoin’s seasonality, highlighting the downward trend for September in previous years, but also the outlook for the rest of 2024.

According to their graph revealing Bitcoin’s average returns by month between 2010 and 2024, we can see that the whole Q4 tends to be bullish.

The data was collected by Bitwise Asset Management, Glassnode, and ETC Group from August 2010 to September 2024.

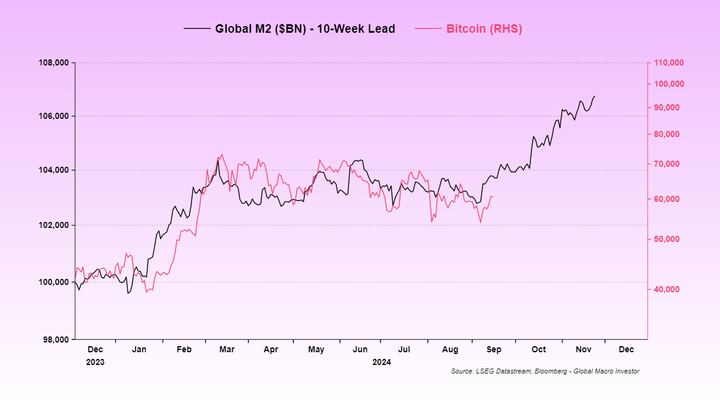

3. M2 Projections vs BTC

M2 is a measure of the money supply that includes cash, checking deposits, and other deposits readily convertible to cash. Basically, M2 tracks the global supply of money. The more money is in the system, the more it can flow into the crypto market.

Raoul Pal shared a post via X a few days ago, highlighting Bloomberg’s 10-week projection of M2 supply overlaid with Bitcoin’s performance.

Pal shared the graph on September 16, and since then, BTC has been able to surge even more, surpassing the $63,000 level.

According to the graph, while in December 2023 the Global M2 was over $1 trillion, it’s expected to surge considerably towards the end of 2024, meaning more money potentially flowing into the crypto market.

4. Bull Market Historically Begins at This Point

Another reason why you shouldn’t leave the crypto market is the fact that the bull market historically kicks off at this point.

A few days ago, Martin Leinweber, digital asset strategist at MarketVector research company, shared the current position in the crypto market.

In a post via X, he wrote that the crypto market is tracking closely with historical bull market cycles.

He mentioned the stronger-than-usual pre-halving rally in 2024 which was mostly attributed to the anticipation of spot Bitcoin ETFs in the US. He also said that the rally following the halving has been weaker compared to other cycles.

However, if historical cycles are any guide, there’s a strong indication that the market will continue to pick up momentum from this point on. History shows evidence that each crypto cycle is gradually increasing in length and this trend could suggest surging institutional involvement.

Longer cycles can be indicative of a more mature and stabilized market environment. The first cycle between 2010 and 2011 was the shortest compared to the current one, the 5th cycle, starting in 2022.

5. Rate Cuts Are Here

On September 18, the US Fed decided to cut interest rates by 50 bps, and lowered rates mean more money flowing into markets over time.

Lookonchain recently analyzed how the Fed’s decision to cut interest rates might affect Bitcoin’s price from now on. They shared a graph showing the impact of interest rate cuts and hikes on the price of BTC in the past 10 years.

The highest impact on Bitcoin’s price was back in 2020 amidst the emergency rate cuts in the US, triggering a crypto rally between 2020 and 2022.

Bitcoin kicked off a fresh rally this week following the recent rate cuts and the unexpected drop in weekly jobless claims in the US.

6. The 2024 Elections

The 2024 US elections are another reason to be bullish for the crypto market.

Bitcoin and crypto have become a political subject this year, with the strongest support coming from former US President Donald Trump. He has been vocal about the importance of Bitcoin, highlighting that the US should not sell its BTC reserves.

The Trump family has recently revealed World Liberty Financial, a crypto initiative, part of a broader decentralized finance venture.

These are only a few of the many reasons why you should remain in crypto. The market is maturing, it’s seeing more robust regulation, and increased institutional adoption which mirrors surging trust in the industry.