Spotify Technology (NYSE: SPOT), a leading music-themed US stock, had a fabulous run in the charts in 2024. It almost doubled investors’ money in 10 months and is among the top performers in the equities market.

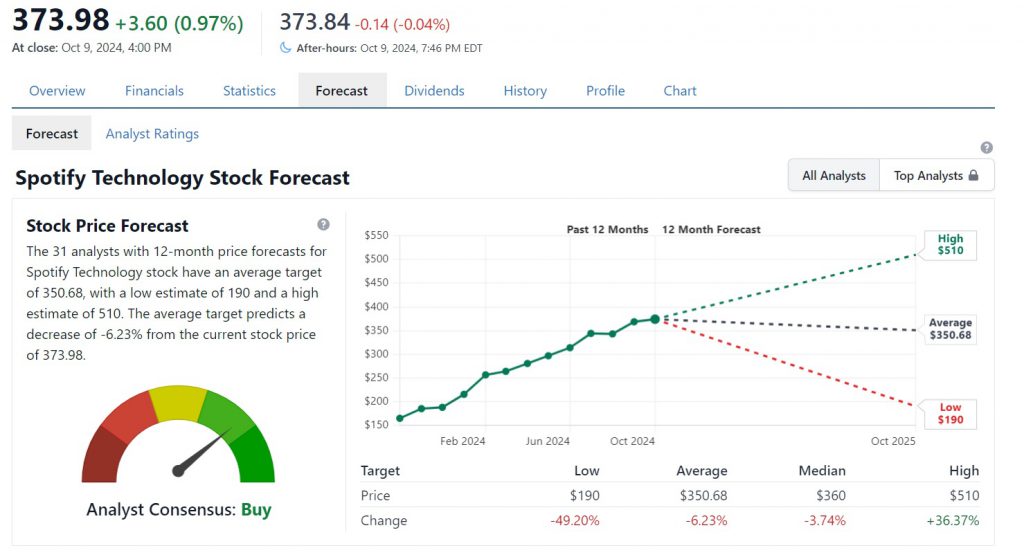

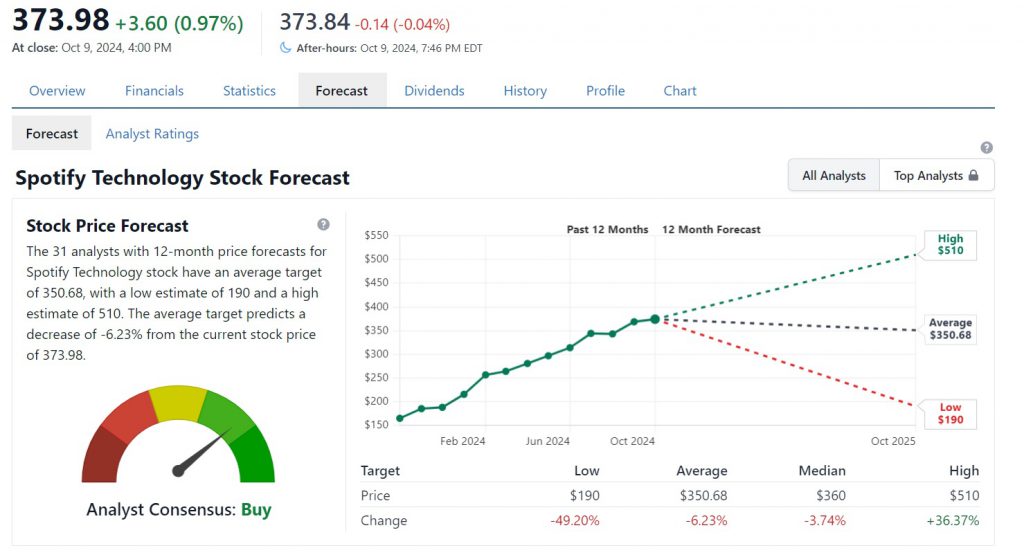

Its price was $188 early this year and steadily climbed up the charts, hitting $373 in October. SPOT surged nearly 98% year-to-date, attracting heavy bullish sentiment in the indices.

Also Read: Marjorie Taylor Greene Buys US Stocks & Treasury Bills Worth $220,000

Investors who took an entry position early this year have doubled their money in a short period. According to a recent price prediction, the US stock’s bullish run in the charts could continue in the next 12 months. The US stock has more steam left and could breach the $500 mark next year in 2025.

Also Read: US Stock: Here’s How High Tesla (TSLA) Share May Rise By Mid-October

US Stock: Spotify Projected to Rise Another 37%

Leading price projection firm Stock Analysis has painted a bullish picture for Spotify Technology. According to the price prediction, the US stock could reach a maximum high of $510 in the next 12 months in 2025.

That is only if the markets maintain their current momentum and carry forward the developments until next year. Therefore, an investment of $1,000 could turn into $1,370 if the forecast is accurate.

Also Read US Stock That Rose 200% Predicted To Rise Another 22%: Do You Own It?

In addition, if the markets experience turbulence, SPOT could trade around the $350 level during the same time frame. If a recession hits the US economy or the stock markets crash, Spotify could plummet to the $190 range. That’s a straight 50% decline from its current price of $373.

Also Read: Nvidia (NVDA) Stock Approaches New High Amid Chip Rally

As of October 2024, 13 financial analysts have given Spotify a ‘buy’ rating as it could surge further in price. Spotify has seen a revenue growth of 21.5% in FY 23-24 compared to its previous growth of 14.8%. The US stock currently remains on the radar of investors as the potential to make gains remains high.