The TRON network has been making big moves in the altcoin market, reclaiming its status as the leading blockchain for transaction volume among major altcoin chains. The TRON network has reported $205 million in revenue for October, marking it as the second-highest monthly revenue in its history. This has boosted Justin Sun’s bet regarding the TRON ecosystem, as he believes Tron will consistently achieve monthly revenues surpassing $200 million.

Tron Regains Its Aura

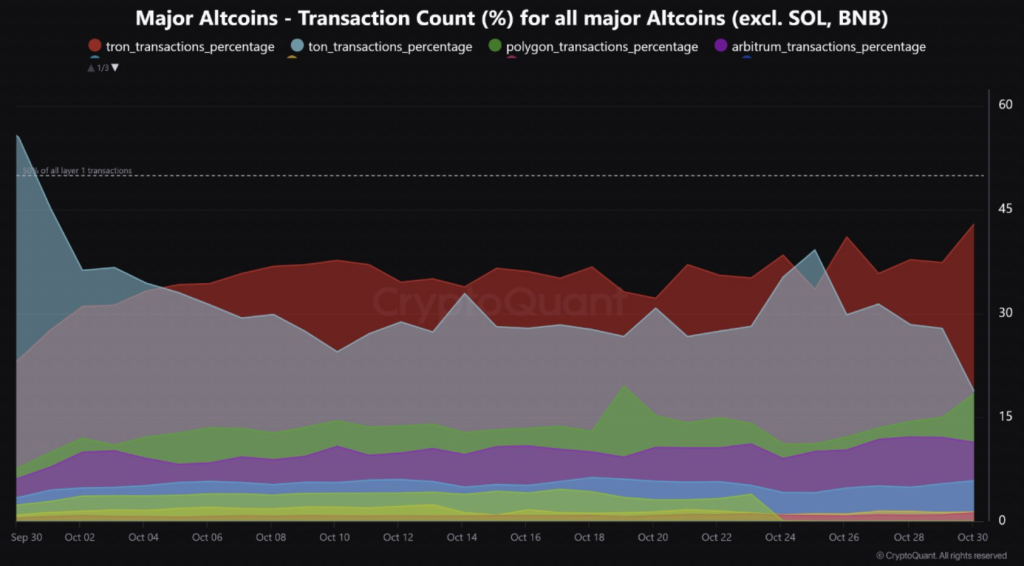

CryptoQuant noted that TRON has recently shown significant transaction dominance, managing about 43% of transactions across major altcoin blockchains in October.

CryptoQuant further revealed that the monthly revenue of Tron shows a clear trend of high performance. After reaching an all-time high of $220 million revenue in August, the network has continued to show strong financial health.

TRON processed approximately 230 million transactions, marking a significant activity surge. On October 24, the network peaked, handling 10.46 million transactions, around 25% higher than its 30-day average.

This activity level reflects TRON’s increased usage, following its performance in 2024, when it frequently led in transaction volume. However, between late August and early October, TRON’s transaction dominance slightly declined, with other networks experiencing temporary spikes in activity.

Also read: TRON DAO Partners with Chainlink for Enhanced DeFi Data Security

The insights from CryptoQuant indicate that TRON’s leadership in transaction volume may continue. Historical trends confirm that TRON has consistently sustained high transaction levels over time, with Justin Sun believing that monthly revenues will consistently stay above the $200 million mark.

Notably, the network’s current share of transactions reflects a solid movement in the blockchain industry towards platforms that provide scalability and low transaction fees.

Tron Prepares for a Short Squeeze

While TRON’s on-chain metrics are showing strong performance, the market price of its native token, TRX, has also experienced positive trends in recent weeks.

Following a solid price rally in the crypto market, led by Bitcoin, TRX has mirrored the overall bullish momentum, rising by 8% over the last four weeks.

In the days ahead, the trend of TRX’s price will likely depend on its capacity to sustain its current momentum and surpass the resistance level at $0.18. If it successfully breaks through this threshold, TRX’s rally could intensify, potentially influencing the market as short positions may be forced to close.

On the other hand, if TRX encounters resistance and undergoes a pullback, it could still attract interest because of its integral role in the stablecoin ecosystem and the increasing use of its blockchain for transactions.

The increasing short interest along with significant long positions might trigger a bullish breakout which could be the sign of a short squeeze.