Wazirx, one of the biggest Indian crypto exchanges, is still in hot waters. In the aftermath of the massive $234 million hack that hit WazirX, the Indian cryptocurrency exchange is facing intense scrutiny and significant challenges. With over 43% of customers’ funds at risk, the road to recovery seems long and uncertain. Let’s break down what’s happening and what it means for WazirX’s users.

The Hack and Its Impact

On July 18, Wazirx experienced one of the biggest crypto heists in India’s history. Hackers stole around $234 million worth of crypto assets. This shook the confidence of 4.3 million Wazirx users. Since then, the company has been scrambling to address the situation. After their first townhall video conference on September 2, it looks clear that users are not going to get 100% of their funds back. According to the legal advisor of Wazirx, customers can expect to recover only 55-57% of their funds. That means half of the crypto holdings are gone forever.

Restructuring Efforts: A Ray of Hope?

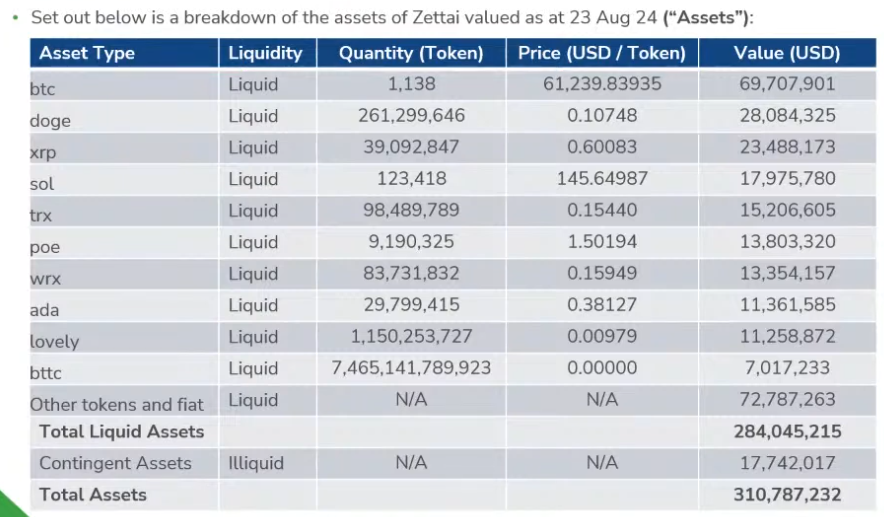

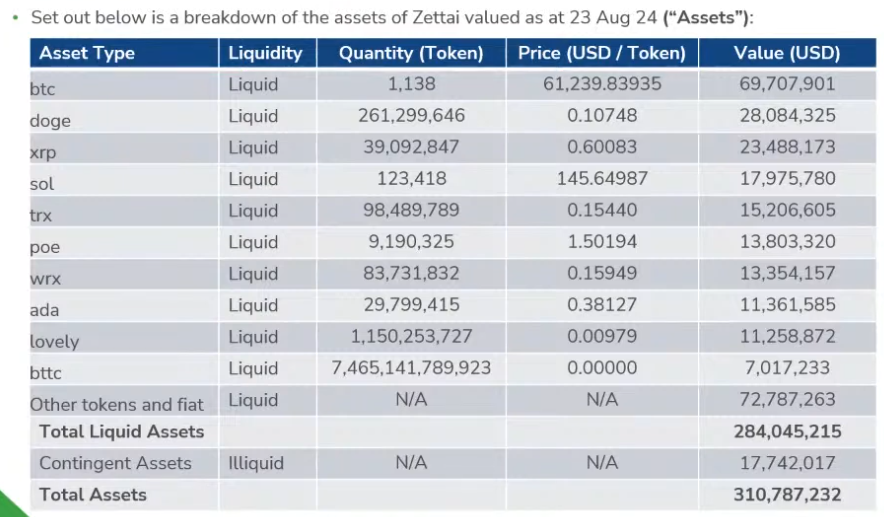

Wazirx is currently seeking protection from legal actions in Singapore court to undergo a restructuring process. According to the company, they are in talk with some investors or partners who could help with the much needed capital. However, this does not guarantee that users will get 100% of their funds back. The CEO of Wazirx said that they are working hard to recover the stolen funds however the chances of making customers whole are very slim. Restructuring plan of Wazirx includes distributing remaining funds to the customers and exploring ways for revenue generating products. Company shared their financial position during the video conference. 12M worth of assets are kept aside for various expenses like restructuring, legal fee etc, however data for these funds was not disclosed.

Ownership Dispute with Binance: Adding to the Confusion

The situation is further complicated by an ongoing ownership dispute with Binance, the world’s largest crypto exchange. Binance once claimed to have acquired WazirX but later denied it, leading to a public spat and termination of tech support in 2022. This dispute has delayed efforts to resolve the hack’s fallout, leaving customers in a limbo. The confusion over who actually owns WazirX adds another layer of uncertainty to an already complex situation.

The hacker moves 2600 ETH

Hours after the first town hall video conference of Wazirx, the hacker wallet displayed movement. Arkham data shows that the hacker moved 2600 ETH valued around $6.5 million. In 26 transactions with 100 ETH in each transaction, the hacker moved ETH to tornado cash. This is another set back for the recovery process as tornado cash makes it nearly impossible to locate where the funds went. Wazirx has not made any comment on this till the time of writing.

In the world of cryptocurrency, the WazirX hack serves as a harsh reminder of the risks involved. As the company works to regain trust and stability, customers are urged to stay informed and cautious in these uncertain times.