Warren Buffett, popularly referred to as the Oracle of Omaha, is the CEO of Berkshire Hathaway. Known as one of the most nuanced stock traders, Buffett’s trading moves are often replicated by many investors. They are keenly explored to earn maximum gains by initiating a single trading move. Buffett recently dumped Apple stocks for Occidental Petroleum (OXY), sparking huge interest in the domain. Here’s how Oxy may perform this October 2024.

Also Read: Cardano: Buying ADA Dip May Prove Lucrative In Future, Analyst Says

Occidental Petroleum: Details

Occidental Petroleum is a leading name among the leading oil firms in the US. It is a heavy-weight energy company specializing in components related to exploration and developing oil and gas properties. The company came on top of the radar after Warren Buffett’s significant stock investment, making it a highly scrutinized company to watch in the long run.

Speaking about Occidental Petroleum’s commitment to its investors, the company is long known as the firm that rewards its investors with dividends and buybacks. Buffett’s investments compelled Occidental to surge high on the investor radar. Berkshire Hathaway’s CEO is known to have made this investment due to the firm’s impeccable track record of generating heavy cash flow, irrespective of the developments taking place in the energy sector.

Geographically, Occidental Petroleum holds nearly $2.8 million acre of land in the Permian basin, which makes it one of the largest oil producers in the area. The company has also acquired CrownRock, strengthening its position in the cheap oil supply domain.

“By completing this transaction, Occidental adds assets that we believe make the best portfolio in our company’s history even stronger and more differentiated. We also welcome new team members who will combine with ours to form a high-performing employee base. The one that is focused on safely and efficiently developing low-emission, low-cost energy,” said President and Chief Executive Officer Vicki Hollub.

Also Read: Goldman Sachs Revises Gold Price Prediction For 2025

Oxy Stock Forecast: A New Surge Incoming?

With the latest geopolitical changes, energy stocks are pivotal in tempting investors to explore the arena.

Per The Motley Fool, despite the uncertainties encountered in the energy sector, Occidental Petroleum has shown remarkable progress and a strong balance sheet that has grown stronger with time. This makes it an undervalued stock worth investors’ money and time. However, investors must do their research before making any investment-centric decisions.

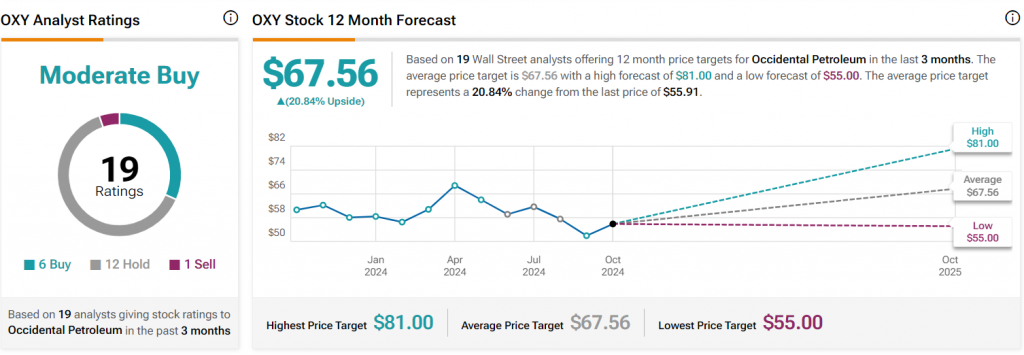

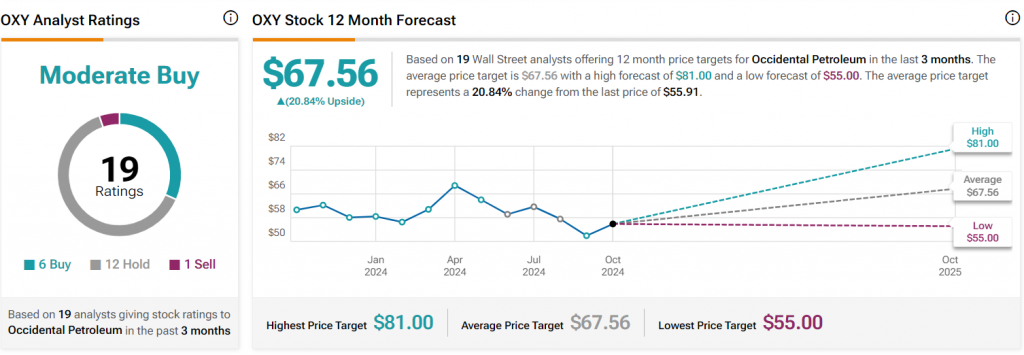

According to TipRanks, the Occidental stock price is currently trading at $55, indicative of an underway surge. The stock price can achieve a higher pedestal of $65 in the next few months. The stock also projects a high price target of $85 that it may claim in the next 12 months.

“Based on 19 Wall Street analysts offering 12-month price targets for Occidental Petroleum in the last 3 months. The average price target is $67.56 with a high of $81.00 and a low forecast of $55.00. The average price target represents a 20.84% change from the last price of $55.91.”

Also Read: IRFC Shares Could Dip to 92: Great Buying Opportunity, Says Analyst