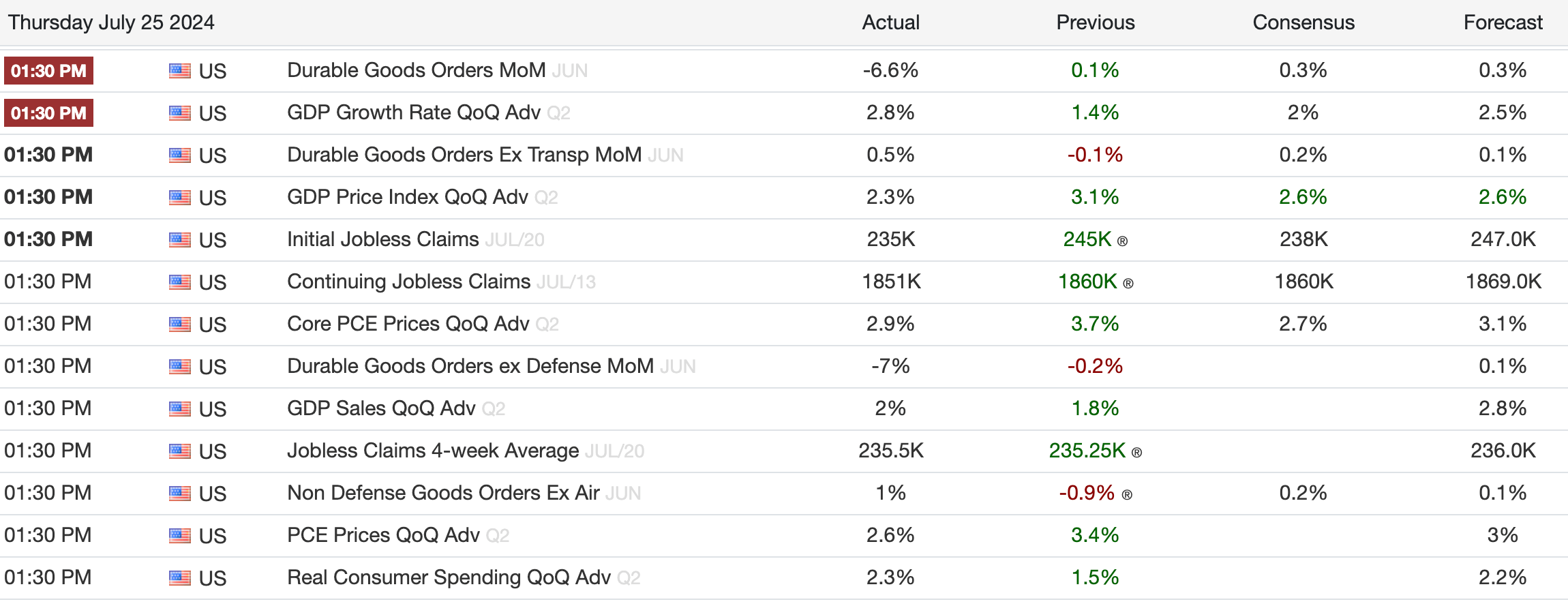

The U.S. economy pulled a surprise move in Q2, with GDP growth getting revised up to 3.0% from the earlier estimate of 2.8%. That’s a big deal because it means the economy is doing better than most people thought. Maybe the economy is definitely dodging a recession.

But here’s the thing. With this sort of GDP growth, the Federal Reserve might hold back on cutting interest rates. High rates mean borrowing costs more, so there’s less easy money flowing around to pump into risky assets like Bitcoin.

A lot of people already expected the Fed to slow down on rate cuts, and Bitcoin’s 5.2% jump after the initial GDP numbers might have been a classic “buy the rumor, sell the news” situation.

We also saw the GDP deflator, a measure of inflation, tick up from 2.3% to 2.5%. Not huge, but it’s there. For Bitcoin, more inflation can make it look attractive as a hedge against the dollar losing value.

On the other hand, if inflation isn’t too wild, the Fed probably won’t be slashing rates anytime soon. So, Bitcoin is kind of stuck in the middle, waiting to see what happens next.

After a big move last week, the price has dropped back into its old range. We’re talking about key support around $56,000. If it stays above this, we might see another shot at $64,000. But if it falls below, all bets are off, and we could see more losses. The Fear & Greed Index is at 45, which is pretty neutral, but there’s definitely a feeling that the market could go either way.

And the bigger picture for the U.S. economy still looks pretty resilient. Sure, inflation is higher than the Fed’s 2% target, but it’s way below the 9% we saw at the peak of the pandemic.

Workers’ wages are holding up, layoffs are low, and while unemployment is up a bit, it’s still not too bad. And just as the GDP data dropped, the Department of Labor released jobless claims numbers that showed no big change, keeping things steady.

Stock markets liked the news, opening higher. But the odds of the Fed cutting interest rates by a big 50 basis points next month are getting slimmer. The market seems to think the Fed will cut rates, but not go too far.

It’s a mixed bag for crypto, especially Bitcoin. Some capital might flow back to traditional assets if the Fed keeps rates steady, making Bitcoin a less attractive option for investors looking for a quick buck.

And looking ahead, there’s already talk about Q3 GDP estimates sitting around 2%. Rising unemployment could push the Fed toward cutting rates, but right now, they’re likely to play it safe unless the data takes a sharp turn south.