El Salvador’s 70% yield dollar bonds attract Wall Street, while President Nayib Bukele’s commitment to debt payment reassures bondholders. Despite this, Bukele’s Bitcoin investments have decreased by about 30%, purchased at an average of $41,240 per coin.

Two years ago, El Salvador’s President Nayib Bukele surprised Wall Street by getting into Bitcoin. But now, skeptics are noticing the good profits from bonds in the country.

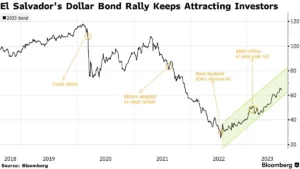

Investors are getting interested in El Salvador’s bond markets. These bonds are doing better than other bonds from developing countries this year.

El Salvador’s Dollar Bonds Yielding Profits

President Bukele’s dollar bonds are making a big 70% profit every year, said Bloomberg on August 15. This has changed Wall Street’s view after they initially doubted it.

Big names like JPMorgan Chase, Eaton Vance, and PGIM Fixed Income are now buying these bonds, according to Bloomberg.

In a note in July, JPMorgan researchers said, “Even though we missed out on a lot of the rise, we still think El Salvador’s bonds have value. These bonds could keep doing better.”

Bukele is showing he wants to pay back the debt by buying bonds back and getting advice from someone who worked at the IMF. This is helping bondholders feel less worried.

Dollar bonds are special because they’re in USD, not the issuing country’s money. This means El Salvador’s bonds are linked to Bitcoin without the risk of currency changes.

El Salvador dollar bond performance. Source: Bloomberg

Zulfi Ali, who manages investments at PGIM, said:

“The situation still looks good for the money situation, and Bukele is consistent in telling bondholders he’s serious about paying off the debt.”

Other companies like Lord Abbett & Co, Neuberger Berman Group, and UBS Group are also buying El Salvador bonds, even though there are risks. They think El Salvador’s bonds are worth more than they’re priced.

Mila Skulkina, who manages money at Lord Abbett, said:

“El Salvador has done well in managing its money, including buying back debt in the last part of 2022.”

In January, El Salvador’s lawmakers approved a law that allows them to make Bitcoin bonds, often called “volcano bonds.”

Bukele’s Bitcoin Monitoring

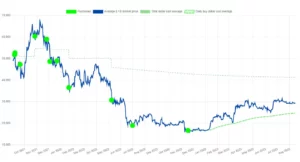

El Salvador started buying Bitcoin in September 2021, before the market peak. Even when the price was above $60K in October 2021, they kept buying. They continued buying even when the market went down in 2022.

On November 17, 2022, Bukele said they would buy 1 BTC every day from then on.

El Salvador Bitcoin Purchases. Source: NayibTracker

El Salvador has 2,924 BTC in their Bitcoin treasury, worth around $85.3 million. But their investment has gone down by almost 30%, with an average cost of $41,240 per BTC.

Still, more crypto companies like Binance, Strike, and Tether are looking at El Salvador.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News