A Bitcoin trader sold a significant amount of BTC, making substantial profits after holding for two years.

The weekend saw Bitcoin surge past the $66,000 mark, continuing its upward trajectory from previous gains. However, by Monday, the market experienced a notable shift.

In a span of hours, Bitcoin’s price dropped by $2,000, falling back to $64,200. This sudden correction follows several days of sustained growth, with the asset holding above $65,000 before the decline.

Despite this dip, Bitcoin’s long-term price performance remains impressive. The crypto has particularly surged by 136.2% over the past year, providing substantial gains for long-term holders.

Trader Capitalizes on Bitcoin Gains

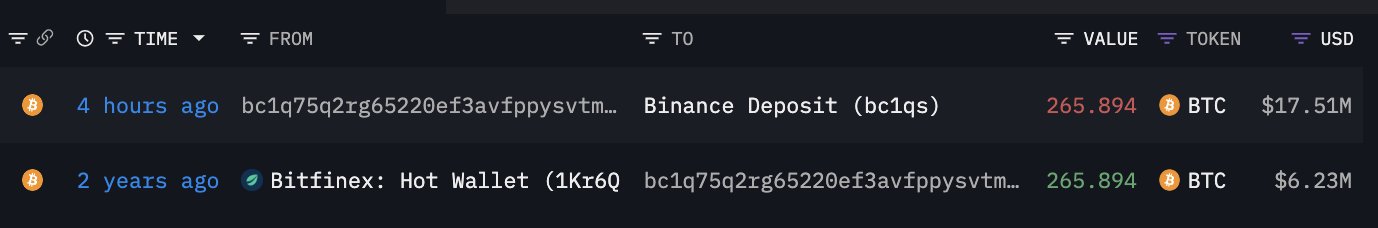

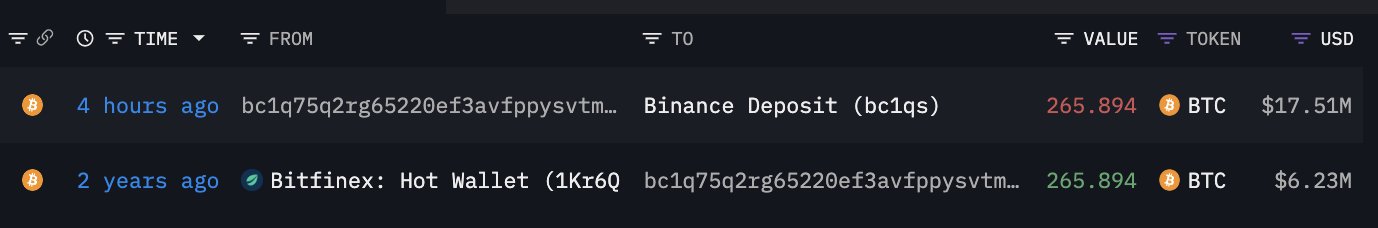

One trader, in particular, made significant profits from Bitcoin’s yearly rise. According to data from Lookonchain, the trader sold 265.89 BTC, worth $17.5 million, realizing a profit of $11.28 million.

This sale occurred today after Bitcoin’s sharp decline, indicating that the trader strategically capitalized on Bitcoin’s earlier gains. The trader originally purchased 265.89 BTC at $23,443 each two years ago, making an 181% profit on the sale.

This case is not unique; other long-term holders have also begun to profit. For example, a September 20 report noted that miner wallets inactive for over 15 years moved a total of 250 BTC, worth approximately $15.9 million. These wallets received 50 BTC per block as mining rewards in 2009 when Bitcoin was priced at just $0.0009.

Profitability Metrics for Holders

Analysis by IntoTheBlock highlights that a significant portion of Bitcoin holders remains in profit. According to the “Global In/Out of the Money” metrics, most Bitcoin addresses acquired the cryptocurrency at prices below its current level of $63,318.82. A majority of holders bought at ranges between $18,986 and $51,156, benefiting from Bitcoin’s price appreciation over time.

Conversely, fewer addresses are holding Bitcoin at a loss, as indicated by red zones in the analysis. These addresses acquired Bitcoin at prices between $62,010.99 and $72,500.92, placing them out of profit given the current market value.

Notably, many of these buyers entered during Bitcoin’s peak, but as the current price remains lower, they are holding at a loss.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.