- The US government moved seized funds from the FTX cases in the last few hours.

- FTX has been fumbling with a creditors’ repayment plan over the past year.

The crypto market is ablaze with activity as several altcoins stage bull runs. In an additional spur, discussions on who would succeed Gary Gensler as SEC Chair have spiked quite the interest. Prominent journalists such as Eleanor Terret speculate that Paul Atkins will be the next SEC Chair. Meanwhile, the US government has continued moving seized funds to anonymous wallets, intensifying further speculatory areas in the sector.

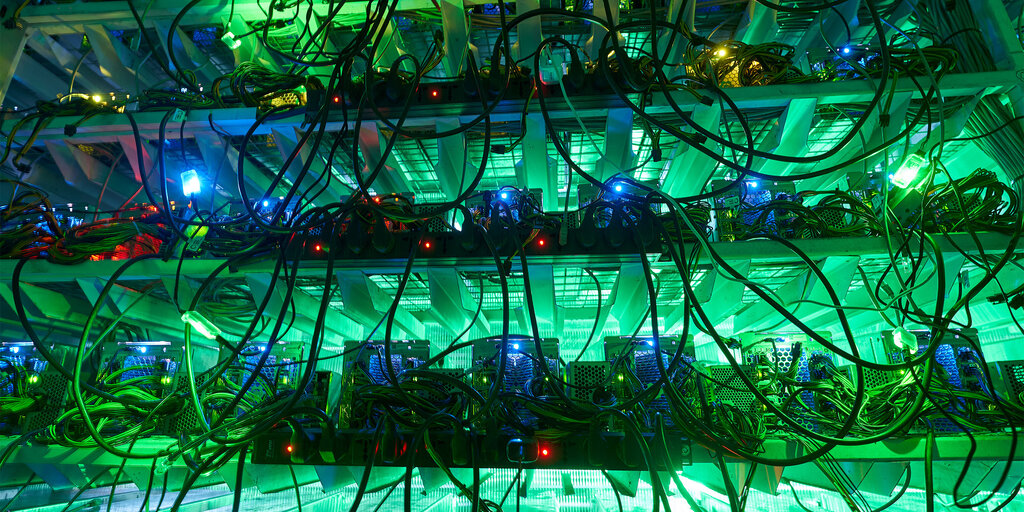

According to Arkham Intelligence data, the US government has moved funds worth approximately $33.60 million in the last 10 hours. These funds were in the form of various cryptocurrencies, particularly altcoins. Some included ETH, WBTC, BUSD, SHIB, and other tokens.

Moreover, these tokens were part of the funds the US government seized during the FTX collapse. The government seized these crypto funds in association with the FTX Alamada cases, two years back, in 2022. Arkham Intelligence updates show that the funds were moved to two anonymous wallets – “0x9cd” and “0x9ac”.

Previously, over the past day, the US government also caught market attention with the movement of another set of seized funds. These were Bitcoin tokens seized from the Silk Road cases. The wallet moved 19.8K BTC worth $1. 9 billion roughly 20 hours ago to a Coinbase wallet.

How Is the FTX Repayment Plan Coming Along Amid US Government Transfers?

Over the past year, the FTX crypto exchange has made several announcements regarding its repayment plans. In multiple instances, this has even contributed to existing bull runs in the market. Recently, on November 21, the firm stated that it would finalize plans by the end of December.

Additionally, the FTT token has also witnessed several price surges in the past month. This resulted from rumors about the creditors’ repayments prior to the official announcement. Meanwhile, the US government moving seized funds has sparked previous debates within the community.

Finally, there have been no specific comments from sources within the authority regarding the transfers. The cause and reason behind this action have not yet been revealed.

Highlighted Crypto News Today:

Grayscale Files for Solana Spot ETF Listing on NYSE Amid Crypto Optimism