On Friday, June 28, VanEck made a significant update to its Bitcoin Trust by appointing Coinbase as an additional custodian for its HODL Bitcoin ETF. This agreement includes specific terms and safeguards to protect the ETF’s Bitcoin holdings.

This move is a major achievement for Coinbase, which is already the custodian for eight other Spot Bitcoin ETFs, including those from BlackRock, Bitwise, and Grayscale.

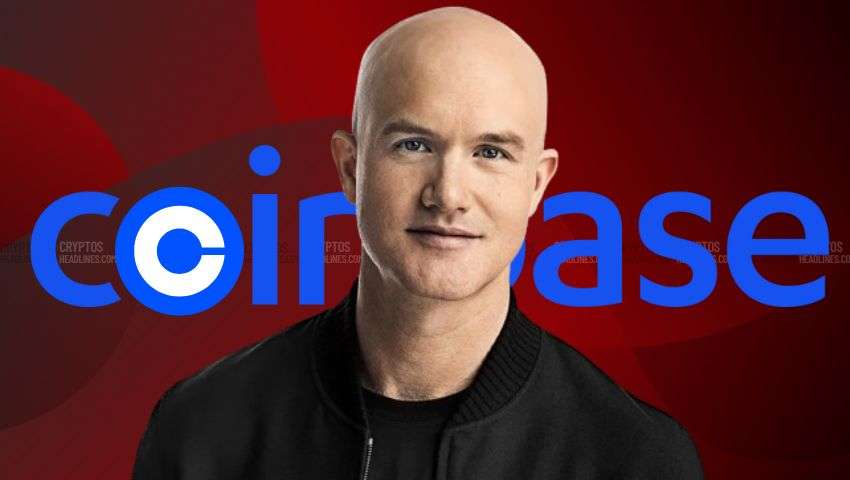

Coinbase Appointed as Custodian for VanEck’s Bitcoin Trust

Coinbase has been appointed as an additional custodian for the VanEck Bitcoin Trust, with its primary role being to hold the Bitcoin in cold storage. This means the Bitcoin will be stored offline to protect it from potential cyber threats, except when temporarily moved for withdrawals.

According to the SEC filing, Coinbase will use segregated cold storage addresses specifically for VanEck’s Bitcoin, which will be separate from those used for its other customers. These addresses are verifiable on the Bitcoin blockchain, providing an extra layer of security and transparency for VanEck’s holdings.

The agreement also stipulates that Coinbase must clearly record and identify the Bitcoin it holds as belonging to the Trust. Coinbase is prohibited from withdrawing, loaning, hypothecating, pledging, or encumbering the Trust’s Bitcoin without explicit instructions from VanEck.

VanEck has reviewed Coinbase’s policies and controls for safeguarding the Bitcoin, noting that while these measures align with industry standards, VanEck does not control Coinbase’s operations. Therefore, there is no absolute guarantee against theft, loss, or damage.

Coinbase has insurance to cover customer assets against events like fraud or theft, but this insurance does not protect against fluctuations in Bitcoin’s value and is shared among all Coinbase customers. Previously, VanEck had selected the Gemini exchange as its primary custodian for the Bitcoin ETF launched in January.

VanEck and 21Shares Move Forward with Solana ETFs

On June 27, VanEck made headlines by filing a Form S-1 with the U.S. Securities and Exchange Commission to launch a Solana Trust. This trust aims to create an exchange-traded fund (ETF) that will track the spot price of Solana (SOL). If approved, the Solana ETF will be listed on the Cboe BZX Exchange.

Matthew Sigel, head of digital asset research at VanEck, expressed excitement about the potential launch of the first Solana ETF in the United States. He highlighted that SOL, the native token of Solana, functions similarly to digital commodities like Bitcoin and Ethereum. Sigel explained that SOL is used for paying transaction fees and computational services on the Solana blockchain, much like ether is used on the Ethereum network. SOL can be traded on digital asset platforms or used in peer-to-peer transactions.

Following VanEck’s move, 21Shares also filed for a Spot Solana ETF on June 28, marking another step toward expanding Solana’s presence in the ETF market.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News