After the success of Bitcoin and Ethereum exchange-traded funds (ETFs), many crypto enthusiasts are wondering if Solana could be the next big cryptocurrency to get its own ETF. According to Matthew Sigel, head of digital asset research at VanEck, the chances of a Solana ETF being approved are “overwhelmingly high,” with the changing political landscape in favor of cryptocurrencies.

Solana ETF Approval By 2025

Speaking with the Finаnciаl Timеs, Mаtthеw Sigеl has shown robust confidence in the possibility of a Solana ETF being approved soon. He stated that “the chances of this happening by 2025 are “overwhelmingly high.”

This prediction is a major change from the past few years, where the Biden administration’s strict regulatory stance held back crypto products. Sigel believes that recent political change will likely make the way for a Solana ETF to be approved by late 2025.

As VanEck and 21Shares take the lead in Solana ETF filings in 2024, excitement is building around the possibility of a Solana ETF

Blackrock Disagree!!!

However, not everyone agrees. Robert Mitchnik, head of digital assets at BlackRock, says the company isn’t interested in anything beyond Bitcoin and Ethereum, showing a more cautious approach to other cryptos like Solana.

But with growing confidence and changing politics, the chances of a Solana ETF have never looked better!

Solana ETF Gets Hopes Under Trump Presidency

The idea of a Solana ETF has gained even more attention with the speculation that Donald Trump’s return to office could result in a less restrictive regulatory environment for crypto. If this happens, the approval of a Solana ETF could become a reality sooner than expected.

Experts like Matt Hougan from Bitwise Asset Management say Trump’s election could transform the crypto landscape. If these changes happen, the path could be easier for digital assets like Solana, XRP, and Litecoin to thrive.

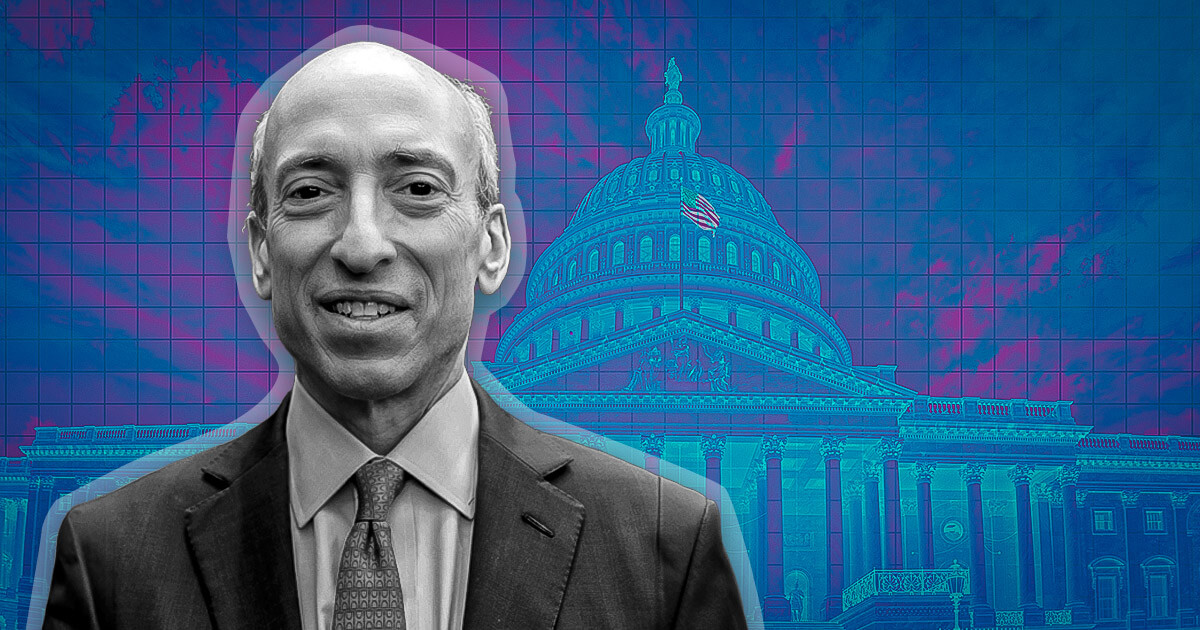

Gensler Could Resgin Soon

However, rumors are growing that SEC Chairman Gary Gensler might resign soon, possibly after Thanksgiving and before Trump’s inauguration.

Many in the crypto world have criticized Gensler’s strict rules, saying they’ve held back the growth of crypto products like ETFs. If he steps down, it could bring new leadership and create a friendlier environment for crypto innovation.