Whales have been accumulating Aave as its price started to rise over the past week, though the token has now entered the overbought zone.

According to data provided by IntoTheBlock, whales holding over 1% of Aave’s (AAVE) circulating supply have accumulated a total of 9.74 million tokens, accounting for over 60% of the AAVE total supply.

AAVE’s large holders’ inflow also increased over the past 24 hours, reaching 291,000 tokens, per ITB data, showing increased interest from whales as the AAVE price recorded an impressive 44% run in the last 30 days.

Data also shows an increased large Aave holders’ outflow, reaching 271,000. However, due to the rising price, the movement cannot be attributed to whales’ selling pressure. Instead, the indicator might show heightened withdrawals from exchanges.

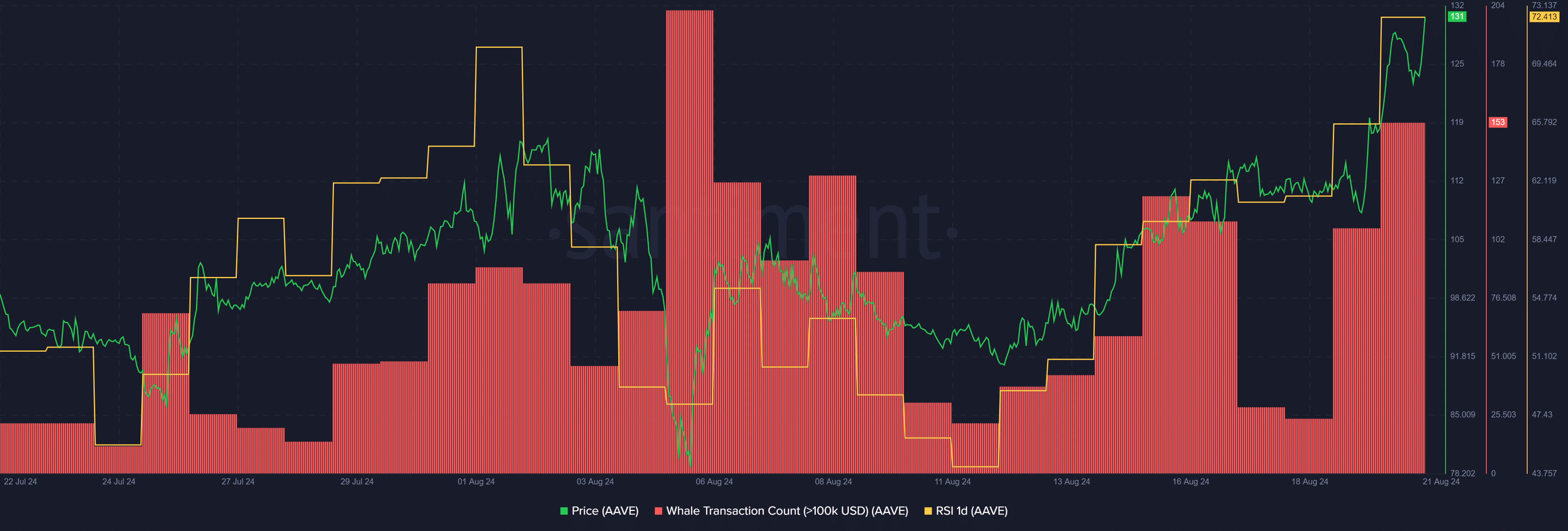

According to Santiment, the number of whale transactions consisting of at least $100,000 worth of AAVE increased by over six times since Aug. 18, reaching 153 unique transactions in the past 24 hours alone.

As the AAVE price and whale accumulation surge, its Relative Strength Index enters the 70 mark, per Santiment data. The indicator shows that the asset is currently overbought and short-term profit-taking could be natural from both small and large token holders.

AAVE is up 7% in the past 24 hours and is trading at $137.2 at the time of writing. Despite the current price rally, AAVE is still short by 79% from its all-time high of $666 in May 2021. The native token of the Aave protocol is currently the 44th-largest cryptocurrency with a market cap of over $2 billion.