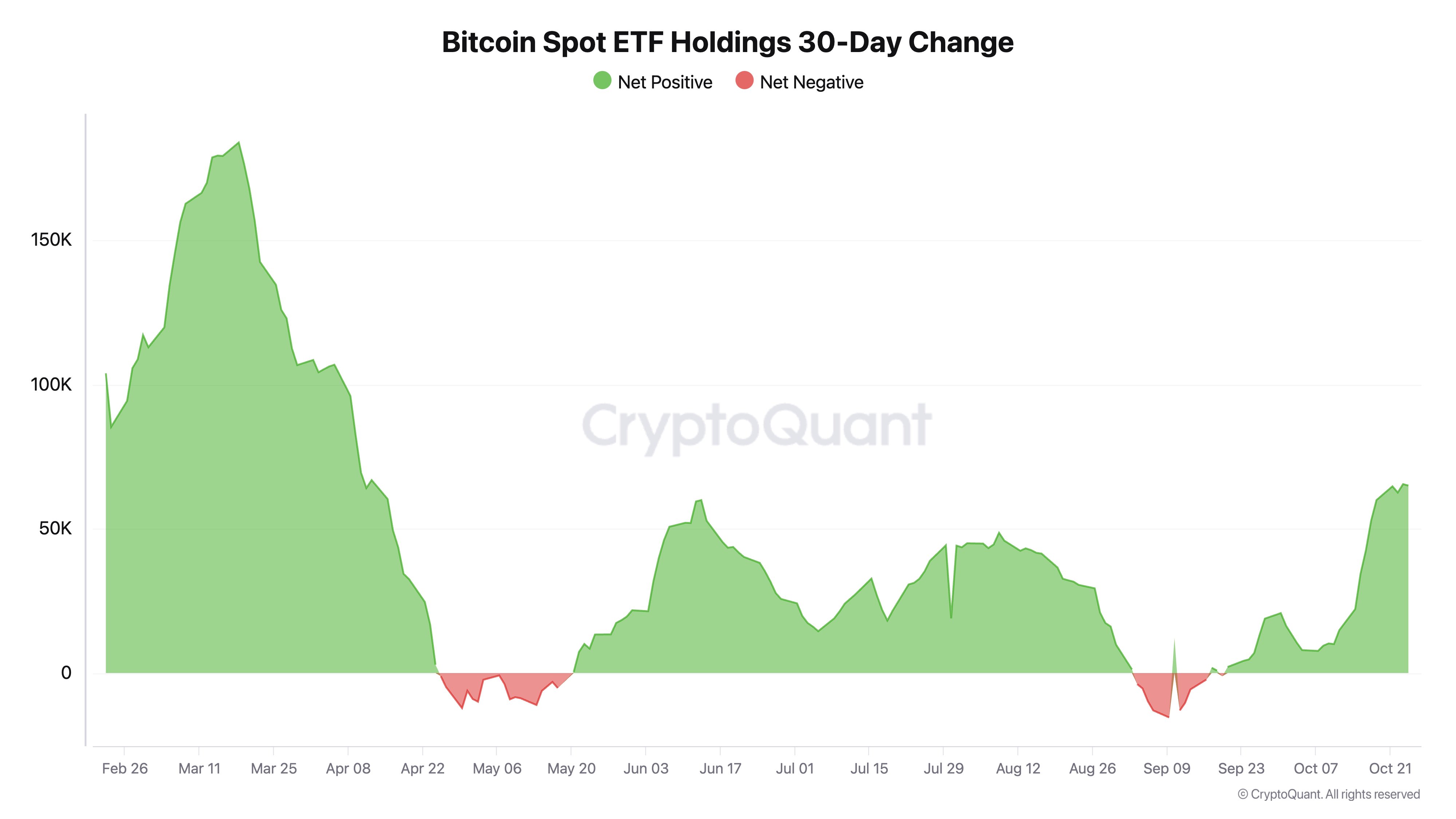

Demand for U.S. spot Bitcoin ETFs has reached its highest level in six months, with net inflows totaling 64,962 BTC over the past 30 days.

Ki Young Ju, the founder of CryptoQuant, highlighted this significant trend in a post on X today. This surge indicates that the U.S. Bitcoin ETF market has seen a remarkable $4.39 billion in new capital over the past month.

The last comparable record was noted in April when Bitcoin traded above $72,000. The subsequent bearish trend in Bitcoin’s price performance was also reflected in ETF flows.

Specifically, spot Bitcoin ETFs experienced a decline in holdings for most of May, coinciding with Bitcoin’s initial retracement below $56,000. However, this trend quickly reversed, with positive inflows reaching monthly highs from June to August before another downturn began in early September.

This bearish trend shifted on September 18, when the U.S. economy welcomed a historic interest rate cut, making investments in crypto assets more attractive. Since then, the positive inflow to Bitcoin ETFs has continued, recently reaching a six-month high.

The massive uptick in ETF holdings confirms renewed interest from institutional investors, with market participants hopeful that this could catalyze further price gains.

Bitcoin Price and ETF Demands

During this period, Bitcoin’s price surged by 20%, rising from around $57,000 to just below $70,000. On Monday, when Bitcoin reached $69,500, Bitcoin ETFs saw net inflows of $294.3 million, with BlackRock’s IBIT experiencing a massive positive flow of $329 million.

Other ETFs, such as the Bitwise Bitcoin ETF, recorded negative flows of $22.1 million, while Ark Invest’s ETF saw a decline of $6.1 million. The Invesco Galaxy Bitcoin ETF and Franklin Bitcoin ETF had no new inflows.

Despite the crypto market losing some bullish momentum, as evidenced by Bitcoin’s ongoing correction, the trend of inflows to Bitcoin ETFs remains positive.

As of Thursday, the U.S. market recorded $188 million in net inflows, led by BlackRock’s $165.5 million and Fidelity’s $29.6 million. Other funds posted no new investments, while Grayscale experienced a drain of $7.1 million.

Additionally, a net flow of $192 million was observed on Wednesday. A negative trend was recorded on Tuesday, coinciding with Bitcoin’s drop to $65,000. Cumulatively, U.S. Bitcoin ETFs have seen $21.6 billion in inflows since January, making it the fastest-growing ETF market in this decade.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.