Crypto expert and YouTuber WendyO has issued a warning to Bitcoin (BTC) investors about the strengthening Japanese yen. Historically, changes in Japan’s interest rates have led to significant fluctuations in the crypto market. The yen’s recent 2.4% rise against the US dollar is raising concerns about potential impacts on Bitcoin and other digital currencies.

Market Movements and the Japanese Yen

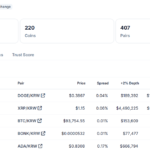

WendyO shared her predictions for the current crypto market, expecting Bitcoin to oscillate between $56,000 and $61,000 and Ethereum to range from $2,500 to $2,800 this week. She also highlighted the anticipation around new crypto ETFs, particularly Franklin Templeton’s application, which could include Bitcoin and Ethereum, with the possibility of adding more cryptocurrencies later. Access NEWSLINKER to get the latest technology news.

The strengthening of the Japanese yen could have adverse effects on cryptocurrencies, which are often considered risky assets. Historical data indicates that the yen’s rise in early August led to a notable drop in Bitcoin and altcoin prices. Furthermore, ongoing speculation regarding potential interest rate cuts in the US continues to shape market dynamics.

China’s Crypto Stance Questioned?

WendyO also noted that there are speculations about China possibly lifting its crypto ban, citing significant Ethereum transactions from Plus Token wallets as a potential indicator of this shift. Meanwhile, changes in the market saw Cardano (ADA) drop out of the top 10 cryptocurrencies by market cap, with Tron (TRX) entering the list, following the launch of Justin Sun’s new memecoin platform, Sun Pump.

Additionally, Solana is making strides by introducing a market prediction betting platform akin to Polymarket. Despite current trends, WendyO emphasized that the crypto market remains highly dynamic, with new opportunities continuously arising.

Key Insights for Investors

- Monitor Japan’s interest rate changes as they can significantly impact crypto valuations.

- Stay updated on new ETF applications, particularly those involving major cryptocurrencies like Bitcoin and Ethereum.

- Watch for regulatory shifts in major markets such as China, which could affect global crypto dynamics.

- Stay aware of emerging trends and platforms, like memecoins and market prediction betting platforms, to leverage new opportunities.

In conclusion, WendyO’s insights emphasize the interconnectedness of global economic factors and their influence on the crypto market. Investors should remain vigilant and adaptive to navigate the ever-evolving landscape of digital currencies.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.